In today’s Money Morning…credit markets not panicking…yet…what happens on 27 July?…this is the game you have to play…and more…

‘To sell or not to sell?’ that is the question.

In the original line, Hamlet is pondering whether it’s preferable to live and be miserable or just end it all and get it over with.

Unfortunately, for investors, the choice seems just as stark right now.

Namely…

Do you stay in markets and potentially see them implode as central banks tighten the monetary screws further?

Or do you get out now, hit the sidelines, and potentially sell the dip as markets roar back to life?

As always with investing, either decision could come with regrets.

My personal rule is that if you’re going to panic sell, panic sell early.

You can always change your mind and buy back in later.

Cash might be trash long term, but it’s also the dry powder you need to take advantage of cheap stocks if we do get a larger correction.

That ‘if’ is what investors are weighing up right now.

And it all hinges on what central banks do next.

The key date to watch is 27 July.

Let me explain why…

Credit markets not panicking…yet

Last week we focused on inflation and three charts to watch on that front.

The numbers coming in on the official data remain stubbornly high.

For example, in the UK last week, inflation hit a 40-year high of 9% — higher than any other G7 country.

And in the US last week, Fed chief Jerome Powell issued a stark warning to investors that until inflation comes down, rates would continue to rise.

He warned:

‘We know that this is a time for us to be tightly focused on the time ahead and getting inflation back down to 2%. No one should doubt our resolve in doing that… What we need to see is inflation coming down in a clear and convincing way.’

Is he serious this time?

Or is he trying to talk inflation down?

After all, there’s nothing stopping the Fed from raising rates today if it wanted to.

My best guess is they’re stalling and hoping the data starts to peak.

Because they know the danger if they raise too far, too fast.

If they do that, we will see credit start to dry up as lenders worry about default risks.

In a way, that would probably be the time the Fed does start to pull back on their tightening — the old Fed ‘Put’ — because a credit contagion would be the one thing they’re more afraid of than inflation.

And there are early signs debt is starting to get expensive.

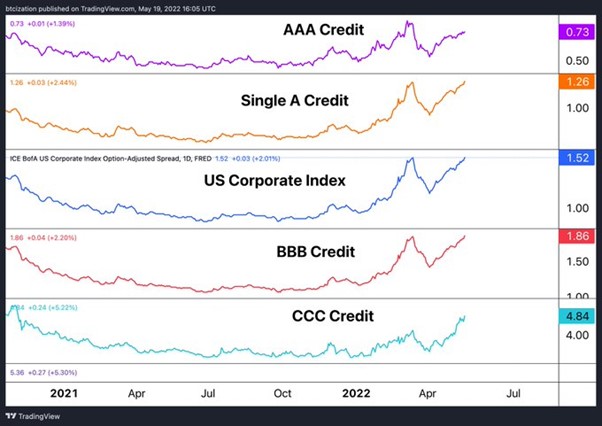

Check out this chart of credit spreads:

|

|

|

Source: Trading View |

All across the board, financing costs are rising fast.

Some say we’re still within the bounds of ‘normal’ for now.

As reported in Bloomberg:

‘Goldman Sachs (NYSE:GS) CEO David Solomon is keeping an eye on credit markets for signs of recession as financial conditions tighten after the Federal Reserve began to raise interest rates to combat inflation.

‘He’s watching for materially wider credit spreads, Solomon said Tuesday in a phone interview with Bloomberg. The bank’s clients are recognizing that economic conditions are tightening, and that process has been orderly so far, he said.’

Like I said before, as long as this market remains orderly, the Fed and central banks will probably feel comfortable continuing to tighten.

Stock market falls don’t bother them, but debt market panics do.

And that’s why all eyes are on 27 July…

What happens on 27 July?

Right now, markets expect two more interest rate rises in May and June.

What’s missing in the picture is what happens after that? There’s been no guidance on this.

While 10-year bond prices suggest up to seven more rate rises in total, it’s clear that the Fed will want to see further data on inflation before signalling the timing and scope of more rises.

And the 27 July Fed meet-up is when we’ll most likely get more commentary on that.

If they continue to talk tough, markets will likely remain under pressure.

On the other hand, they might decide to give the economy more time to digest the changes to date before making further moves.

This is the so-called ‘soft landing’ approach.

We’ll see…

The deeper story to all this is frankly how ridiculous this all is.

Our system is that 12 people in a room decide the fate of billions of lives and trillions of dollars’ worth of assets.

How weird is it that this is all placidly accepted as ‘normal’?

Back when I was at university, such a system of top-down ‘command and control’ was known as communism and was the antithesis of free markets.

Ideology aside, it’s not like they’re doing a great job of things anyway.

As this tweet put it:

|

|

|

Source: Twitter |

But like it or not, for now, this is the game you have to play…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.