Diversified miner Mineral Resources [ASX:MIN] held its annual general meeting on Thursday, following the release of its 1Q23 results last month.

The mining services production volumes in the September quarter rose 8% quarter-on-quarter (QoQ), totalling 69 million tonnes.

MIN’s iron ore segment slumped during the quarter, with shipments falling 3% QoQ to 4.5 million wet metric tonnes.

The average realised iron ore price for the quarter was down 15% QoQ to US$72.77 per dry metric tonne.

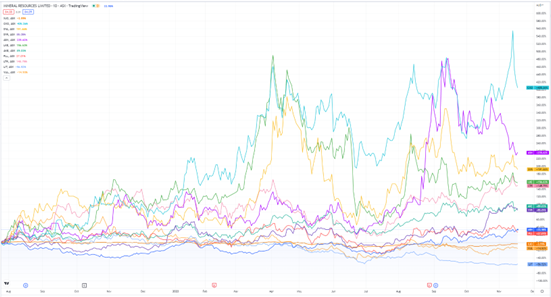

MIN shares are up 40% year to date.

Source: tradingview.com

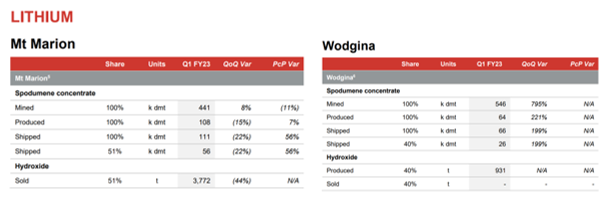

Mineral Resources’ quarterly exploration and mining stats for Q1 FY23

Last month, Mineral Resources provided results for the first quarter of the fiscal year 2023.

As to be expected for a diversified miner, some areas performed better than others.

Overall, MIN reported an 8% increase in production volume quarter-on-quarter, with a total of 69 million tonnes.

Across the quarter, 56,000 dry metric tonnes (dmt) of lithium spodumene was extracted from the company’s Mt Marion Project, with an average realised concentrate price of US$2,364 per dmt — including grade adjustments and discounts.

MIN revealed that the average spodumene concentrate of 6% (SC6) equivalent FOB pricing was used for both its Wodgina and Mt Marion spodumene shipments, for converting to US$4,187 per dmt from 1 July to the end of December (95% of the three-month trailing monthly average benchmark prices).

The company’s Wodgina ramp-up continued with its first spodumene concentrate delivered by Train 2 in July, shipping 26,0000 dmt over the quarter.

However, earnings won’t be recognised until this product has been transformed into a lithium hydroxide product and sold.

The lithium hydroxide that has been converted over the quarter consists of 4,703 tonnes.

This comes from the 51% offtake share of Mt Marion spodumene (3,772 tonnes), which was converted in China (and sold to Jiangxi Ganfeng Lithium Co as per existing agreements at US$79,288 per tonne), and a further 931 tonnes of lithium hydroxide converted from Wodgina by Albemarle, in which MIN has a 40% share, and it expects to sell in Q2 FY23.

Source: Mineral Resources

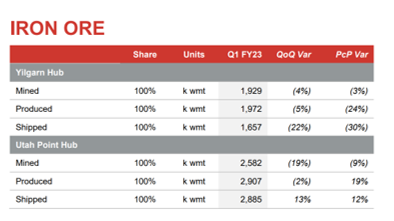

Mineral Resources revealed that it was a tough quarter for iron ore, with ore shipments down 3% QoQ at 4.5 million wet metric tonnes (wmt) — which the company actually said was in line with its mine plan and guidance for FY23 — (between 17.2 and 18.8 million wmt).

Prices for iron ore were also down by 15 QoQ at US$72.77 per dmt average realised pricing — which represented a 70% realisation to Platts 62% index.

Source: MIN

MIN’s project portfolio well-positioned for energy overhaul

Despite Mt Marion production lower quarter-on-quarter due to lower-grade ore and plant-expansion closures, MinRes believes Mt Marion to be on track to reach FY23 guidance of 300-330,000 dmt.

MIN also shared that it will launch a Final Investment Decision (FID) for the development of Red Hill Iron Ore, a joint venture with Baosteel Resources Australia, POSCO and AMCI — this is for the Onslow Iron Project, a new mine forecast as a 30-years or more project, expected to mine 35 million tonnes ore a year.

Together with its lithium ventures, existing ore projects and Yilgarn (magnetite) and Pilbara projects. Not to mention its exploration in the Perth and Carnarvon basins — Mineral Resources has cast its net across a wide, diversified network of energy-related developments.

MIN continues to evaluate its options to maximise its value, including its lithium business.

And the timing couldn’t be better…

Is the ASX about to see a commodities boom?

Our new resources expert and former geologist James Cooper thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities.’

A boom where Australia (and ASX stocks) stands to benefit.

James recently penned a mammoth report on the topic.

You can access that report and access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For Money Morning