Micro-X [ASX:MX1], the Adelaide-based X-ray technology company, has announced that it has been awarded an extension on its existing contract with the US Department of Homeland Security (DHS) to build and test self-screening X-ray checkpoint modules in US airports.

The extension comes after signing two contracts with the DHS in November 2020 to build and test two prototypes of its miniaturised CT baggage scanners. These prototypes are due for delivery in the coming months, but initial results have obviously impressed.

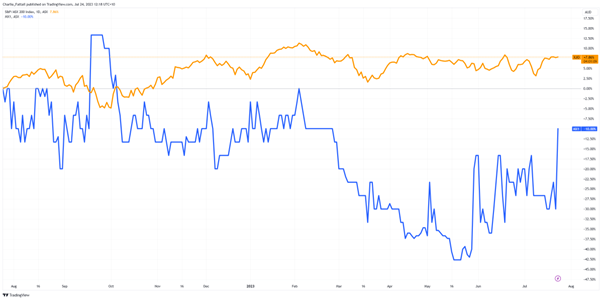

Investors were similarly rapt about today’s news, with the share price taking off today — up by 28.57% and trading at 13.5 cents per share.

Today’s trading has recovered a considerable chunk of the losses seen by the company’s share price over the year, which is down by 12.9% over the past 12 months, as shareholders became concerned about low revenues in 1H23.

Source: TradingView

DIY Security Checks and More

Micro-X has announced the extension of its contract with the DHS to manufacture and demonstrate a self-screen airport check within a US airport.

The extension marks a major milestone for Micro-X, providing up to AU$21 million in funding over 40 months. The initial commitment of $7.25 million covers the first 18 months of the project, with subsequent milestone payments ranging from $3–6 million.

The project focuses on the Passenger Self-Screening Project, which seeks to replace the current conveyor belt design for screening passengers’ carry-on luggage with a bank of multiple self-service security stations.

The extension allows Micro-X to progress from the detailed design phase to live airport testing. This involves the fabrication of a single self-screening station, followed by three stations, and ultimately a full six-station lane.

Source: Micro-X

Inspired by the concept of self-service checkouts in supermarkets, the aim is to increase throughput and enhance the passenger experience.

Micro-X’s miniaturised CT technology plays a pivotal role in enabling this vision, offering the potential for quicker and more accurate security checks.

Their proprietary X-ray technology differs from traditional X-ray machines that have remained largely the same since their invention in 1895.

Traditional X-ray machines use a heated filament similar to an incandescent lightbulb to emit X-rays.

Micro-X is the first company to instead use an electronic X-ray tube that could be best imagined as similar to an old cathode ray TV that fires rays through a controlled burst of energy.

With this new breakthrough technology, they have a cold X-ray machine that is faster to scan, around five times lighter and has a longer use life.

The X-ray technique appears well-refined by the company. Its next step is testing the end products for commercial release.

Micro-X will gather valuable feedback from the DHS and TSA (Transport Security Administration) throughout testing to refine and enhance the system’s design.

Micro-X Chief Executive Officer of Americas, Brian Gonzales commented on the extension, saying:

‘The partnership we have formed with DHS and TSA enables us to combine input from both the end-customer and the safety regulator to deliver a design that completely re-imagines security screening but is also grounded in the reality of airport operations and regulations.

‘We are excited to continue our partnership with DHS and TSA as we build and then demonstrate this design in real airports.’

The ultimate goal is to create a fully integrated passenger self-screening security system capable of transforming security screening across airports — and potentially outside aviation.

Micro-X has developed uses for its X-ray technology in the defence industry, announcing last week the first delivery of its Rover Plus system to the Australian Defense Force (ADF). The mobile X-ray system has been used in Ukraine and developing countries this past year.

Outlook for Micro-X

The contract extension is a significant advancement in Micro-X’s airport security strategy.

The opportunity to collaborate with the DHS and TSA in this contract gives Micro-X a huge advantage as its primary customer is also the main regulator in the space.

Micro-X’s contract extension with the DHS represents a promising opportunity for the company to demonstrate its technology in busy airport environments.

By leveraging miniaturised CT technology, Micro-X aims to revolutionise airport security and significantly improve the passenger experience.

This collaboration with the DHS and TSA propels Micro-X’s position in the airport security market and highlights its potential in the health and security sectors.

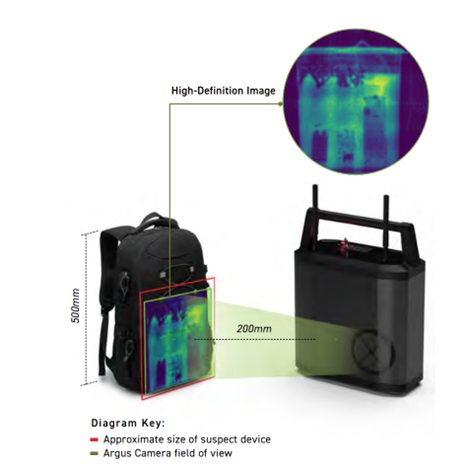

Micro-x’s X-ray technology is also being developed for commercial products in brain scanning and portable IED-explosive cameras.

Source: Micro-X

The strength of this scattershot product approach for Micro-X will be the ability to pivot to whichever sector responds well to its first products and grow from there.

Whichever sector becomes its primary customer— Micro-X is primed for growth.

Growth opportunities exist for other small-caps within Australia, but you need to know where to look.

Finding Small-Cap Opportunities

Are you looking for opportunities to make money in the stock market?

Depending on your risk tolerance, you may want to consider investing in small-caps.

Small-cap stocks are those with a market capitalisation of less than $500 million.

Investors often overlook them, but if you invest in the right ones, they can offer significant growth potential.

In our new report, we show you three ASX small-cap stocks that are already profitable and currently paying dividends. These stocks are:

- A mining services company that is serving Australia’s huge mining sector.

- A leading retailer in its niche that ended 2022 with $18.5 million in profit.

- A technology company that is developing a new product with the potential to revolutionise its industry.

We believe that these stocks are undervalued by the market. If the market realises their potential, these stocks could rise in value.

Of course, there is no guarantee of success when investing in small-caps. Small-cap investing carries high risk and their price can fall if things don’t go to plan. So never invest more than you are prepared to lose.

However, given their proven business models and healthy balance sheets, we believe these stocks have a good chance of success.

That’s why you should consider adding them to your watchlist today.

Click here to learn how you can access our FREE report, to learn more about these three stocks.

Act now to learn about this opportunity.

Regards,

Charles Ormond,

For Money Morning