Metallica Minerals [ASX:MLM] has announced the definitive feasibility study (DFS) results for its Cape Flattery Silica Sand Project in North QLD.

The DFS confirms the project’s potential as an operation that could achieve consistently attractive profit margins — given QLD Government support and market dynamics in the Asia-Pacific region.

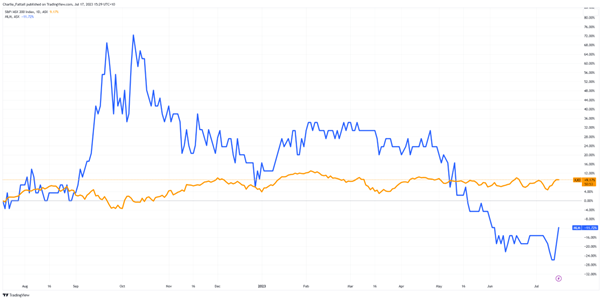

Investors regained their excitement after hearing today’s news, with shares up by 8.7%, trading at 2.5 cents a share. This matched the movements seen in the share price following the PFS release in March of last year, as similar sentiment was shared by commentators.

However, it’s been a shaky 12 months for MLM, with shares down by 11.7% as it faced delays in project approval and construction timing. This is due to Environmental Impact Statement (EIS) requirements by the Department of Climate Change, Energy, the Environment, and Water (DCCEEW).

While one government body taketh, another gave it away, with the QLD Government’s announcement of a new critical minerals strategy helping reduce the project’s development costs.

So, what does today’s study mean for MLM?

Source: TradingView

DFS confirms excellent economics

Metallica Minerals announced the results of its DFS today, highlighting the economic potential of its 100% owned Cape Flattery Silica Sand Project.

The DFS forecasts the life of project cash revenue of $2.910 million, returning pre-tax net present value (NPV10) of $437.3 million and an internal rate of return (IRR) of 32.2%.

The initial capital cost of the project is estimated to be $165 million, with a payback period from the commencement of production of 2.85 years. Most of this cost will be constructing a 24-hour processing facility and a purpose-built jetty for shipping.

The reserve for the Project is 47 million tonnes (Mt) at 99.18% SiO2, which will be processed over a 25-year project life to yield high-quality silica sand of 1.5 Mt per annum.

Metallica Minerals Executive Chairman, Theo Psaros said the company is very pleased with the results, saying:

‘The DFS confirms Cape Flattery Silica sand’s status as a low-cost, high-purity silica sand project that can achieve attractive profit margins. Combined with our location in Far North QLD and support from the QLD Government’s Critical Minerals Strategy, Metallica is well positioned to become a leading provider of high purity silica sand to the booming Asia-Pacific market.‘

Source: Metallica Minerals Ltd

The Project will also contribute to and benefit from the QLD Government’s Critical Minerals Strategy, which supports the development of ‘new economy’ minerals projects in Far North QLD.

The strategy was unveiled in June by Premier Annastacia Palaszczuk and came on the heels of a similar strategy announcement by the Federal Government.

Under the strategy, the government will commit $245 million in investment into supporting minerals that it deems critical for the movement towards net zero.

This includes high-quality silica, which is used primarily in PV glass for solar panels.

Metallica still has a few hurdles before the project can commence construction.

Its first challenge will be its negotiations with the traditional landowners. To date, six meetings have been held with representatives of the Nguurruumunga and Dingaal peoples — with further meetings slated for this year.

The next challenge is the continued delays in the EIS as guidelines have shifted multiple times since the first studies began in February 2022.

Thankfully as part of the critical minerals strategy, the QLD Government will undertake baseline environmental studies that should assist in getting the EIS over the line.

Looking ahead for MLM

The DFS is a significant milestone for the Cape Flattery Silica Sand Project and Metallica Minerals. The company is now looking forward to advancing the environmental impact statement, progressing negotiations with traditional landowners, and looking at other initiatives to enhance the value of the project.

The outlook for the project is positive. The global demand for high-purity silica sand is expected to grow in the coming years, driven by the increasing use of silica sand in solar panel glass, electronics and other applications.

Many of these applications are supported by government subsidies focused on reducing carbon emissions.

The project’s low-cost production profile and long mine life make it well-positioned to benefit from this growing demand.

Australia’s high-purity silica sand is crucial for the global shift towards a low-carbon economy — and we have neighbours that are ready to buy.

The Asia-Pacific region accounts for 47% of the global demand for silica sand. It has also seen a boom in solar panel sales worldwide as countries move toward green and zero-emissions power generation.

Source: Sky Quest Report

As demand increases for high-quality silica sand, Metallica Minerals is keen to play its part in the global green economy.

The company is also looking at other initiatives to enhance the value of the project, such as exploring the potential to export silica sand to markets outside of the Asia-Pacific region.

The biggest risks for investors to watch out for are the completion of the EIS without further delays, ensuring it maintains its window of opportunity to secure its off-load contracts.

It has signed an extension to its Memorandum of Understanding (MoU) with Mitsui & Co, one of Japan’s largest trading and investment companies. This will expire in September 2024, so the company must make progress to maintain that relationship.

Silica isn’t the only mineral benefiting from the new critical metals strategy and growing demand.

Another is an unassuming metal that is often taken for granted and could face shortages.

That’s copper.

The Red Drought and what to do with it

Stopping climate change will require trillions and a global supply of critical minerals — one special metal from this range, is copper.

This means that we’re going to need a lot of red metal, and more exploration will be required to restock supplies.

If you subscribe to Fat Tail Commodities, you will have access to the most recent insider report on the subject from our resources expert, James Cooper.

James gives you tips on investment strategies for the copper industry. He also explains the copper supply crisis and how you can position yourself to take advantage of incoming changes in the industry.

Find out more about the red drought by clicking here.

Regards,

Fat Tail Commodities

Comments