The Nearmap Ltd [ASX:NEA] share price plummeted today as NEA faces legal proceedings from US rival EagleView.

Having alluded to potential legal proceedings after entering a trading halt yesterday, Nearmap disclosed further details today.

The legal proceedings are being brought against the company by rival aerial imaging firm EagleView.

The announcement saw Nearmap coming out of a trading halt to a cold reception.

At the time of writing, NEA share price is down 20.3%.

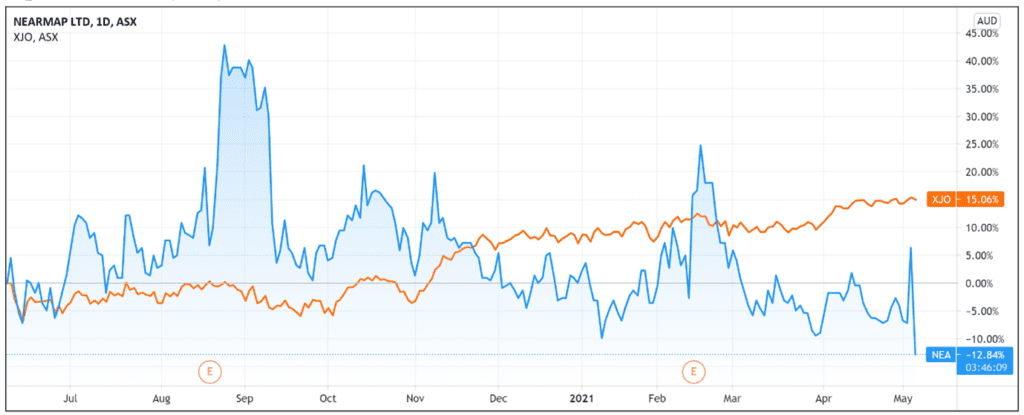

The fall means Nearmap is down 15% year-to-date, although the stock is still up 13% over the last 12 months.

Nearmap rises then falls

Nothing epitomises the rollercoaster nature of the stock market quite like Nearmap’s last two trading days.

On Wednesday, NEA shares soared 14.5% in morning trade.

Today, at noon, the stock is down 20%.

Wednesday’s spike came after Nearmap released a trading update at the close of markets on Tuesday, upgrading its FY21 ACV guidance.

In that update, Nearmap disclosed that it upped its FY21 annual contract value guidance to $128–132 million from $120–128 million.

The revised guidance represents a 20% to 24% increase on FY20 ACV of $106.4 million.

Nearmap’s revision was aided by a ‘strong’ 1H21 performance.

NEA also revealed that with each of its investment initiatives ‘on track’ and ACV growing, it expects net cash outflow to be less than $10 million this financial year.

PS: We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

Patent complaint filed against Nearmap

But the positive sentiment didn’t last.

Nearmap’s stock rise was suspended when the company requested a trading halt relating to ‘potential legal proceedings.’

No further elaboration was offered until this morning.

And the elaboration entails EagleView Technologies and Pictometry International lodging a legal complaint against Nearmap’s US subsidiary for patent infringement in the United States District Court of Utah.

Nearmap disclosed that the complaint relates to the plaintiffs’ roof-estimation technology and that the plaintiffs are seeking unspecified monetary damages and the prevention of further alleged infringement.

Court documents lodged by EagleView and Pictometry claim the plaintiffs are ‘market leaders in providing technologies relating to such reports in the construction, government, solar, and insurance markets’.

They assert that Nearmap directly competes with them and that Nearmap infringed on eight patents.

Nearmap’s response

Nearmap’s ASX update included comments from its CEO and Managing Director Dr Rob Newman.

Mr Newman stated that Nearmap takes intellectual property rights seriously and believes the ‘allegations are without merit.’

As a result, the company will ‘vigorously defend against the complaint.’

He concluded by saying Nearmap’s business ‘remains unaffected by the complaint.’

The latter point was reiterated in NEA’s response, with the company claiming that the allegations ‘do not affect Nearmap’s core proprietary technology and do not affect the surveying of imagery or the delivery of premium content.’

What happens from here for the NEA Share Price?

As the Australian Financial Review noted, the possibility of legal action against Nearmap was on the market’s radar.

For instance, this February, short seller J Capital released its short report on the company.

That report flagged ‘intellectual property challenges’ for Nearmap’s US arm.

J Capital reported Nearmap’s roof reports could infringe on EagleView patents and, if legally challenged, Nearmap ‘may be required to pay a royalty to EagleView, find a different way to do a map, or stop producing roof measurements and roof reports altogether in the US.’

This could undercut Nearmap’s claim that its core business remains unaffected by the legal proceedings.

J Capital estimated 41% of NEA’s US sales come from roof reports for the insurance sector, which uses them to assess damages claims.

RBC Capital, on the other hand, estimated Nearmap’s contract value in this market segment to be much smaller, comprising less than 5% of total group revenue and about 10% in the US.

However, the bank did warn that the ‘undefined but potentially material impacts on Nearmap’s business will likely weigh on investor sentiment until resolved.’

For example, the bank hypothesised that the US government sector ‘may be hesitant to procure work from a company which may be seen as infringing on Eagleview’s technology.’

If you’re put off by Nearmap’s recent volatility but are interested in stocks at the forefront of technological advancements, then I recommend reading our free AI stocks report.

It details why the AI boom could accelerate in 2021 and outlines five high-potential stocks to watch. Download your free report now.

Regards,

Lachlann Tierney,

For Money Morning