The whole world is nervously waiting for whether the respective allies of Israel and Palestine will send armed forces or weapons to escalate the conflict further.

There’re too many factors in play to fully understand how this will impact the financial and commodities markets. However, the markets appear split in how they’re positioned.

Gold, silver and crude oil seem to trade with the expectations that the US Federal Reserve might need to cut interest rates sooner than the central bankers will have the world believe. However, base metals are positioned for an economic slowdown or recession.

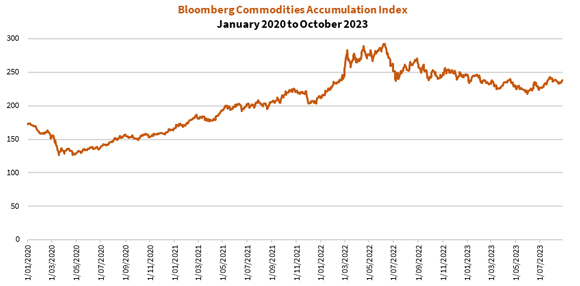

The lack of clarity in the commodity markets has caused sentiment to weaken for mining stocks. Here’s a figure showing how the Bloomberg Commodities Index has been trading without a clear trend for an extended time:

|

|

| Source: Refinitiv Eikon |

I want to turn my attention to gold and silver, as many who invested in mining companies in this space are no doubt feeling down in the dumps.

Since the heady bull run in 2019–20, gold stocks have experienced several false rallies and a yawning selloff last year. There was a short and sharp recovery earlier this year, but it hasn’t applied to the broader industry.

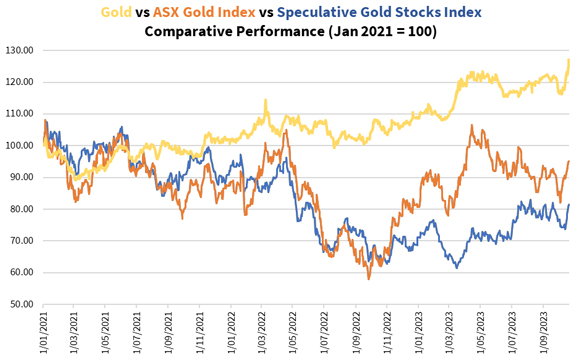

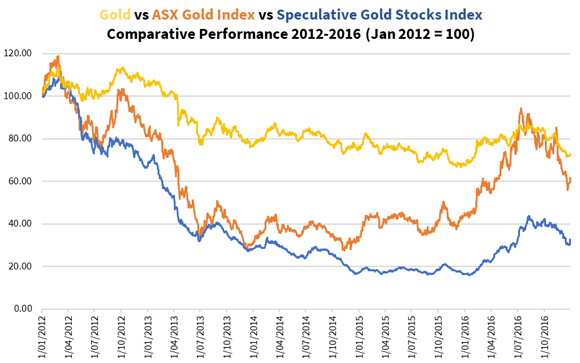

If you look at the figure below showing the relative performance of gold, established gold stocks (proxied by the ASX Gold Index [ASX:XGD]) and explorers (proxied by my own Speculative Gold Stocks Index), there’s a clear divergence between gold and gold mining stocks:

|

|

| Source: Internal Research |

It’s natural to question why gold is technically in a bull market, yet gold stocks are underperforming by such a significant margin.

Let’s explore that and why I believe there’s a ray of hope to those who’re feeling stuck in this space right now.

What’s weighing down on gold stocks?

The unprecedented government stimulus and widespread lockdowns in 2020–21 created one of the biggest economic imbalances in history.

On one hand, a flood of liquidity hit the markets that caused a flurry of economic activity. On the other hand, lockdowns stifled business activity with certain industries operating while others were suspended.

The glut of currency didn’t spur productivity by as much. This eventually caused inflation to accelerate beyond what governments and monetary policymakers were comfortable with.

To combat this, central banks around the world engaged in the fastest tightening of currency supply and rate raises in over 40 years.

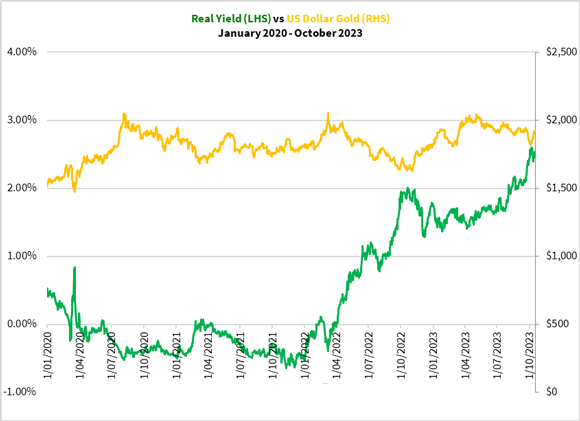

When this occurred, it caused gold to retreat as you can see in the figure below:

|

|

| Source: US Treasury, Refinitiv Eikon |

That was the obvious factor that caused gold stocks to retreat. Revenues from gold sales fell.

What many people missed were two other key drivers which affected expenses incurred by gold mining companies.

