In today’s Money Morning…why the ASX is up today…welcome to the pot, kettle black bizarro world — Yellen on crypto…US politics will be ground zero for what comes next…and more…

I finished yesterday’s article on the intersection of commodities and monetary policy with this statement:

‘Central bankers are going to behave in predictable ways while technological advances will always surprise.’

Cue more predictable behaviour from central bankers.

Some might label this a Janet Yellen (Biden Treasury nominee) attack piece, but it’s not entirely that.

No, today I’m going to make a deeper point about how Australian investors can profit from US politics.

Why the ASX is up today

The ASX is looking to edge higher on quotes from Yellen Blather.

Urging the now Democrat-controlled legislature to embrace the money printer, Yellen said:

‘Economists don’t always agree, but I think there is a consensus now: without further action, we risk a longer, more painful recession now — and long-term scarring of the economy later.

‘Neither the president-elect, nor I, propose this relief package without an appreciation for the country’s debt burden. But right now, with interest rates at historic lows, the smartest thing we can do is act big. In the long run, I believe the benefits will far outweigh the costs, especially if we care about helping people who have been struggling for a very long time.’

Pretty standard stuff here, really.

If you read yesterday’s ominous lead headline from Reuters, you would see one titled ‘Wall Street Outlook Darkens’.

Then today, you would be waking up to Australian Financial Review headlines like ‘ASX to Follow Wall Street Higher,’ after the quotes uttered overnight.

It’s rinse and repeat, it’s fear and greed, and you can see it all coming from a mile off.

Amongst other Yellen fluff and blather was, ‘The United States does not seek a weaker currency to gain competitive advantage and we should oppose attempts by other countries to do so.’

This was before the Senate Finance Committee’s confirmation hearing for the Treasury gig.

But here’s what really grinds my gears about the new Yellen policy dynamic, and a few hints as to how Australian investors could position themselves in the coming years.

[conversion type=”in_post”]

Welcome to the pot, kettle black bizarro world — Yellen on crypto

Here’s another quote from Yellen (via Coindesk):

‘I think many [cryptocurrencies] are used, at least in transactions sense, mainly for illicit financing and I think we really need to examine ways in which we can curtail their use and make sure that anti-money laundering doesn’t occur through those channels.’

To go with that, a proposed change to the ‘Financial Crimes Enforcement Network, including a controversial rule that would require exchanges to collect and store counterparty information for unhosted wallets.’

Following this gem (that’s aging poorly) from 2015:

‘We do not interpret bitcoin’s popularity as having a relationship with the public’s view of the Federal Reserve’s conduct of monetary policy.’

How things have changed in 2020/21.

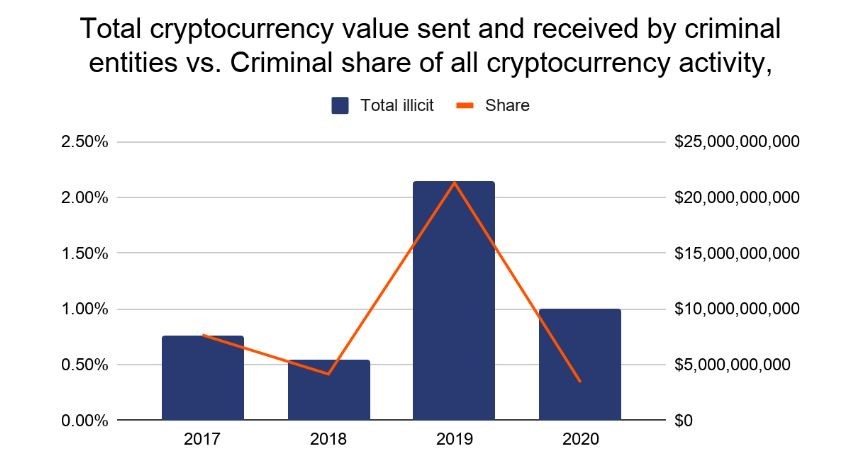

According to Chainalysis’ most recent crypto-crime report, illegal transaction volumes are falling rapidly as you can see below:

|

|

|

Source: Chainalysis.com |

So, when Yellen takes aim at crypto it’s almost like the following never happened or isn’t worth consideration:

- Panama Papers

- HSBC cartel scandal

- In Australia, the fee for no service scandal

- Wells Fargo fake account scandal

- Relentless multiyear precious metals price fixing by Deutsche Bank and others

Welcome to the central banker’s pot, kettle black bizarro world.

It’s as if human nature (the fact that bad people do bad things sometimes) is only concerning if it happens in a technological sphere that government can’t control.

Yellen is simply more of the same.

On monetary policy, on fiscal stimulus, and on technology.

And when it comes to money printing, I read one particularly good roast of Yellen recently, which said something to the effect of the following:

‘Crypto’s most serious competition [read: Yellen] comes from someone who thinks 10-year-olds today are going to want to pay back more than $27 trillion in debt when they grow up.’

So, all this hints that Australian investors need to be thinking long and hard about the future of money, in order to grow and protect whatever it becomes.

US politics will be ground zero for what comes next

Australian investors should be watching US politics closely if they want to succeed.

Here’s what could come next…an even weaker US dollar, a ballooning crypto market cap, the prospect of super-hot inflation, a commodities boom, the rise of renewables, the fall of traditional banking, and the advent of medtech and synthetic biology.

We cover all these topics in Money Morning, and we hope it makes for a compelling read.

And I know it all sounds futuristic but it’s actually the present.

So, stick around, we’ve got some exciting themes lined up this year and will be offering access to the services that can help you take advantage of them in 2021.

I’ve got one final thought too, which is this…

Being a successful investor doesn’t mean you have to be a futurist.

You just have to be a near-futurist that can see further ahead than most.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.