The Musgrave Minerals Ltd [ASX:MGV] share price looks to continue its upwards swing today with the explorer announcing the discovery of large, high-grade gold zones at its Cue Gold Project in WA.

We last visited the MGV share price in October, when it was also showing signs of shifting momentum upwards.

Though that was clearly not meant to be.

Source: Tradingview

When valuating stocks like MGV, who already has a large, defined resource, it is also important to factor in movements in the price of gold.

Coincidently, the price of gold has spiked over the past couple of days.

At time of writing the MGV share price is up 3.75% to trade at 41.5 cents per share.

What is the Musgrave Minerals share price waiting for?

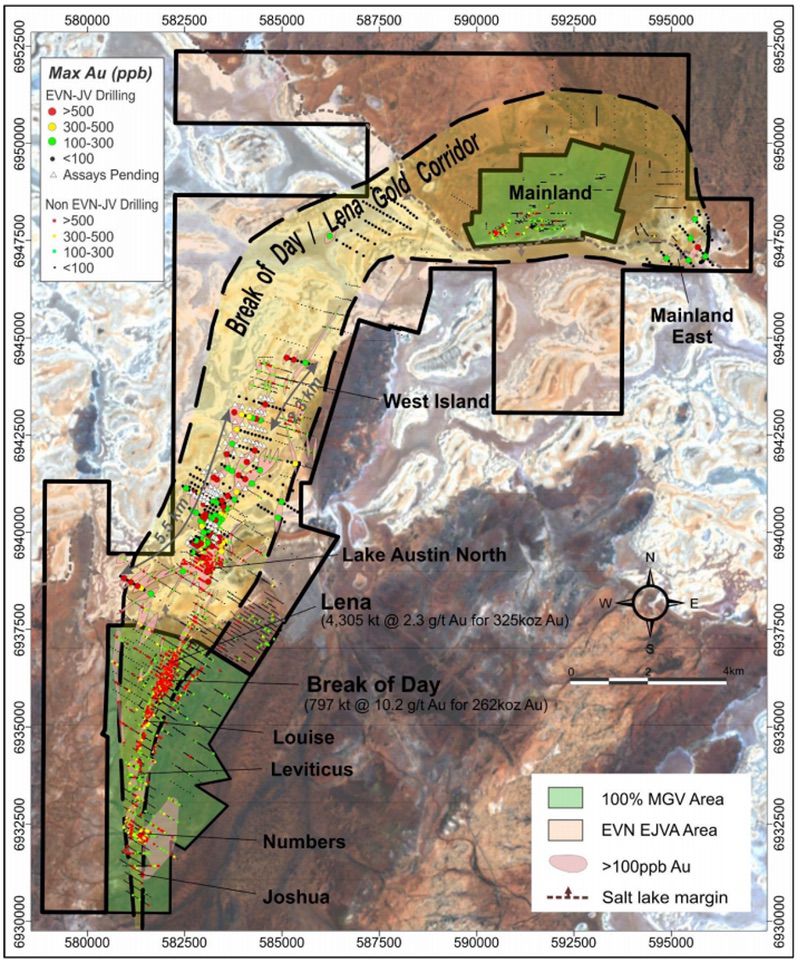

Today, MGV announced the results from its Lake Austin joint venture with Evolution Mining Ltd [ASX:EVN].

Highlights include:

- 5m at 12.1 grams of gold per tonne (g/t) from 90m, including 1m at 53.7g/t from 90m

- 13m at 1.9g/t from 96m, including 1m at 17.2g/t from 106m

- 69m at 0.8g/t from 126m, including 23m at 1.3g/t from 159m

MGV said its latest results have strengthened the company’s exploration model for a large gold system beneath Lake Austin.

Today’s results form part of Phase 2 drilling at the site have extended and infilled the Lake Austin North gold anomalism where mineralisation remains open.

Discover why this gold expert is predicting a HUGE spike in Aussie gold stock prices. Download your free report now.

In fact, many of the drill holes in both phases of the program terminated in anomalous gold, meaning that the mineralisation could remain open below ‘basement’ level.

Source: Musgrave Minerals

So, with a swath of positive results across the Cue Gold Project (be sure to read up on them here), what is it going to take for the share price to push upwards again?

Having already defined a large mineral resource at the project, the MGV share price could be entering a phase called the ‘orphan period’.

This is where the speculators, who have already made their money in the run-up, take their profit, which pushes shares down.

Are Musgrave Minerals’ shares cheap?

There is still plenty of activity ongoing across MGV’s tenements at Cue.

Most notably, the explorer said that the appropriate surveys have commenced in preparation for further development studies.

While development could be more than a year (if not two or more) away, during this stage we often see institutional investors begin to buy in the lead up to production.

But a word of caution, I’m talking in general here and it does not mean this will happen to MGV.

Our resident gold expert Shae Russell is tipping Australia to become the new gold epicentre. If Australia knocks China off the top spot, we could see more attention given to Aussie gold stocks like MGV. In her free report, Shae details why this could mean big spikes for Aussie gold stocks and what to look out for. If you’re interested, get your free copy here.

Kind regards,

Lachlann Tierney

For The Daily Reckoning Australia