The first was a rising crude oil price. A combination of lockdowns affecting energy producers that were operating on skeleton staff and the global move to reduce fossil fuel reliance dramatically reduced the supply of oil.

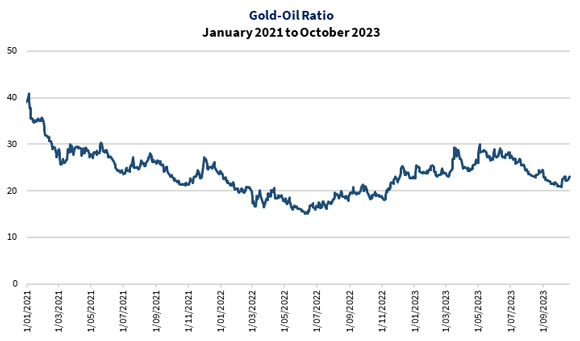

You can see in the figure below how the gold-oil ratio, or the barrels of oil that an ounce of gold could buy, has been in a falling trend for much of the last three years:

|

|

| Source: Refinitiv Eikon |

Like energy companies, mining companies experienced a shortage of staff during the lockdowns to operate and then needed to compete for skilled workers as restrictions were lifted.

All this resulted in rising costs from delays in operations, higher salary and wages and lower efficiency.

Gold stock investors fed up by a perfect storm

All these contributed to mining companies underperforming the underlying commodity prices. Even the best performers in the industry suffered a sell-off, as investors who were willing to pay a premium during the gold bull market sold out when management announced lower profitability and an increasingly conservative outlook on their operations.

During this period, several companies raised capital. Some did so more than once. The positive cases were the companies doing so to purchase other mines or acquire a competitor. The instances where companies raised capital to repair their balance sheet as expenses blew out or to repay looming debt deadlines, hurt investors deeply.

Either way, many investors who held these companies were unhappy with seeing their shareholdings diluted while waiting for the share price to rally. These capital raisings delayed this from happening.

A ray of hope

The figures that I’ve shown in this article show the state of the economy and the challenging conditions that gold mining companies were contending with these last few years.

Things have been difficult to say the least.

Even though it’s hard to conclude whether the worst is behind us, I’m confident that we aren’t far off.

As you saw in the comparative performance of gold and different gold stocks, producers appeared to have found the bottom almost one year ago today. Explorers may’ve hit their lows in March.

While several gold stocks — both producers and explorers alike — are trading close to their 52-week lows right now, this is because market sentiment is all but gone.

That reflects the emotions of investors. Many wrongly ascribe the current prices as coming from an informed and rational market.

Most mining investment veterans wouldn’t agree with that. Nor do I.

Having kept track of the quarterly performance of gold producers for several years, I accept that they’ve underperformed in the past year or so. Hence the disappointing share price performance.

Many of them are making the best out of a challenging period and they deserve credit where it’s due.

But most of the large and mid-tier producers have a large cash balance. Even a small producer like Alkane Resources [ASX:ALK] has over $80 million.

Several of these companies have bought out smaller peers or a mine deposit as bargains started to appear in this lull.

In fact, almost all the producers with a market capitalisation exceeding $500 million have made an acquisition — whether a company or mine properties — since 2021.

The most recent corporate activity is Genesis Minerals [ASX:GMD] announcing last week the purchase of the remaining 20% of Dacian Gold [ASX:DCN] it didn’t own to consolidate the Leonora gold region.

As for the small end of the gold space, I’m seeing companies with solid projects and great future prospects trading at deep discounts. Several of them have a solid cash balance so they’re not in a hurry for a cash injection.

They’ve progressed significantly over the last 18 months, but their market value is a fraction of what they were back then.

No wonder some of the larger companies are gobbling up these companies now, even if they’re issuing new shares and diluting their capital. This is because they recognise these hard-to-miss opportunities that won’t last long.

Inexperienced and impatient shareholders mightn’t appreciate these moves. But those who hold a long-term perspective can foresee that these could pay off handsomely going forward.

So all is not lost just because gold stocks are trading lower than what they were the past three years. This is a consolidation period as the governments and central banks wrangle with the economy. They’re on a thin wedge now as their policies are proving to hinder global growth and prosperity.

When they fold on their strategy, that’ll unleash a significant rally in gold and other industrial metals. That should cause market sentiment to return in gold stocks.

If history is an indicator, have a look in the figure below at how gold stocks recovered from 2015–16 in the last cycle in 2012–16:

|

|

| Source: Internal Research |

Those who bought and held their ground from 2013–14 were well rewarded in the 2015–16 rally. I was one of those who enjoyed some substantial gains.

I almost tripled my investment from July 2013 to September 2016.

But instead of reminiscing fondly of the past, here’s your chance to make history ahead of time!

The current state of the economy and geopolitical instability has spurred governments and central banks worldwide to go to all lengths to buy and own gold.

This, and what I covered in today’s article, combine to potentially set up a seriously powerful bull market for gold stocks when the time comes.

Learn about why I’m so confident about the future for gold and gold stocks by checking out this presentation, and consider signing up to my precious metals investment service, The Australian Gold Report so you can find opportunities to build your portfolio in precious metal bullion and gold stocks!

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

Comments