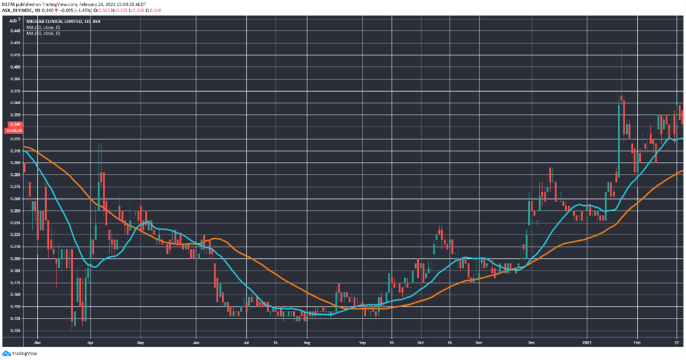

At time of writing, the share price of Medlab Clinical Ltd [ASX:MDC] is down more than 2%, trading at 33.5 cents.

After an impressive run-up, the MDC share price is now starting to move closer to its January heights where it went as high as 42 cents:

We look at the latest Medlab results and the outlook for the MDC share price.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Key points from Medlab results

Here they are:

‘– Revenue from ordinary operations rose 77.4%

– Net loss after tax of $5.3M (2020: $7.1M), a decrease of 25.4%

– NanaBis™ get[s] US FDA IND Approval

– NanoCBD™ HoA executed with Arrotex Australia Group Pty Ltd for Australian Pharmacy’

There were also numerous operational updates contained in the announcement.

Perhaps the most exciting of which, was the FDA approval that ‘permits Medlab to commence the Phase III trial of NanaBis™ at sites in the US.’

The US cannabis market is certainly lucrative so this shapes as the key catalyst for a move higher should all go according to plan for MDC.

Here’s how I see MDC’s current position.

Outlook for MDC share price

Even with several key announcements, not all runs go on forever.

So, it’s natural for the upward movement in the MDC share price to take a breather.

The financial aspects of the half yearly were decent but not stellar.

The fact that the loss is coming down is positive, but with a $6.8 million cash balance a capital raise is not out of the question at some point.

The key going forward will be progress in the US jurisdiction which is increasingly supportive of projects like Medlab’s.

Navigate a capital raise, finish off that Phase III trial, and it could be blue skies ahead, ie: revenue growth.

If you want a more accurate picture of the current state of US regulations in this area, be sure to download this report.

It includes profiles of three different cannabis companies that are ASX-listed.

Regards,

Lachlann Tierney,

For Money Morning

PS: If you think using shark antibodies to treat disease is innovative, then check out these four well-positioned small-cap stocks — these innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.