Earlier today, minerals developer Neometals [ASX:NMT] released an update regarding engineering costs for its newest EV-materials recycling plant in Germany.

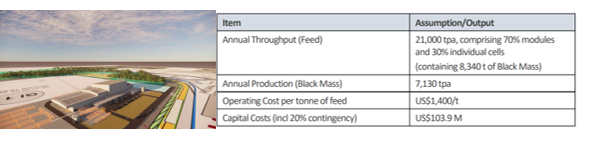

Neometals has estimated the costs per tonne of feed to reach around US$1,400 at a rate of 7,130 tpa for the greenfields shredding plant.

Over the last month, the NMT share price went up 16% and even higher by more than 21% in the last week alone.

As for the year, the miner is up 90% in share price value over the past 12 months.

Source: www.tradingview.com

Neometals updates on newest Primobius recycling plant

Today marks the day where Neometals could share the results for its first Engineering Cost Study for stage 1 of joint-owned shredding — ‘Spoke’ — plant, Primobius.

The plant, half-owned by SMS Group, is being considered for a potential 50 tpd integrated lithium-ion battery recycling operation, including ‘first-in-Europe’ discharging and disassembly operations.

Larger modules from returned and ‘end-of-life’ electric vehicles (EVs) will be able to undergo processing as EV battery cell scrap, and be reborn as new products, like nickel and cobalt, called ‘Black Mass’.

Neometals has estimated costs-per-tonne of feed will reach US$1,400 — assuming a mix of 70% modules and 30% cells — at a rate of 7,130 tpa.

Capital costs have been drawn up around US$103.9 million, with a 20% contingency rate. This will also include land, buildings, plant, pre-production, and equipment costs, as well as installation and infrastructure expenses.

Costs have increased, which the company explains is due to bigger module storage and operations that cater for larger modules.

Results of the cost study were said to be +30% positive with a negative -10% accuracy rate, compared with a previous +35% in May’s tests.

The second stage of the Cost Study will be for the hydrometallurgical refinery Hub segment, due in December this year.

Neometals’ Managing Director Chris Reed said:

‘The Spoke ECS allows us to better assess and control the costs of constructing and operating Europe’s largest battery recycling plant that is purpose built to take the larger battery modules arising from EV’s. The addition of a large manual discharging and disassembly operation for modules comes at a cost, that is outweighed by access to a larger market in the medium to long-term. It is also worth noting that we currently get paid to processmodules whereas many American recyclers compete to purchase individual cells.

‘Our proprietary refining Hub is the largest value generator for Primobius and its customers. The Hub processes Black Mass into high-purity and higher-value battery materials which can be used in production of new batteries. Integrated recycling closes the loop, reducing the carbon footprint of new cells using recycled feedstocks and complies with pending EU-regulatory requirements.’

Source: NMT

Outlook for NMT

NMT’s new Spoke ECS has been designed based on trials and performance at Primobius’ commercial 10 tpd Spoke plant at Hilchenbach.

Neometals said the studies will allow for prioritising supply agreements such as 10 tpd Spoke for Mercedes-Benz and 50 tpd Spoke for Stelco Holdings Inc, with refinery Hubs expected for both parties in 2023.

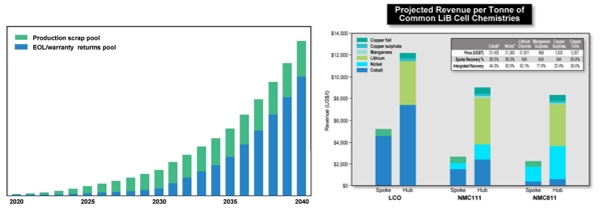

With both plants working in unison, the company expects production scrap and end-of-life warranty returns to grow steadily into 2040:

Source: NMT

Furthermore, once plants and Hamilton steel work segments are underway, Neometals is aiming to create a consideration of an investment decision for Primobius to acquire up to 50% equity in Stelco’s battery recycling business around March 2023.

Neometals has been clever in spotting the gap in the EV production game early by opting for the recycling of the bigger materials many other companies haven’t yet prepared for.

As competition thickens, and developers ramp up production, this could prove a useful advantage.

Lithium is one way to play the EV revolution

The EV market is rapidly expanding, boosted by government initiatives and funding programs supporting production worldwide in the race to net zero.

But our energy expert, Selva Freigedo, thinks the global transition to EVs means the industry faces a supply crunch, which may send prices for battery materials soaring beyond 2022.

If you’d like to know more, check out Selva’s battery tech metals report, here.