This ancient Chinese expression, deemed a curse, is coming to bear on the Australian economy rapidly.

Do we stick with Team USA or shift allegiance to China?

For a long time, Australia has sidestepped this uncomfortable dilemma… choosing to have its cake and eat it too.

What do I mean?

We’ve followed US ideology, thrown billions at AUKUS, and allowed the US to build military bases all across the country.

If America tells us to jump, we jump… From the Vietnam War to Afghanistan to leading anti-China rhetoric.

Australia lives in a world of contradiction, aligning itself with Uncle Sam but continuing to bite the hand that feeds it, China.

Recall Australia was one of the first countries to blame China for its role in the Covid-19 pandemic.

Meanwhile, China continues to pour billions into our economy, supporting Australia’s enormous wealth.

But decision day is coming… Australia could be forced to pick a side sooner than most expect.

So which direction should it go?

If it chooses America, it could have major economic consequences as China seeks alternative suppliers for its raw materials.

But stepping away from the US leaves Australia ‘vulnerable’ and alone in China’s vast and growing sphere.

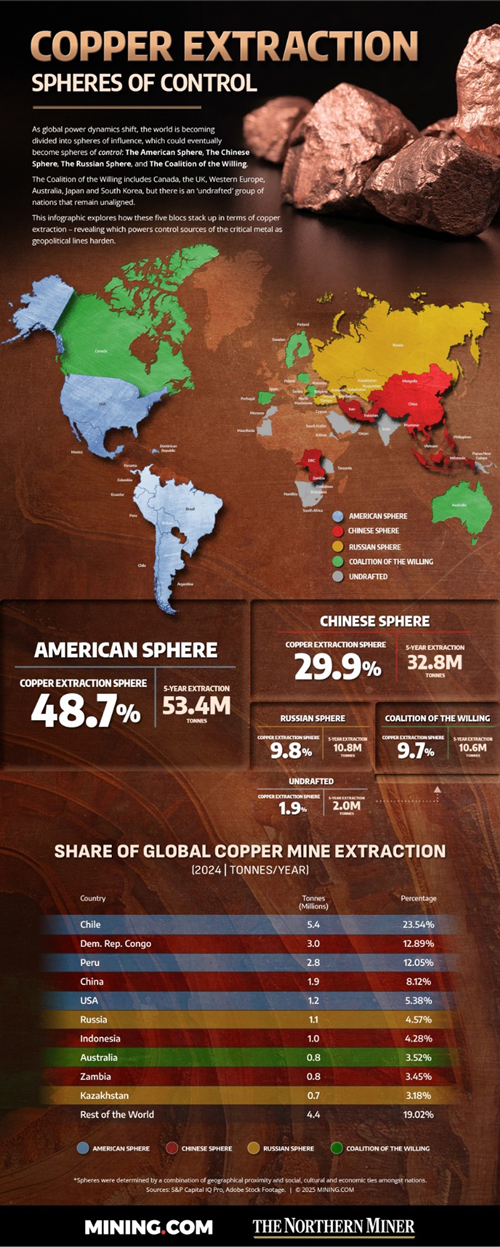

To show you what I mean, here’s a graphic published by the Northern Miner last weekend:

|

|

| Source: Northern Miner |

This shows where the battle lines could be drawn as the global economy divides into separate ‘spheres of influence.’

These theorised alliances are based on copper supply but offer an analogy for all global trading.

In this scenario, the US aligns with its southern neighbour, South America.

The world’s largest copper-producing region and overall mineral-rich continent.

Forget Greenland. Forget Ukraine. This is the US’s most crucial advance if it wants to secure supply chains.

In terms of China, it has been preparing for this event for years… Throwing trillions at its Belt and Road Initiative.

Developing highways, railways and ports to connect Asia, the Middle East, Russia, Eastern Europe, and Africa to the Middle Kingdom.

This will be a monumental power struggle, and as I’ve highlighted for years… Commodities remain the frontline battleground.

And Australia sits in the Cross-hairs

No other country has so much to lose from this new fragmented world order:

China, our most important trading partner, is in a trade war with our long-term ideological partner and protector, Uncle Sam.

That puts Australia in a more vulnerable position than most.

So, there’s no telling which direction this could go or how big the consequences could be.

One thing’s sure: investors will be anxious as the global economy embarks on its most significant change in decades.

‘May you live in interesting times.’

This has never been so apt for the Australian economy.

So, has our good fortune turned into a curse?

Perhaps.

But let’s look at this another way…

Whether Australia starts to unpeg its alliances with the US or decides to diversify trade away from China, we hold one critically important ace.

Australia is a commodity-rich nation.

And resources will be the only game for investors in this new fragmented world order.

Why?

Well, consider this: if manufacturing declines in China amid US tariffs, another country will need to step in and produce those goods.

Consumption may drop, but it won’t end.

Whether manufacturing shifts to the US or a newly formed Trump trading alliance… Korea, Japan, Mexico, India, or a combination—new hubs must be built.

The early 2000s build-out of China’s manufacturing empire offers a blueprint for what this might look like regarding the demand for raw materials.

So, play it again, Sam.

If Trump gets his way, a new infrastructure capex boom could be on the horizon.

Think copper, iron ore, aluminium, zinc, nickel, and energy.

This is what the US (and its partners need) if it wants to rebuild manufacturing outside China.

That’s why industrial metals remain a contrarian hedge against Trump uncertainty. Perhaps it is something to consider before the next tariff deadline hits.

June 15, 2025. The clock is ticking!

Until next time.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments