Mineral Resources [ASX:MIN] today released its Q3 FY22 exploration and mining activities report.

The market shrugged at the update, however, with MIN shares flat in afternoon trade.

In a turbulent 12 months for the stock, MIN is up 35% over the year, trading as low as $36.95 a share.

Currently, MIN is exchanging hands for about $60 a share:

Source: Tradingview.com

Mineral Resources March quarter lowdown

During the March quarter, MIN’s production volumes of 63.4 million tonnes mined were 16% higher on the prior corresponding period (pcp).

MIN said its mining services business is on target to meet FY22 production guidance of 275 million to 290 million tonnes:

Source: Mineral Resources

Iron Ore

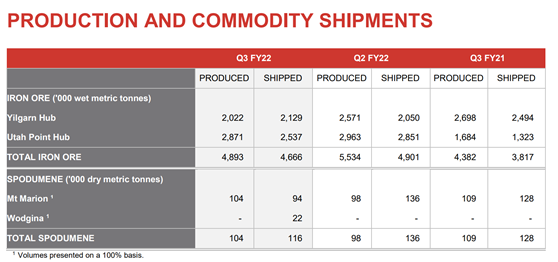

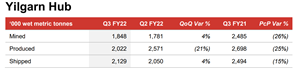

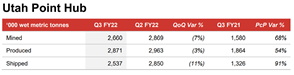

MIN’s iron ore shipments came in at 4.7 million wet metric tonnes (wmt), up 22% on pcp.

Mineral Resources says the iron ore business is on track to meet FY22 guidance for export shipments (18.5–19.5M wmt) and costs (CFR ex-royalties) of AU$96–104/wmt for its Yilgarn Hub and AU$80–88/wmt for its Utah Point Hub.

MIN realised an average iron ore price of US$101.31 a tonne for the quarter, 60% higher on a quarter-on-quarter basis.

Source: Mineral Resources

Lithium

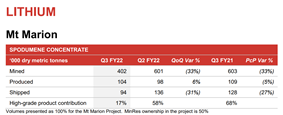

MIN’s Mt Marion Lithium Project produced 104,000 dry metric tonnes (dmt) and shipped 94,000 dmt of spodumene concentrate during the quarter.

MIN said Mt Marion remains on track to meet FY22 guidance of 450,000–475,000 tonnes at the cost of AU$570–615 per dry metric tonne.

Mt Marion’s average realised spodumene concentrate price for the quarter was US$1,952/dmt, a 69% increase on the previous quarter.

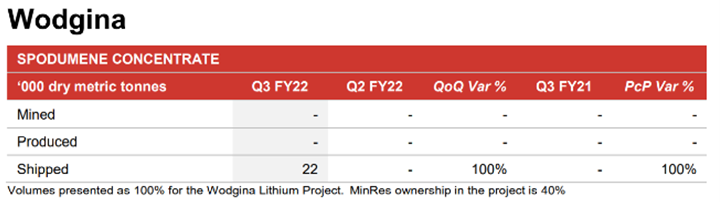

22,000 dmt of spodumene concentrate was shipped from MIN’s Wodgina project, at a realised price of US$2,200/dmt.

First new spodumene concentrate from Wodgina Train 1 is expected in May 2022.

In February, MIN took possession of its 51% share of the Mt Marion spodumene concentrate offtake.

The miner plans to convert this spodumene into the more premium lithium hydroxide product in China under a tolling agreement.

Source: Mineral Resources

Mineral Resources share price outlook

MIN’s recent focus on expanding its lithium resources likely has a lot to do with uncertainty around iron ore prices, especially as China’s economy slows.

As the company admitted in its 1H22 result, the collapse in iron ore prices in the first half of the fiscal year ‘delivered our worst first half financial result in three years.’

But while iron ore’s prices are well off their peaks, lithium prices continue to climb, and with them, MIN’s lithium ambitions.

Despite the importance of battery tech materials like graphite, silicon, copper, and nickel, it was lithium that became one of the hottest investment themes on the ASX as the EV revolution ramped up.

After all, in 2021, eight of the top 10 best-performing stocks in Australia were lithium stocks.

But according to Money Morning’s latest report, there’s a smarter way to play the rise of lithium in 2022.

It involves what you might call lithium’s ‘little brother’.

Access the ‘The NEXT Lithium?’ report here to find out more.

Regards,

Kiryll Prakapenka,

For Money Morning