‘Housing could be 4 per cent cheaper if we axe stamp duty and give future buyers the option to choose an annual land tax’ said a recent NSW report.

The tax switch is a debate that’s gained momentum over recent years in most states and territories.

NSW is well on its way to implementing the transition.

However, the idea to replace certain taxes with a land tax is not new.

It was best advocated by American Political Economist and Author Henry George.

George wanted all taxes that fell on income and productivity to be abolished and replaced with a land tax.

One that was enough to collect a high percentage of increasing increments in land’s price.

He wrote his magnum opus Progress and Poverty, advocating the policy in 1879.

It was a best-seller — said only to have been outsold by the Bible when first published.

It subsequently inspired the economic philosophy that came to be known as ‘Georgism’.

As George stressed, most taxes are acutely damaging to the economy.

Aussie Property Expert’s Bold Prediction for 2026. Discover More.

They carry what economists call deadweight costs.

Reducing supply, raising prices, destroying small business — whilst large monopolies such as Amazon, Google, Apple, etc, have the means to get away with paying no taxes at all…

George stressed that we could not gain economic advantage from ‘ownership’ of the best sites in town without effective resource taxation to ensure land is put to good use.

Replacing stamp duty with land tax is just one step to this end.

I mean, just take a look around you today.

Land banking (holding land undeveloped for gain) is a legal and advocated practice for creating vast amounts of wealth.

Many buyers purchase old suburban knockdowns with zero intention of ever developing.

They’re happy to sit on the sites for years and years.

It’s a great way to make wealth in an economy that punishes workers with high taxation and rewards landowners with low tax in comparison.

The largest developers on the outskirts of our cities have 10–14 years’ supply of land held out of use.

Land that they drip feed onto the market in ‘staged releases’ to keep prices high.

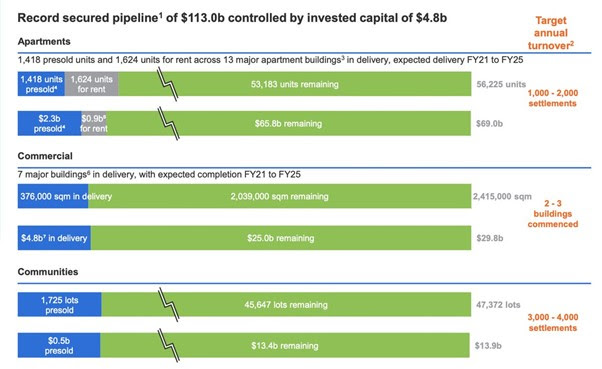

Here’s Lendlease’s August 2020 announcement telling investors how they only want to build 1,000–2,000 apartments a year.

That is despite having a ‘pipeline’ of more than 53,000 apartments ‘land-banked’.

|

|

|

Source: Lendlease |

Whenever you hear a politician spout that the only way to solve housing affordability is to ‘increase supply’, remember that these developers control the supply of accommodation that comes to market.

They also control market prices.

They’re not going to flood the market with supply and sell at a loss.

Developers are greedy — they want the highest price possible. And why not?

Taxing the capital gains from land is seen to discourage this. Thus, reducing land prices and increasing construction in the process.

Still, as for the transition in NSW, stamp duty withdrawal will not immediately be offset by the land tax.

It’s not high enough.

It won’t immediately reduce prices.

It will simply open the market to thousands who have not saved enough to pay stamp duty.

Add to that the proposed NSW plan to gift $25k to first home buyers to get into the market — and you can be sure that any reports that spruiks that prices will be 4% lower with a slight shift to land tax are bogus.

For now, we can expect NSW property prices to continue to inflate. There’s no pullback on the horizon yet.

There are still significant profits to be made.

Over at Cycles, Trends & Forecasts, we teach stock and property investors exactly how to take advantage of this wave with a little bit of inside knowledge about the land cycle.

Check it out now…

Best wishes,

|

Catherine Cashmore,

For The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.