Chemist Warehouse is set to shake up the pharmaceutical sector by merging with Sigma Healthcare [ASX:SIG].

The deal will fuse Sigma’s wholesale operations with Chemist Warehouse’s huge network of stores.

This landmark deal, valued at $8.8 billion, will make the combined entity a top contender in the ASX 200. Marking one of the largest mergers in recent years.

Sigma’s shares are currently on hold after details of the merger leaked last week. Its shares last traded at 76.50 cents per share.

Sigma has been listed for 20 years but has seen little attention, gaining 34.21% in the past year.

Sigma currently has a market cap of $810 million.

Source: Trading View

A New Era in Retail and Wholesale

Under the merger, Sigma will buy all Chemist Warehouse shares for $700 million in cash and all of Sigma’s shares.

Sigma has secured a $1 billion debt facility from ANZ and National Australia Bank to fund the deal.

Sigma also plans to raise $400 million to support the merger, with the backing of Goldman Sachs.

The share offer will be at 70 cents per share, an 8.2% discount on its last traded price.

Post-merger Chemist Warehouse shareholders will dominate ownership with an 85.75% stake in the new group. The big winners are billionaire founders Jack Gance and Mario Verrocchi.

Chemist Warehouse started with a single chemist in Melbourne in 1972 and has become a national retail titan.

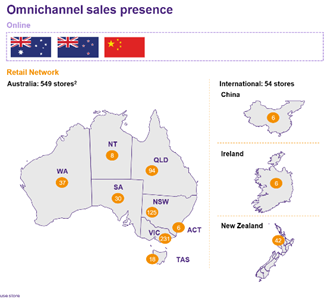

With its expansion into markets like New Zealand, China, and Ireland, the group’s sales were $7.9 billion last year.

If regulatory approvals go as planned for the deal, the next phase will be a vote by Sigma shareholders. If approved, the merger will likely conclude in the second half of next year.

Sigma CEO Vikesh Ramsunder will lead the new group. While key figures from both companies will join the board.

Chemist Warehouse’s chairman, Jack Gance, said:

‘The combination of CWG’s retailing and marketing capabilities and Sigma’s state-of-the-art distribution infrastructure and logistics capabilities presents a unique opportunity for both CWG and Sigma shareholders.’

Sigma has said it expects a post-merger EBIT of over $495 million.

Outlook for Sigma Healthcare

The merger marks a new era for Sigma, propelling it to become a major player in both retail and wholesale.

The combined group will not only supply a thousand pharmacies but will also boast a formidable distribution business.

The retail footprint of Chemist Warehouse is the envy of many, with around 600 stores.

Source: Sigma Healthcare

The new group should see solid international and local interest due to its strong position in the market. As the two will likely be able to be highly cost-competitive on pricing.

The combination of the two groups is expected to see $60 million in cost savings per year.

Before investors buy into the offering, remember that there will be many regulatory hurdles for the deal to jump.

The ACCC and state-based pharmacy regulators still must give their tick-off before the vote.

Still, it’s an exciting time for pharmaceutical retail and wholesale in Australia and one to watch closely.

The merger is more than a business expansion. It’s a strategic alignment that promises to reshape the pharmaceutical landscape.

Another market about to shift

It’s not just pharmacies that are about to face big changes.

With the COP 28 climate talks in their second week, things are set to change.

The movement of economies away from fossil fuels means skyrocketing demand for one metal in particular.

Goldman Sachs dubs it the ‘new oil’, and it’s critical in our ability to build the new grid.

Without it, our hopes of Net Zero and full electrification will fail.

But record demand has not been met with adequate supply.

Geologist James Cooper thinks the time is ripe for investors to consider jumping in.

What’s this critical metal, and the opportunity?

Click here to find out more about the electric age’s ‘new oil’.

Regards,

Charlie Ormond

For Fat Tail Daily