Gas, iron, and lithium miner Mineral Resources [ASX:MIN] today released its half-year fiscal 2023 report, touting a turn of profits that jumped much higher on last year thanks to a healthy lithium segment.

Revenue surged 74% on the same time last year to $2.35 billion, while underlying EBITDA was knocked out of the park by 503%.

The real piece de resistance was for net profit, which cranked up by 1,890%. Statutory net profit after tax was $370 million higher than a year ago.

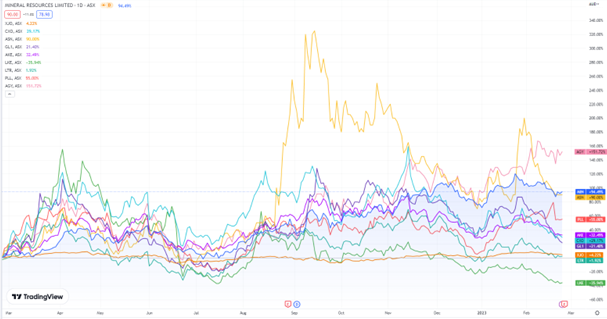

In the morning, MIN saw its share price fluctuate, yet it dipped to around $82.60 at time of writing.

MIN is up 7% so far for 2023, though it is still early days. Looking at the miner’s stock price over the past 12 months, it rose in the green by 89%.

Source: TradingView

Lithium escorts MIN to surging profits

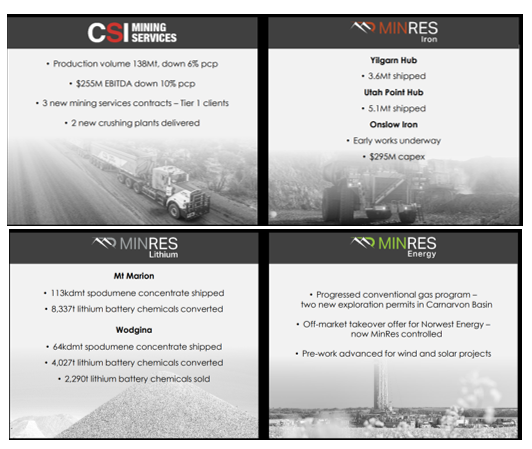

Today, the miner released its first half report for the 2023 financial year, boosted by a strong period of lithium earnings produced from lithium projects Mt Marion and Wodgina.

Revenue had been pushed up to $2.35 billion, and underlying EBITDA (earnings before interest, tax, depreciation, and amortisation) had ballooned 503% to $939 million.

MIN’s statutory net profit after tax totalled $390 million, $370 million higher than the year earlier.

The miner’s diluted earnings per share (EPS) had also rocketed by 202 cps, an increase of 1,888%.

Despite the surge in profits and earnings, the resources group declared the same interim dividend as it had the year before, fully franked at $1.20 per share.

While the company turned a healthy profit, operating cash flow had also increased by an ambitious 333% to $281 million.

Working capital linked to lithium chemical and spodumene conversions drove up expenses, the group’s CapEx climbing 84% to $741 million, pushing its cash reserves down 29% to $1.714 billion.

As it stands, the miner’s FY23 guidance remains unchanged.

MinRes Managing Director Chris Ellison said:

‘MinRes had a strong and stable first half, with solid earnings set to deliver shareholders a $1.20 fully franked interim dividend. We are well set-up for an excellent year, with our balance sheet and performance across all areas in a great position.

‘Our first half was headlined by record lithium earnings from conversion of Mt Marion and Wodgina spodumene concentrate into lithium battery chemicals. This was underpinned by consistent mining services earnings and a return to positive iron ore earnings due to improved product discounts.

‘We have locked in substantial growth in each of these business divisions for the next five years and built the foundations that will set up MinRes for the next 50 years.

‘We’re also taking MinRes to the world by exploring options outside of Western Australian across the business.

‘This financial year is set up for a strong run home, with the pieces in place for an exciting second half that should deliver even better results, as we consistently do.’

Source: MIN

Australia’s boom in commodities, and how to capitalise

Things are getting pretty competitive in the commodities market.

It’s a busy place, with so many options, sometimes it can be hard to figure out which companies to bet on and which ones are on the pathway to the most success.

Our in-house resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’…and better yet, this is a boom where Australia and its stocks stand to benefit greatly.

The next big mining boom is predicted to happen in the next few years, the question is, are you ready for it?

Don’t let the same people who got rich last time be the only ones for a second time!

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia