A little over a year ago, Bitcoin [BTC] was flying high.

The long-coveted embrace of institutional acceptance had finally arrived.

On 12 August 2021, Forbes was telling us:

|

|

| Source: Forbes |

This (comical) extract is from the article (emphasis added):

‘In its formative years, bitcoin was dismissed by institutions as a showy worthless digital asset favored by criminals. Gradually, the tectonic plates that shape sentiment in the corridors of power shifted. Bitcoin, which appeared to be on an ideological collision course with institutions in its first decade of existence, recently bears the hallmark of institutional acceptance.

‘This has been driven by a number of factors led by the outstanding performance of bitcoin relative to any other asset class on the planet. “Smart money” is allocating to bitcoin as a portfolio diversification strategy.’

‘Smart money’? What a joke.

Bitcoin was the most speculative of assets in the greatest speculative bubble in history. How could anyone possibly think putting money into this stuff was ‘a portfolio diversification strategy’?

In buying this overpriced rubbish, you were simply concentrating your exposure to an even higher risk asset, NOT diversifying away from it.

The golden rule of asset bubbles is this: When the asset bubble busts — as they ALL do — the one that rose the highest always falls the hardest and fastest. Never fails.

You might be thinking ‘with 20/20 hindsight we all know that’.

In the days following the Forbes article, the 16 August 2021 issue of The Gowdie Letter made this observation:

‘Learning from the past

‘Here’s what I know from my experience in this business.

‘If there was a growing trend in society to “sell-your-mother” for profit, you can rest assured institutions would find a way to package up a product to capitalise on the trend.

‘Heck, if the bonuses were good enough, the instos would even throw in their own mothers.

‘Institutions getting involved in a hot sector is as old as time.

‘In 1986/7, “Special Situation” Funds were created to invest in entrepreneurial stocks. In late 1990s, “tech-related” funds came to market in their droves.

‘Then we had 2006/07…subprime lending and mortgage securitisation.

‘The conditions we have today are almost identical to those of 2007…with one major exception.

‘This bubble is SO much bigger.

‘Whenever I hear “the institutions are getting involved in crypto”, it brings a wry smile to my face.

‘From my experience, institutional involvement in a hot product is driven by a desire to “make some serious hay while the Sun shines”, rather than an endorsement of the long-term value of the investment.’

If you’ve been around markets long enough AND you learn the lessons, none of this is new…it just comes dressed in a different guise.

As the crypto pyramid continues to crumble — and it’s only a matter of time before you’re going to see more headlines of high-profile collapses — the prospect of institutional money pouring into the crypto market is about as likely as me being anointed the next Pope.

The putrid stench of Sam Bankman-Fried’s FTX fraud will be far too repugnant for even the greediest and morally corrupt of Wall Streeters.

And if there ain’t a cracker to be made, and made quickly, the instos close the funds down. Just like they did with the ‘hot sector’ products of past manias.

The absence of new money coming into the pyramid scheme all but assures us of more front-page news stories on the ‘unexpected’ collapse of the crypto holdouts like Binance, Tether, and a few others.

The regulators are a comin’

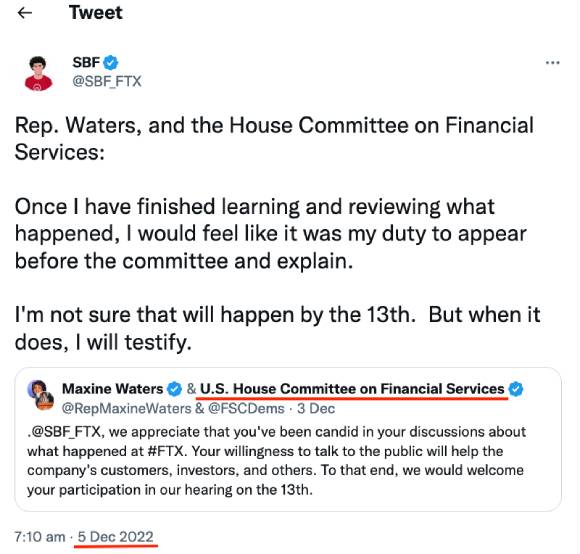

On 3 November 2022, US Congresswoman Maxine Waters (chair of the House Committee on Financial Services) posted a tweet asking Sam (or is that Scam) Bankman-Fried (SBF) to ‘participate’ in a Congressional Hearing convened on 13 December to ‘explore the collapse of FTX’.

