Aussies have been robbed.

There’s the central bank playing with interest rates…

World Markets: Global Insights into Financial Trends and Investment Opportunities

When concerned with the global economy, it’s important to look beyond the powerhouses that are often in the spotlight, and to look at the various emerging markets operating just off stage.

Today’s biggest emerging markets (BEMs), include Argentina, Brazil, China, India, Indonesia, Mexico, Poland, South Africa, South Korea and Turkey. Not as big, but still making impact, are Egypt, Iran, Nigeria, Pakistan, Russia, Saudi Arabia, Taiwan, and Thailand.

Westpac Share Price is Climbing Back Up: Should You Buy the Westpac Dip?

The Westpac share price is climbing back up since the New Year, after the AUSTRAC scandal wreaked havoc on the company. We take a quick look at whether this is a buying opportunity.

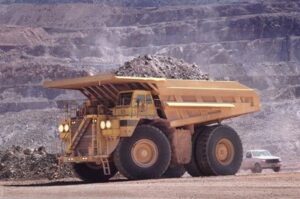

The Two Biggest Trends for 2020: Mining and Exploration

Towards the end of last year, I explained what I think are the two biggest trends for 2020: More mining merger activity and more exploration.

Keep a Close Eye on Resources This Year

India is an important space for Australian investors as it could be the source of a new resources boom for the 2020s. The ambitious Modi government has plans to target GDP of US$5 trillion by 2024–25, a figure that would propel India into the top five economies in the world.

The Rise of the Financial Warrior

Just last week I made the case that there would be three key subjects we’d be looking at in 2020.

Gold, interest rates, and the increasing economic impact of climate instability.

The Smart Fitness Industry is a Huge Potential Investing Opportunity

The smart fitness industry is a huge potential investing opportunity. It’s the kind of early-stage disruptive trend that can make you a fortune if you choose your picks wisely.