The share price of small-cap iron, gold and base metal explorer, Meteoric Resources [ASX:MEI] are up a hefty 36.84%, or 0.7 cents this morning to trade at 2.6 cents per share.

Today’s rise marks the first day of trading in MEI shares in nearly three weeks as the explorer remained in a trading halt pending the announcement of its latest acquisition.

MEI announced it had signed a conditional legally binding term sheet to acquire the Palm Springs Gold Project located 30km southeast of Halls Creek in the Kimberley, WA.

With operations currently focused in Brazil, the recent acquisition could hedge the risk of operating in a country where MEI just resumed drilling after sites were closed due to COVID-19.

Historic gold prices renewing historic projects

With the price of gold looking like it could springboard its way back towards historic highs, thanks to renewed market volatility, old mines like Palm Springs in Australia are again becoming economically viable.

Gold price in USD (blue) and AUD (red) last 12 months, source: Tradingview

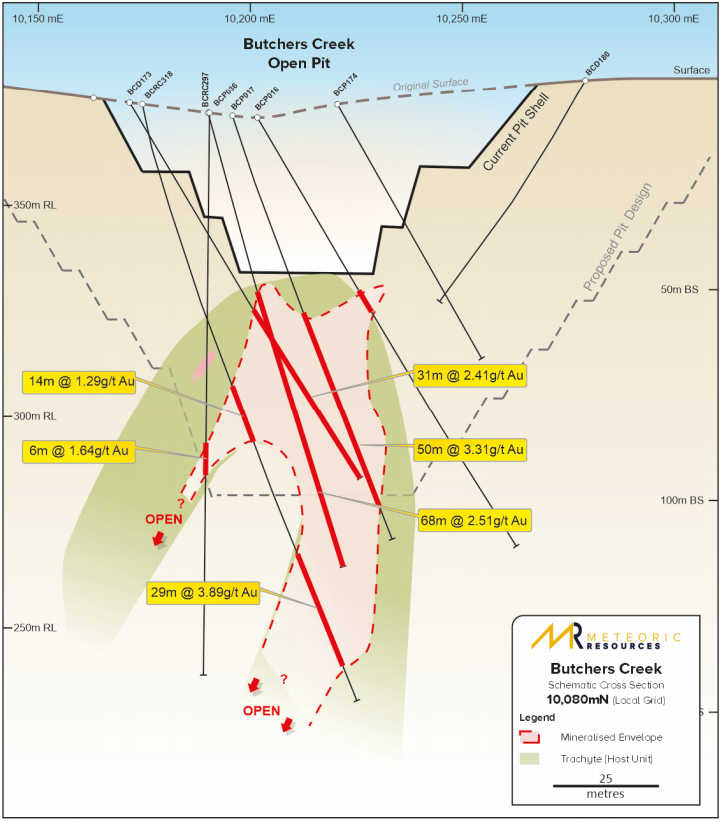

MEI’s acquisition of the Palm Springs Gold Project also includes the historic high-grade open-pit mine Butcher Creek.

Butcher Creek was active during the late 1990s, producing 52,000 ounces of gold at 2.1 grams per tonne (g/t).

Mining was later stopped due to unfavourably low gold prices at the time.

Discover how some investors are preserving their wealth and even making a profit, as the economy tanks. Download the free report by clicking here.

Source: Meteoric Resources

Historic drilling below the open-pit mine at Butcher Creek has returned some shallow, high-grade areas of mineralisation.

Highlights include:

- 68m at 2.5g/t from 44m

- 19m at 8.8 g/t from 56m

- 14m at 7.5 g/t from 82m

A few kilometres to the northeast lay the Golden Crown and Faugh‐a‐Ballagh Prospects (which lay within the Palm Springs Gold Project).

Northern Star Resources Ltd [ASX:NST] had previously completed drilling at these prospects, which also included numerous high-grade finds.

Could this be another speculative buy?

If you follow gold explorers closely, you’re no doubt accustomed to the sometimes sensationalist language these companies use in their ASX announcements.

That’s why it’s always best to cast a critical eye over the information presented to you.

Given the era when Butcher Creek was last explored and producing gold, data relating to the estimated resource size and other geological surveys has been lost.

Meaning that MEI must undergo additional evaluation work to report any remaining resources.

Ultimately, there is no guarantee there will be a mineral resource consistent with what has been previously reported.

At the Golden Crown and Faugh‐a‐Ballagh prospects NST reported an inferred resource of 28,000oz of gold.

MEI said it would be completing additional exploration of the areas over the 2020 and 2021 field seasons.

The acquisition of the Palm Springs Gold Project will be facilitated by a capital raising of $1.44 million.

The current holder of the Project, Pinnacle Nominees Pty Ltd, will receive $750,000 in cash and $250,000 in MEI shares at two cents per share.

The outstanding amount will be used for the first drilling program that will be undertaken shortly, according to MEI.

If you watch Aussie explorers, developers or miners closely and you liked the reasoning behind today’s article, make sure to subscribe to The Daily Reckoning Australia; it’s a great way to stay ahead of the curve when it comes to Australian miners. It’s free too. Subscribe here.

Kind regards,

Lachlann Tierney,

For The Daily Reckoning Australia

Comments