The Nuix Ltd [ASX:NXL] share price fell 10% today after media reports questioned its governance and financial accounts leading up to Nuix’s float.

The media reports published today prompted Nuix to release a statement to the ASX, although the company chose not to address each of the specific matters raised.

At the time of writing, Nuix shares traded at $3.15 per share, notching another red day for the tech stock.

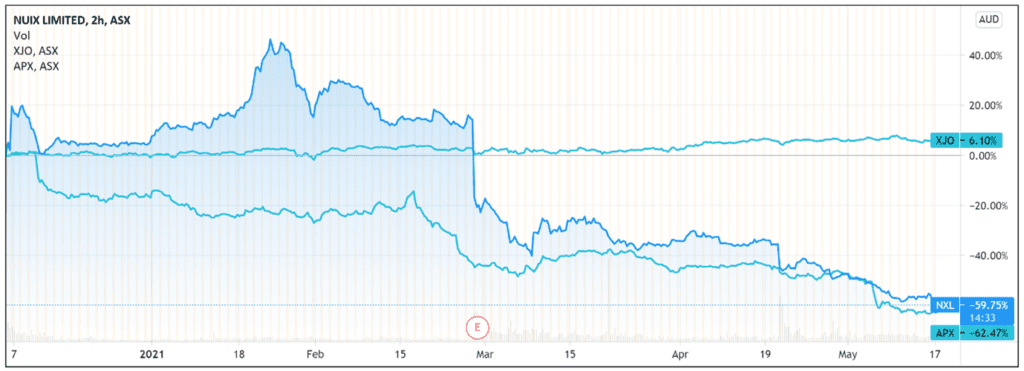

Having traded as high as $11.86 in January, the Nuix stock is now down 60% year-to-date, underperforming the ASX 200 benchmark by a substantial 90%.

Nuix responds to AFR and SMH joint investigation

Finding truth in a digital world is the motto championed by the recently-listed data analytics company Nuix.

In an ironic development, the company now finds itself at the centre of contested claims as investors seek out the truth following a joint investigation on Nuix published by The Sydney Morning Herald and The Australian Financial Review.

Some of the reporting included claims that 14 months before its ASX debut, Nuix was still not meeting its revenue forecasts.

The Herald reported that an October 2019 email from chief accountant Stephen Doyle revealed the company’s December half sales were running 20% below budget, representing a $US11 million shortfall.

Such revenue shortfall problems led in part to ‘furious cost-cutting’ between June 2019 and June 2020.

The Herald cited internal documents that showed the staff turnover rate hit 35% in the year to June 2020, ‘a rate comparable with call centres’.

In a statement prompted by the investigation, Nuix declined to offer blow-by-blow responses.

Instead, it offered a general defence of its business integrity:

‘Nuix is committed to the highest standards of corporate governance. The Company has operated across multiple jurisdictions over many years and has a proud history of working with regulators exercising the highest standards of probity.’

The company also touched on its initial IPO financial forecasts which it had to downgrade last month, sending its share price tumbling.

Nuix stated that:

‘Financial forecasts at the time of its IPO and subsequent updates have been thoroughly explained in the company’s market disclosures, including Nuix’s IPO prospectus and recent trading updates highlighting post-IPO changes in customer preferences and shifts in industry conditions.’

The company reiterated that its prospectus was the ‘subject of a thorough due diligence process involving leading law firms, internationally recognised accounting firms, and top tier financial and investment banking advisers.’

What next for Nuix Share Price?

Nuix compressed enough trials and tribulations in six months that would take many other stocks six years.

NXL spiked more than 50% from its $5.31 IPO price in December and later soared to about $12 before a sharp sell-off saw Nuix shares at a large discount.

Investors may be wondering whether the data analytics stock can regain its early momentum or whether the market is turning its back on the company for the near term.

Certainly, the joint investigation published today spooked many and Nuix’s response — declining to tackle the investigation’s specific claims — didn’t bolster the market’s confidence.

That said, Nuix’s management remains confident of its long-term prospects, writing today that Nuix’s ‘performance and market positions are strong’.

If you’re looking for other data and tech plays with more explosive short-term potential, then I have a reading suggestion.

Our latest report on AI stocks covers a cohort of emerging small-caps primed for growth in 2021, including five companies that you need to know about, right now.

To read the full report — for free — click right here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Promising AI Stocks: Discover why the AI boom could accelerate in 2021 and five high-potential stocks to watch. Download your free report now.

Comments