To which Scam Bankman-Fried replied on 5 December…‘once I have finished learning and reviewing what happened’:

|

|

| Source: Twitter |

Wow.

For someone who actively cultivated an image of ‘the smartest guy in the crypto room’, he still hasn’t figured out the ‘how and why’ of this collapse?

PLEEEAAASSSSE spare us this ‘I’m an unsuspecting victim bullsh*t’.

Here’s another all-but certainty…SBF is going to testify…but not of his own free will.

Waters’ tweet was a friendly invitation to participate. The next one won’t be.

If Ken Lay (Enron), Bernie Madoff, and Elizabeth Holmes (Theranos) are any indication of what awaits blatant fraudsters, SBF is destined to appear before a US Congressional Hearing in an orange suit and handcuffs.

When the cryptosphere collides with the meteor of economic and financial reality — my guess is the Big Bang moment might occur in the first half of 2023 — US regulators are going to milk it for all its worth.

With the media in attendance, the Washington theatre of pretence will put on a grand show.

Parading the perps. Asking pointed questions. Passing legislation. All in the name of protecting the people AND making sure nothing like this ever happens again.

Yawn. Seen this all before too.

In the 5 October 2021 issue of The Rum Rebellion (as the price of bitcoin was near its all-time HIGH), I wrote:

‘A global crackdown on cryptos is coming

‘This is NOT new news.

‘Regulators are reactive, not proactive.

‘Action only ever gets taken AFTER the proverbial hits the fan.

‘To quote from the 2009 Parliamentary Joint Committee Inquiry into financial products and services in Australia (emphasis added)…

“On 16 March 2009 the Senate agreed that the following additional matter be referred to the Parliamentary Joint Committee on Corporations and Financial Services…

“The committee will investigate the involvement of the banking and finance industry in providing finance for investors in and through Storm Financial, Opes Prime and other similar businesses, and the practices of banks and other financial institutions in relation to margin lending associated with those businesses.”

‘Note the date our Senate agrees to hold an Inquiry into the perils of leveraging into investments…16 March 2009.

‘Classic example of horse bolted; gate shut.

‘The ASX 200 — after falling 53% over a 15-month period — bottomed out a fortnight earlier on 1 March 2009.

|

|

| Source: Yahoo! Finance |

‘By the time our elected officials limped into action, the damage was well and truly done.

‘The Inquiry should have been held in 2006…before the highly speculative strategies of Storm Financial, Opes Prime and others cost investors their life savings.

‘The present-day Wild West of financial markets is in cryptos.

‘These digital multi-level marketing scams are a haven for fraudsters, criminals, speculators, and the naïve (those who really think there’s going to be a legitimate digital currency alternative…just taking a momentary pause while I get my laughter under control).

‘Anyway, in this mostly unregulated frontier world, the crypto pump and dump schemes are grist for the mill.

‘The “whales” and the networks and exchanges they control, manipulate prices to enrich themselves and impoverish their victims.

‘Bitcoin is a worthless proposition which is being given a (completely ludicrous) value thanks to speculators speculating on the speculation.

‘In professional circles this is known as…the bigger fool theory.

‘Blind faith-based value is a seriously flawed pricing model.

‘To those who say, “If this is true, then why have cryptos gained so much traction?”

‘The answer can be found in the wisdom of Einstein…“Two things are infinite: the universe and human stupidity; and I’m not sure about the universe.”

‘The bottom line is people need to be protected from their own stupidity. I saw this firsthand with Storm Financial clients. No amount of reason could dissuade them from pursuing this flawed investment model.

‘Whereas tougher and tighter regulations BEFORE the event, may have limited the damage.

‘…as in 2009, the really tough and restrictive regulatory actions won’t happen until the crypto pyramid scheme collapses under its own fraudulent weight.

‘And, for those who think accounts held in the ether can evade regulatory oversight, you really are living in a fool’s paradise.

‘When US regulators — empowered by (an as yet to be held) US Senate Inquiry into “Crypto Corruption” — decide to get serious, they’ll have reach and power beyond their national borders.’

All of this (and what’s to come with cryptos) was foreseeable years ago.

The ONLY thing you cannot foretell is how long the con can be maintained.

Madoff kept his going for two decades.

Theranos and Enron hid their sins for a few years.

The reason why it’s so predictable is best summed up by US President Harry S Truman:

‘There is nothing new in the world except the history you do not know.’

The writing of this chapter in history should serve as a lesson for generations to come…but it won’t.

Why?

Because history shows us that history is always dismissed with the classic one-liner…this time is different.

It never is.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia