And away we go for another week here at The Daily Reckoning Australia.

And what could be more important than to reckon with the outlook for inflation right now?

Only a fool could believe the official government numbers.

Such garbage has no place in a durable investment framework.

We need to base our decisions off market signals.

Current Outlook for Inflation

That’s because anyone holding fixed-income investments could find their purchasing power shredded.

Pretty soon your weekly shop will tell you all you need to know anyway.

Bloomberg reports that:

‘A small handful of commodities form the backbone of much of the world’s diet and they’re dramatically more expensive, flashing alarm signals for global shopping budgets.’

Indeed. The wheat price is up 30%, corn has doubled, and soybeans are up 86%. Canola prices are also up 92%.

What is inflation but higher prices? It’s ripping around the world right now.

The central banks say it’s barely there, and they can contain it if it does break out.

Hmm.

That reminds me of Former Fed Chair Ben Bernanke completely missing the housing bubble that resulted in the Panic of 2008.

This surge is going to pressure interest rates if it continues. I think it will.

After all, how many millennials do you know that have taken up farming lately?

It’s not something that can turn on a dime. High agricultural prices could persist for years.

We’ll see on that.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

More urgently for us, fairly soon the market will price in rate hikes before the central banks have guided that they are prepared to lift them.

Prepare yourself: things could get volatile!

This is going to place the Reserve Bank of Australia in a double bind fairly shorty too.

When commodities rally in a big way, like they are now, international traders buy the Aussie dollar as a ‘macro’ way to trade the dynamic.

Naturally, this buying pushes up the dollar against the USD.

The RBA is already aware that the Aussie dollar has appeal from the higher interest rates here than elsewhere too.

There could be a lot of money surging into Australia fairly shortly.

I expect the Aussie dollar will soon go well over 80 US cents.

I remember a few years ago, under a similar situation for the Aussie dollar, my colleague Jim Rickards advised that the RBA should print dollars to buy gold.

Money Printing Weaken The Currency

The argument: money printing would weaken the currency.

The RBA would be left with a hard and undervalued asset to add to its reserve base.

The argument still stands today. But we could also twist it. The RBA could weaken the currency the same way but buy gold and bitcoin.

After all, bitcoin and gold share the same attribute — they are hard assets in an inflationary world.

Put the outlook for both in the context of today’s market. All over the globe government bonds pay a pittance.

It was a reasonable place to park cash in the disinflationary dynamic after the collapse of 2008.

But now?

No way. The US dollar looks anaemic. Global commodities are priced in dollars. As the dollar goes down, commodities go up. That takes inflation higher again.

If you’ve been around a while, you’ll know this argument was made after 2008. But this time is NOT the same dynamic.

After 2008, US banks were weak and did not lend much. They was so weak that there was less money circulating in the US in 2016 than there was in 2006.

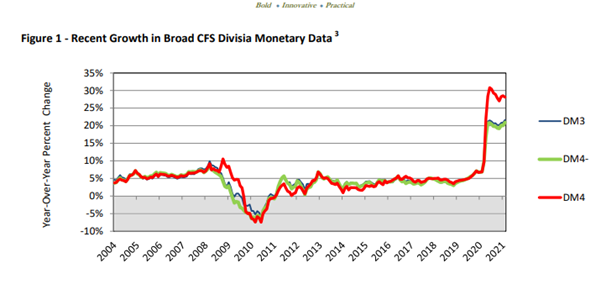

That’s not now. Here’s the latest money supply chart from the Centre for Financial Stability:

|

|

| Source: Centre for Financial Stability |

See that big spike from 2020? Now, look at commodities roaring higher around the world.

Consider US stocks at all-time highs. Oh, not to mention cryptocurrencies going absolutely bananas.

It doesn’t take Einstein to work out all this money being pumped out is finding a home wherever there is the chance of a capital gain.

This year’s run in cryptocurrencies could just be a warmup considering that the central banks continue to juice the markets with freshly printed money.

I’ll keep saying the same thing. Now’s the time to be accumulating land, bitcoin, gold, stocks…and cryptos.

In other words, anything that can’t be created on a printing press.

Make sure you go here for the latest on the crypto craze gathering steam around the world.

Millennials may not be into farming, but they love shoving their stimulus cheques into the crypto market.

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.

Comments