The future is inherently unpredictable. The global economy and stock market is a hugely complex machine. So coming up with an outlook for 2025 is a tricky endeavour.

Which is why I’m not going to bother. And as I argue below, I don’t think you should either.

Let’s start by understanding why we humans like the prediction game. And why the stock market in particular is so full of prognosticators.

I wrote extensively about this in my book, You, Your Brain and the Stock Market. Here’s a brief excerpt:

‘In his excellent book, Deviate, Beau Lotto writes:

“…all brains are deathly afraid of uncertainty — and for good reason. “Not knowing” is an evolutionarily bad idea. If our ancestors paused because they weren’t sure whether the dark shape in front of them was a shadow or a predator, well, it was already too late.

“We evolved to predict. Why are all horror films shot in the dark? Think of the feeling you often have when walking through a familiar forest at night as compared to during the day. At night you can’t see what’s around you. You’re uncertain. It’s frightening, much like the constant firsts life presents us with — the first day of school, first dates, the first time giving a speech. We don’t know what’s going to happen, so these situations cause our bodies and our minds to react.

“Uncertainty is the problem that our brains evolved to solve.”

‘In investment markets, however, you cannot ‘solve’ the problem of an uncertain future. You simply manage it as best as you can.

‘How?

‘By creating stories — or fictions — about how the world works. Nobel Prize-winning psychologist Danny Kahneman calls it the illusion of understanding. In his book, Thinking, Fast and Slow, he writes:

“The illusion that one has understood the past feeds the further illusion that one can predict and control the future. These illusions are comforting. They reduce the anxiety that we would experience if we allowed ourselves to fully acknowledge the uncertainties of existence.”’

So, there you have it. We predict to solve for uncertainty, which is an evolutionary nightmare. Even though those predictions are an illusion.

But if stock market predictions are a mug’s game, what should you do?

For me, simple awareness of this evolutionary shortcoming is the best defence against getting carried away with predictions.

If I understand why we like a good prediction, I’m less inclined to care too much about the prediction, given I know the futility of getting it right.

The other damaging aspect of the prediction game is that it focuses you on the short-term.

Investing is a long-term game. Yet we constantly focus on short-term market influences. This suits the financial services industry. The more you buy and sell and change your mind, the more fees flow into their pockets.

Instead, if you ignore short-term predictions and just sit with what you have, your chances of success are much greater.

Let me explain…

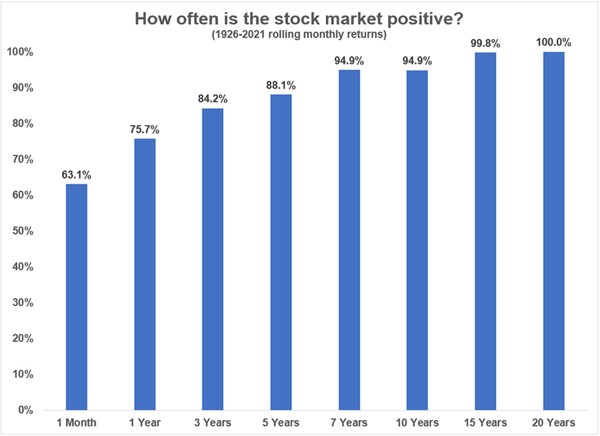

The chart below is from Ben Carlson’s Wealth of Common Sense blog. It shows that over a one-year time frame (using US stock market data from 1926–2021), you have a 25% chance of losing money.

That’s not bad odds. But they’re not great either.

However, give it seven years, and your odds of making money increase to 94.9%. Over nearly a century of data, the odds of being underwater after seven years are just 5%.

Give it 20 years, and you’re guaranteed a positive outcome. Don’t forget, that period included a global depression, a world war, and many other regional conflicts, oil shocks, and a huge inflation spike in the 1970s.

| |

| Source: A wealth of common sense |

What do I expect in 2025, then?

The correct answer is, ‘who cares’!

By that, I don’t mean to ignore your portfolio and just let fate take care of things.

But I do mean you shouldn’t worry about whether interest rates are going up or down, whether Trump will impose tariffs, or whether Labor will lose the coming election.

In the scheme of things, these factors don’t matter.

Throughout any 12-month period, there will always be lots of noise around largely meaningless events. The job of a long-term investor is to discern signals from noise and act to take advantage of others’ folly if you can.

Which brings me to the closest thing to a 2025 prediction you’ll get from me…

I’m expecting a lot more noise in 2025. By that, I mean more volatility.

2024 was a very quiet year. The biggest correction experienced by the ASX200 was a 5.8% drawdown in July/August. It lasted all but a few weeks. If a technical correction is 10%, we didn’t have one in 2024.

To be clear, I’m not predicting a bear market. Conversely, if this bull market continues to unfold, with an accompanying increase in bullish sentiment, then markets will head higher over the year. But it’s unlikely to be as smooth sailing as experienced in 2024.

As bullish investment sentiment picks up, the market becomes more ‘emotional’. An emotional market is a volatile market.

Instead of getting caught up in that emotion, the long-term investor must stand aside and be an observer of it. Only then can you discern the signal from the noise.

My guess is that the noise will be of the bullish variety. I wouldn’t be surprised to see a correction of 10% or more, followed by renewed bullish moves higher. Valuations will price in an increasingly rosy future where earnings grow faster than economic growth.

Companies with little to no earnings will trade at ridiculous prices again as speculative fervour takes hold.

Long-term investors will know what to do with that. Short-term prognosticators will eventually find themselves in a world of pain.

I guess I’m saying 2025 could be another good year, albeit a volatile and unsustainable one.

I’ll continue to play the long game. Buying good companies at good prices and saying goodbye to them when they get too expensive. It’s a simple formula that works, and you don’t need any predictive skills!

Have a Happy New Year, and I’ll see you on the other side!

Regards,

|

Greg Canavan,

Editor, Fat Tail Alliance, The Insider and Fat Tail Investment Advisory

Comments