Aerial imaging company Nearmap [ASX:NEA] rose on Wednesday following the release of its FY22 results.

NEA shares are up more than 65% in the past month and were further boosted by an indicative $1 billion takeover offer announced on Monday.

Nearmap’s FY22 revenue rose 29% to $146 million, but its net loss also widened 64% to $30.8 million.

Source: www.tradingview.com

Nearmap reveals 2022 numbers

Nearmap has released its full 2022 trading results, reporting ‘record incremental annual contract value growth’.

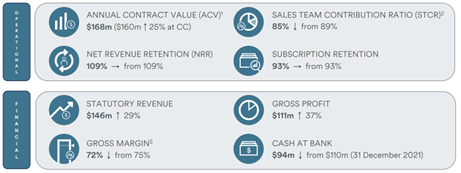

Here were the key results:

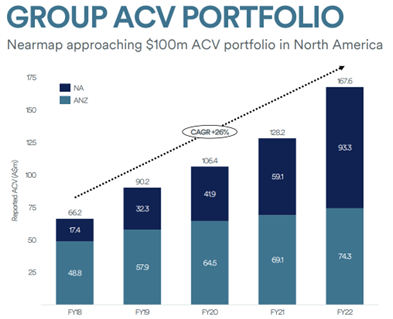

- Reported ACV portfolio of $167.6 million, up 31%

- Cash balance of $93.7 million

- Group cash outflow of less than $20 million having guided for $30 million

- Reported statutory revenue of $145.9 million, up 29%

- Reported statutory loss after tax of $30.8 million

Source: NEA

Highlights by market

Australia and New Zealand:

- ACV portfolio totalled $74.3 million ($69.1 million in 2021), representing 8% portfolio growth

- Subscriptions came to 9,426 (9,015 in 2021)

- ARPS increased to $7,886 ($7,663 in 2021)

- Pre-capitalisation gross margin of 91% (92% in 2021)

North America:

- ACV portfolio totalled US$64.3 million (versus US$44.5 million) representing 45% portfolio growth

- Subscriptions were 2,716 (versus 2,240), growth of 21%

- ARPS increasing 19% to US$23,662 (versus US$19,844)

- 54% pre-capitalisation gross margin (50% in 2021)

Source: NEA

Nearmap management commentary

NEA’s CFO, Ms Penny Diamantakiou, said:

‘Nearmap has delivered another strong performance in FY22, validating the strength of our underlying business model and our vertically aligned strategy.

‘FY22 has been a year of continued investment in building our systems and processes to support the scaling of our business and as we continue to grow there is more to do.

‘We continue to foresee the pathway to positive operating leverage in FY23. Our gross margins remain robust and together with an increase in the North American capture program to cover 80% of the population (FY21: 71%), the efficiency of our capture program enabled by our world leading aerial camera systems has ensured we were able to continue to expand our gross margin in North America to 54% (FY21: 50%), an outstanding achievement.’

Outlook for Nearmap: On track for positive free cash flow by FY24

Given the widening net loss in FY22, Ms Diamantakiou said Nearmap will continue to invest in technology, seeking to drive further growth in its ACV portfolio.

The CFO also said Nearmap was on track to generate positive free cash flow in FY24:

‘FY23 represents a year of execution for Nearmap.We will continue the roll out of our world leading aerial camera systems, HyperCamera3, with five systems targeted for production and delivery to North America in the first half of FY23.

‘We will continue to invest in technology, delivering tailored industry vertical solutions for core growth verticals and more Nearmap AI solutions to customers, further extending our technology leadership position.

‘We will remain focused on our strategy, successfully driving further growth from our ACV portfolio and we remain on track to generate positive free cash flow in FY24. I am confident in the outlook for our business as we remain focused on extending our global leadership in subscription-based location intelligence.’

From imaging tech to battery tech

The EV market is rapidly expanding, boosted further by government initiatives and funding programs supporting production across the globe.

But our energy expert, Selva Freigedo, thinks the global transition to EVs means the industry faces a supply crunch, which can send prices for battery materials soaring even higher in 2022 and beyond.

If you’d like to know more, I suggest checking out Selva’s battery tech metals report.

Find out more about ‘Three Ways to Play the Great EV Battery Race’ here.

Regards,

Kiryll Prakapenka,

For Money Morning