1. Mr Market seems to have stalled for the moment. That might sound like a surprising comment.

Anyone who looked at the headlines about the Aussie market hitting new highs might think we’re in a raging bull market.

Not so, mostly. Both volume and speculation are decidedly absent.

One of the algos we have here at Fat Tail Media is cautious on the market as well (for now).

This dynamic is interesting in the context of the ‘Robinhoodie’ idea from last year.

Remember when they got the blame (or credit) for some of the ripping moves over 2020. Where are they now? Back at school or uni?

There are bright spots in the market now — property trusts and the energy sector are two.

But now’s a time when you need to know if you’re trading short-term momentum or a long-term accumulator.

You could put my new colleague Brian into the latter category. He just sent out his top five gold investments for readers of Strategic Intelligence Australia

Brian has been investing exclusively in the gold sector since 2013.

He’s got a few scars from gold stocks going through a bear market, but made money when the going is good.

He sent me one of his Excel spreadsheets for the gold stocks he tracks. I doubt there’s one bit of data he misses!

Gold stocks have been on a bit of a tear since bottoming out in March. They’re having a slight pause as of now.

I suspect we’ll see gold break US$2,000 an ounce before this year is out.

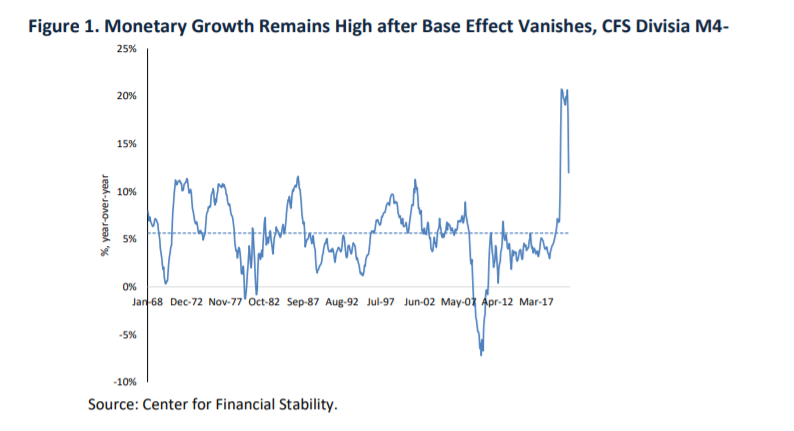

The US money supply is still exploding, as you can see here…

|

|

|

Source: Center for Financial Stability |

The firm that collates this data doesn’t mince its words either when it comes to the implications…

‘Going forward, inflation will likely continue its upward ascent and stretch beyond the Fed’s comfort zone. The present global macro backdrop for investors and officials is one of the most challenging and complex in decades.’

If you’re ready to jump on the gold freight train, check out Strategic Intelligence Australia

2. I have to tip my hat to my colleague Greg Canavan today too.

Greg has made some ripping contrarian calls lately.

He got his subscribers into the big bank sector last year, and they’ve been coasting up to new highs ever since…with juicy yields still to come after 30 June.

Then he backed the oil sector to keep running up when the outlook for demand looked very crook indeed. Oil is threatening to hit US$80 a barrel now.

I’ve been sceptical of the oil run the whole time, so I haven’t been fishing in these waters.

But Greg’s been busy going over the energy names. He’s looking for mispriced opportunities in the top 200 stocks to weather what he calls ‘Life at Zero’.

That’s the reality you, I, and everyone else is living in. There’s no return in bank deposits. That coerces you into the share market for cash flow.

You have to risk your capital in order to get access to the dividend flows. But where do you do that? Let Greg guide you on this complex task.

You’re likely going to need some help with that. Over the weekend, The Australian reported that financial planners are leaving the industry in droves because of regulation and compliance burdens.

See here:

‘Financial advice for all but the richest Australians is in serious jeopardy.

‘The advice sector is shrinking, the majority of students in existing courses are not becoming planners and now evidence is accumulating that the best advisers are cutting off anyone who is not officially “wealthy”.

‘The concerns are echoed across the financial planning industry with the issue at its most severe where advisers cut a whole layer of clients leaving them to find their own way through a forest of financial products and social welfare legislation.’

One wonders where this will lead. No doubt there are plenty of shards out there that will take advantage of this confusion, too, while the responsible and trusting advisors quit, retire or don’t bother.

It’s perhaps not a problem to vex you today, but if you have a good, trusted source of financial help — don’t let them go easily.

Here at Fat Tail Media, we do as much as we can to bring our readers what they need to know.

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.