It used to be spruiked that immigration was the cause of high and rising property prices.

But following two years of virtually zero immigration coupled with the biggest property boom since the late ‘80s — the blinkers are off.

That’s not to say that immigration doesn’t add to the stew of all else being equal. Especially in Melbourne and Sydney, which have historically captured the greatest influx.

It’s just that fat juicy homebuyer grants and government tax invectives, coupled with recent COVID migration trends, have had a far greater influence on the speed and direction of property prices than immigration per se.

The incoming Albanese government, with their shared-equity scheme, know it. They won’t allow prices to drop on their watch.

Still, one sector that has suffered significantly is the CBD apartment market. Particularly in Melbourne.

There was always an oversupply — I used to quip that we’d run out of students before we ran out of inner-city high-rise apartments.

Back in 2018, Melbourne City Councillor Nick Reece admitted as such.

He said that many of Melbourne’s high-rise monstrosities were ‘crap’, poor quality construction:

‘“We have let too much crap be built,” Melbourne City Council’s planning chair Nick Reece says…

‘“We want to see more buildings that give back to the public realm,” says Cr Reece, who argues that while Melbourne is by far Australia’s most attractive and interesting city, it has been degraded by recent bad architecture and design…

‘“We are seeing low-quality design outcomes”…’

The sector was further decimated during the COVID lockdowns.

Agents in the CBD and Docklands reported that that the market was ‘flooded’.

There was an ‘unprecedented’ apartment apocalypse!

Thousands of short-term rentals turned into long-term rentals.

In truth, the only thing that could turn the trend was to ramp up immigration.

It’s why, at the end of 2021, Nick Reece, now Deputy Lord Mayor of Melbourne, called for a ‘massive wave of new immigrants to help get the city back on track’:

‘Our city now needs a massive wave of new immigrants to help get the city back on track.

‘The population of Melbourne is projected to be 300,000 less by 2025 compared to where it would have been without the pandemic. While Australia will be almost one million people down.

‘Across Melbourne, businesses are facing acute labour shortages…

‘Australia had an immigration plan to help rebuild after World War II, now we need an immigration plan to help rebuild after the war on COVID…

‘To bring back the buzz in all its glory we need the Commonwealth to come to the party and open the borders to a welcome wave of new arrivals.’

Reece’s call has been heeded.

The Australian Financial Review this week reported a huge surge in approvals for student visas from Nepal.

The surge likely being driven ‘by non-genuine students who want to take advantage of the removal of a cap on the number of hours they could work and possible corruption of the visa approval process’.

‘There were 6312 applications from Nepal to study a vocational course in Australia, with visa approvals running at an exceptionally high 85 per cent. Application numbers for China and India, the two largest source countries for overseas students, were 3930 and 3483 respectively.’

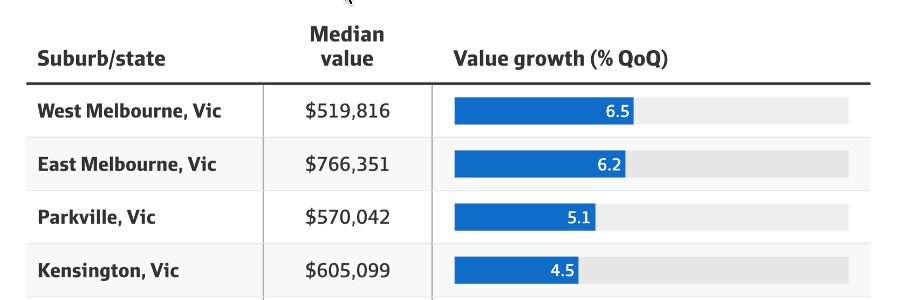

A turn in trend has been reportedly by CoreLogic. Some inner-city apartment markets rebounded strongly from the recent downturn:

|

|

|

Source: CoreLogic |

That’s not to say that apartments are now a great investment.

The sector is riddled with risks for the unaware buyer.

Poor quality construction, areas of oversupply, high owner’s corporation fees, and rising costs of insurance.

But it does underpin why I advocate that it will take more to slow the market than small shifts in the cash rate/lending rate alone.

Not forgetting to mention that Australia’s fourth largest lender, ANZ, has just cut its lowest variable rate back down to 2.29% for new customers!

‘“RateCity.com.au research director, Sally Tindall, said: “What these big bank cuts show is that competition in the mortgage market is still alive and kicking, despite the RBA hikes.”’

Onwards and upwards!

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Listen to my recent interview with Dr Cameron Murray as we uncover insights to Australia’s property market that challenge the mainstream narrative.