Shares of Medibank Private [ASX:MPL] are holding strong today, up by 1.71%, as the fallout from last October’s massive data breach continues. Shares were trading at $3.56 this afternoon as investors remain hopeful that this will be the end of a painful chapter in the company’s history.

Medibank has seen its shares claw back to values seen before the data breach eight months ago after shares dropped by 20% when the breach was revealed — despite Medibank’s best efforts to buffer the bad news and extend the trading pause as the initial shock hit the market.

With current markets fearful, the insurance giant has seen plenty of interest from retail investors looking for safer waters, with shares up by 19.66% in the past 12 months.

Source: TradingView

On Tuesday, the Australian Prudential and Regulation Authority (APRA) announced it has acted against Medibank following a review of the data breach that found their cyber security and oversight inadequate.

APRA has increased Medibank’s capital reserve by $250 million as punishment for the breach. The agency said this will remain in place until a review is undertaken by APRA looking at internal governance and risk culture.

The company is also facing three class action lawsuits from customers and shareholders related to the breach as well as a complaint to the Office of the Australian Information Commissioner, which can force Medibank to compensate affected customers.

The hack of Medibank was the fourth largest in Australian history with the criminal organisation stealing 9.7 million customers’ personal information. These included:

- Date of birth, address, phone numbers, email address, next of kin contact information

- Medicare Numbers for AHM customers

- Health claims for 480,000 customers including sensitive medical conditions and treatment

- Health provider details, including names and addresses.

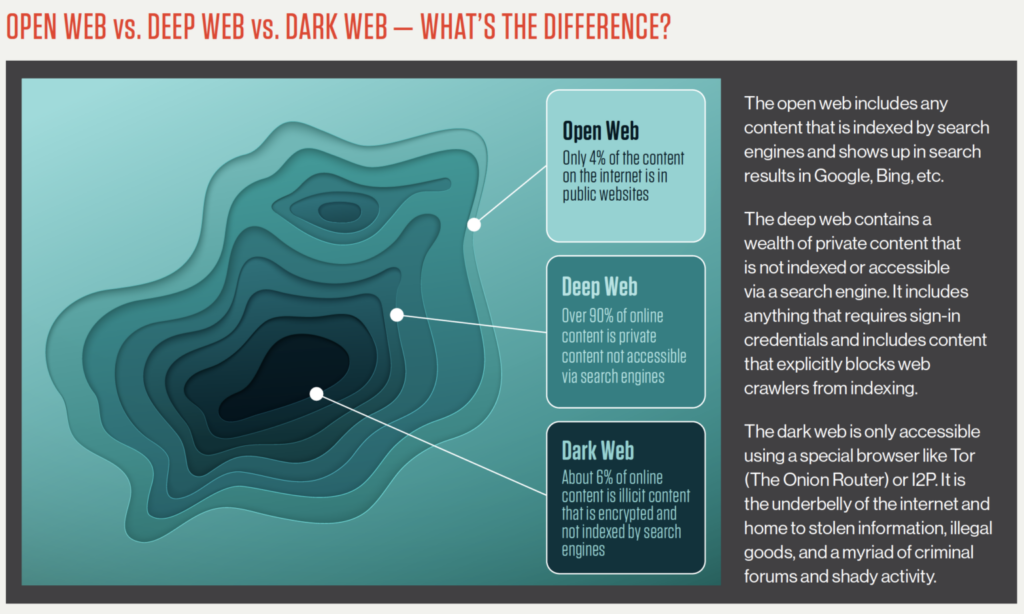

In November last year, Medibank announced it would refuse to pay the ransom for the data, resulting in a partial release of the data and the presumptive sale of the information on the dark web. Below is a simple explanation of what the dark web entails.

Source: Crowdstrike

Medibank chief executive David Koczkar said the insurer took its responsibility to safeguard data seriously, saying:

‘Medibank has continued to strengthen our systems and processes to provide our customers with the security they expect and deserve. We will continue to work to enhance our systems and processes.’

Months after the hack, it was revealed that Medibank was fined $2.2 million — which was the maximum at the time. Ministers expressed their frustration at the small limit of fines after the Optus and Medibank hacks and pushed for change. Attorney-General Mark Dreyfus fast-tracked an amendment to lift the fine to a maximum of $50 million, which is now in place.

‘When Australians are asked to hand over their personal data they have a right to expect it will be protected,’ Mr Dreyfus said.

What’s next for Medibank

This could be the end of bad news for the Insurance giant, as the public has been drip-fed negative information about the breach for 8 months.

Fundamentally little is likely to change with the company, although the APRA does hold some sway over the company.

APRA member Suzanne Smith noted that Medibank had addressed the ‘specific control weaknesses’ but remained under review by the agency as it looked to broader governance, saying:

‘APRA expects Medibank to undertake any recommended remediation actions and ensure there is appropriate consequence management, including impacts to executive remuneration where appropriate,’ Ms Smith said.

It seems that retail investors have continued to trickle into the stock in a defensive position as signs of global headwinds continue and investors look for healthy dividends.

With the size of Medibank’s war chest, the capital requirement shouldn’t change the company’s dividends as the company still maintains healthy profits due to surges from the pandemic. Market expectations for future dividend payouts are around 15–16 cents per share, giving a yield of nearly 5%.

For investors on the lookout for defensive stocks that will pay healthy dividends to ride out the uncertainty, are there any bargain stocks paying good dividends?

Bargain stocks 2023

Markets are starting to realise inflation will be sticking around a while longer, with rates rising, bond yields increasing, and the overall market beginning to slow and dip.

What’s really driving things home is the repeated dismal results being posted by companies in earnings season.

Johns Lyng Group [ASX:JLG] fell by 12.8% this week after posting disappointing earnings yesterday, taking quite the knock after a run of green growth in recent times.

Some companies have better news, but they can be hard to find in the wider scope of things. It’s a big sea of crashing ASX-listed stocks out there.

But our small-cap expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia right now’.

And the best part is that right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Charles Ormond

For The Daily Reckoning Australia