BetaShares released this new product in March 2020. It’s called ATEC [ASX:ATEC].

Trading at $17.36 at the time of writing, the ATEC fund is making an explosive start to life. But will it last?

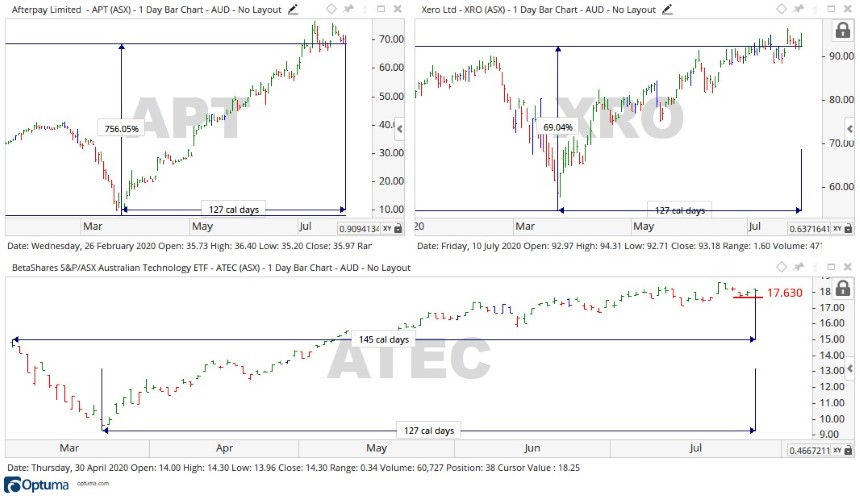

Source: Optuma

What’s driving ATEC forward?

Like all ETFs, ATEC is a collection of stocks grouped together in one tradable product. The performance of the fund will be guided by the underlying assets.

In the case of the ATEC product — it holds 50 Australian-based stocks, all related to the tech sector.

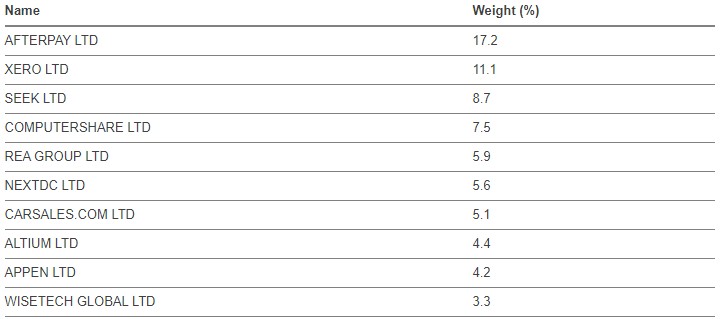

Source: Beta Shares Website

Despite holding 50 stocks, it is the top 10 and the weightings that we will focus on today.

The top holding in the fund is Afterpay Ltd [ASX:APT], which through the COVID-19 pandemic keeps gaining in stock price and market cap, currently sitting at $19.06 billion.

While this all looks great, there are some broader implications that may factor into the future of this product.

In a recent article we discussed Afterpay and the reasons the APT share price was propelled forward through COVID-19.

In fact, with so many of us being forced to stay home, the BNPL sector and many other fintech companies have been the silver lining for growth investors.

Holding a 17.2% weighting in the ATEC fund and with the tailwinds behind it, Afterpay along with Xero Ltd [ASX:XER], at a 11.1% weighting, are 28% of the whole fund.

This is where I see a potential issue for ATEC

In the broader economic sense, there seems to have been a perfect set of conditions brewing.

In March 2020, the Federal government combined with Australia’s big banks announced a six-month mortgage repayment freeze.

Along with this, the Federal government set up the JobKeeper program to help businesses retain employees while not trading and doubled the JobSeeker payment.

This has given a lot of people, businesses, and families breathing space while at home, and what’s fun to do while at home…shop and shop online!

These fiscal stimulus mechanisms are all scheduled to either stop or be scaled back in September 2020.

With the economic clock ticking and September fast approaching, will the rallies in the fintech space continue? And by its very make up will the ATEC fund keep motoring up?

The potential future of the ATEC fund

I think this particular ETF product will generate a lot of interest going forward.

The fintech space is also talk of the town in investing circles currently. So those chasing returns may be attracted to ATEC.

All is not what it may seem though.

The chart below shows a comparison.

Source: Optuma

The bottom chart is the daily data for the ATEC fund. The entire product opened, fell into the March low then rallied in line with the stocks in its holdings.

But the fund itself is only 145 days old! It’s just cracked out of the egg, so to speak.

From the march low to today we are looking at 127 days, and in those 127 days Afterpay rose over 756%, while Xero pushed up over 69% — remember these two stocks are over 28% of the fund.

Just these two alone can make the performance of the new ATEC fund look outstanding.

While this product may represent a new type of ETF, full of shiny tech darlings and doing away with the old banks and miners, it still needs to be said it came to life in the perfect conditions to make it look better than it potentially could be.

It may be too early after only 145 days of trading life, to predict where it might fall and rise to.

But with the looming economic cliff coming in September, I would say keep a close eye on Afterpay and Xero as the economic conditions will affect spending, in turn effecting these companies which will come through in the performance of the ATEC fund.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

Comments