ASX BNPL stocks Openpay Group [ASX:OPY] and Sezzle Inc [ASX:SZL] both fell on Tuesday after releasing trading updates.

OPY shares were down 4% in afternoon trade.

SZL shares were down 6%.

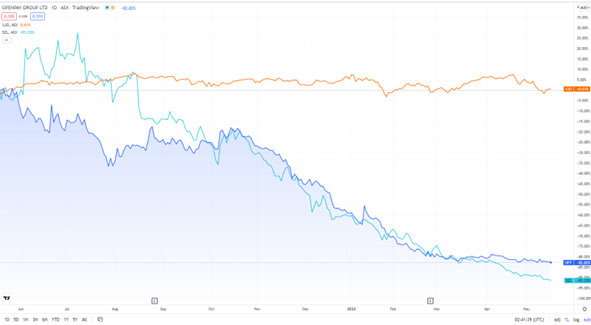

Like the whole BNPL sector, the pair has been under heavy selling pressure for months.

Over the last 12 months, Sezzle is down 90%, and Openpay is down 80%.

Both are hovering near their 52-week lows:

Source: Tradingview.com

Openpay releases April trading update

Here are Openpay’s key April results:

- ‘4,042k Active Merchants, an increase of 14% vs pcp (April 2021)

- 314k Active Customers, up 22% vs pcp, delivering 1.7m Active Plans (52% higher than pcp)

- Strong TTV of $30 million, an increase of 44% vs pcp

- Revenue of $2.5m, up 69% vs pcp

- Net Transaction Margin of 2.9% (vs 1.4% in pcp)

- Net Transaction Loss of -0.9% (vs -1.6% in pcp)’

Openpay announced that despite ‘strong ANZ performance in April’, core profitability is not expected until June 2023.

Mind you, profitability in the BNPL sector has proved elusive.

OPY’s accumulated losses as a public company equal $170 million.

In its latest half-yearly, Openpay reported a net loss of $42 million.

Openpay also admitted that UK operations have been ‘significantly reduced with the book now close to run off.’

Most of Openpay UK capital will be passed back to Australia, while OPY looks out for opportunities to monetise UK segments by other means.

OPY has also appointed a new CFO: Mr Jussi Nunes will be replaced by his second-in-command, Mr Oliver Josem.

Sezzle released trading results

Like Openpay, Sezzle has struggled with widening losses in recent years.

In its latest quarterly report, Sezzle reported a net loss of US$27.6 million, up on a net loss of US$11.2 million in the prior corresponding quarter.

Sezzle also reported that during the quarter it reduced staff and cut back on its growth ambitions:

‘Additionally, on March 10, 2022 the Company undertook a workforce reduction to provide the Company with an additional cost savings.

‘Management is also exploring scaling back the Company’s international operations to further reduce the Company’s future expenses.

‘Currently the company is also looking into scaling back international operations in order to avoid future surplus expenses.’

ASX BNPL stocks fall — but other opportunities abound

Once the talk of the town, ASX BNPL stocks are now languishing near record lows as investors sour on the currently loss-making business model of ‘buy now, pay later’.

Today’s jittery climate spooked by inflation and rising rates doesn’t help matters, especially if you are a growth stock with profitability a distant prospect.

But that’s not to say that all stocks are down and out right now.

The current climate offers opportunities for the savvy investor willing to zag while others zig.

But how best to identify the opportunities?

Our expert, Callum Newman, recently released a report on ‘left-for-dead’ stocks that could rebound in a big way.

You can find out more about Callum’s three ‘grave-dancer’ stocks here.

Regards,

Kiryll Prakapenka,

For Money Morning