In today’s Money Morning…gap in China-Australia relationship is widening…other commodities to consider…key takeaways…and more…

Dear reader,

Well, as more details emerge about the Evergrande fiasco unfolding in China, there’s news that Australia just signed a deal for nuclear submarines with the US.

Here are the details on that, as per the Australian Financial Review:

‘Australia will obtain nuclear submarines for the first time under a new alliance with the United States and the United Kingdom called AUKUS, which has been set up to strengthen the military presence and operability of allies in the Indo-Pacific.’

Meanwhile in China via Bloomberg:

‘Chinese authorities have told major lenders to China Evergrande Group not to expect interest payments due next week on bank loans, according to people familiar with the matter, taking the cash-strapped developer a step closer to one of the nation’s biggest debt restructurings.’

What do nuclear subs, a giant failed Chinese property developer, and iron ore have in common?

It’s a complex jigsaw to put together, that much is certain.

So today I’ll piece it all together and give you some tips on how you could invest in this environment.

Hint: commodities, but maybe not iron ore.

OK, let’s break it down.

Gap in China-Australia relationship is widening

Now, we all know that China and Australia are increasingly at arm’s length.

The strategic nuclear sub deal is part of that.

Not that there’s likely to be a conflict or anything that serious.

But it’s about tempering expectations. China will definitely still buy a range of commodities from us, for the simple fact that they can’t torpedo their manufacturing sector.

Just not as much iron ore.

The reason for that is that Brazilian iron ore giant, Vale, ‘is still looking to return to a capacity of 400 million tonnes, which would see it regain the title of world’s biggest producer that it lost to Rio Tinto in the wake of the Brumadinho dam disaster two years ago.’

If China and Australia are getting a divorce, this is a messy protracted affair.

Throw into the mix Vale’s resurgence, and maybe Fortescue Metals Group Ltd [ASX:FMG] may not be so attractive in a year’s time.

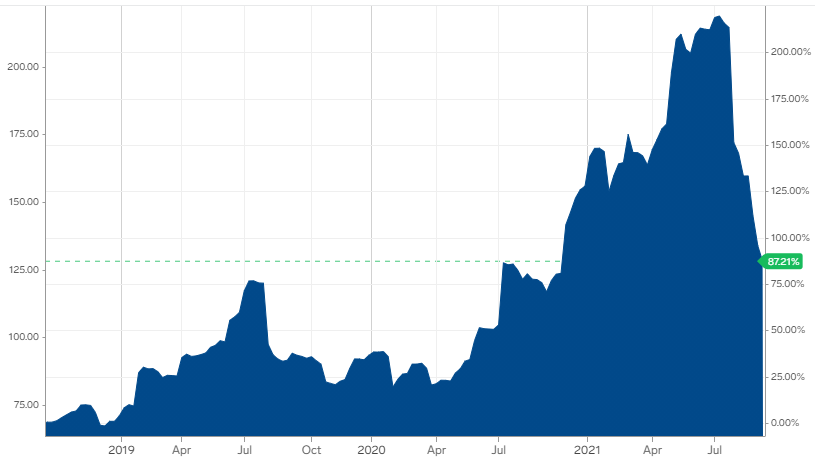

As for smaller iron ore players with good projects, this environment could still yield ‘catch-up’ winners as the iron ore price is still sitting at where it was a year ago:

|

|

| Source: CNBC |

It’d be very contrarian to take trades on iron ore at this stage, and the coast might not be clear until some support comes in on the iron ore spot price.

But here’s where I’d be looking for mining trades outside of iron ore.

In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report

Other commodities to consider

A few charts coming here…

|

|

| Source: Tradingeconomics.com |

|

|

| Source: Tradingeconomics.com |

Nickel and copper are holding up pretty well.

When everyone’s attention is on iron ore, these less obvious metals are hardly sliding down the charts.

Then of course there’s the commodity on everyone’s lips — uranium.

Here’s the lowdown on that:

‘Uranium stocks surged to their highest levels in a decade, before paring their gains on Monday, amid a buying frenzy by Sprott Physical Uranium Trust that’s seen it amass millions of pounds of the commodity used to power nuclear reactors.

‘The world’s second-largest uranium producer Cameco Corp. fell 0.8%, erasing earlier advance of as much as 8.5% in Toronto, highest intraday since March 2011. ’

And the uranium price chart:

|

|

| Source: Tradingeconomics.com |

That’s straight to the Moon stuff.

And I’ve seen a heap of smaller uranium companies bolt hard.

Our uranium-tech-recycling play at Exponential Stock Investor is now up around 260% on the initial recommendation.

Not bad after a long dormant period.

And nuclear looms as a key technology in a decarbonised world.

It’s even better if you can recycle the uranium tailings.

All of this shows that commodities are still throwing up opportunities.

Key takeaways

China isn’t about to unwind the whole Chinese manufacturing-Aussie commodity JV overnight.

That would be catastrophic.

It’ll be a slow-motion distancing act.

At this stage, with all the headlines about the China-Australia friction driven by a media landscape that profits from fear, it’s almost contrarian to say that the commodities bull is still on.

Perhaps more correctly, the iron ore-centric commodities bull is over.

With shifting supply chains in Europe and South America’s mining scene to come back online, it’s an ever-changing beast to keep track of.

The final punchline today is…

Don’t get sucked into the narrative that the mining boom is over because of one commodity’s collapse.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.