We’re only up to the second official day of trading for 2021, but major gains are already being made.

Case in point is Byrah Resources Ltd’s [ASX:BYH] stunning 30% rise at time of writing. Soaring on the back of an announcement this morning regarding a manganese discovery.

Let’s delve into the details.

Fantastic results, better prospects

As Byrah divulged this morning, their Byrah Basin project — located in WA — has had some great results. With recent drilling programs uncovering several high-grade (>30% mineralisation) sites.

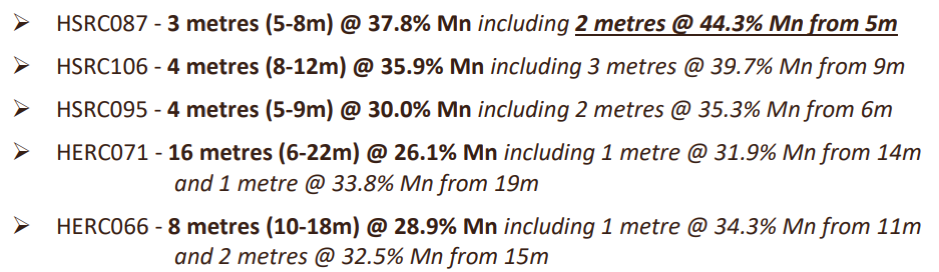

Here are just some of the notable finds:

Source: Byrah Resources

As you can see, each of these holes showcase some incredible mineralisation (Mn). Suggesting that the site may be rich with manganese for Byrah to extract. A discovery that will no doubt give them further confidence in pursuing a pilot plant.

Granted, with just over a $14 million market cap, this is a very tiny company. Meaning that funding any further endeavours could be a challenge.

However, that is precisely why they executed a joint venture agreement with OM Holdings Ltd [ASX:OMM] in 2019. A much larger manganese miner that has extensive experience with the metal. As well as the capital to get a project like Byrah’s off the ground.

In fact, OM has funded much of the drilling to date. Including the drilling that yielded today’s results. And with a 30% stake as of right now, OM is clearly just as keen for a good result.

What’s next for Byrah?

The real question for Byrah now, is how it will proceed.

Because as the company notes in today’s update, they received a $5 million offer for their stake in this manganese site. An offer that OM does have the rights to match.

Therefore, with today’s results, we could see a bidding war for this site. Depending on just how much both parties want to get their hands on this resource.

Either way, it could spell good news for Byrah and their shareholders.

Only time will tell how things unfold.

For resource investors though, it is a fantastic sign. Or at least, it should be. Possibly hinting at what may be a remarkable year for commodities. After all, 2020 was already shaping up nicely for a lot of niche metals.

Lithium, for instance, a sector that had been largely dormant for years, sprung back to life recently. Which is why we put together an entire report on how to capitalise on this lithium resurgence. A report that every resource investor needs to know about — and which you can find, right here.

Because if 2021 continues where 2020 left off, resource stocks could be in for a very good year. And Byrah has certainly picked up the torch today.

Regards,

Ryan Clarkson-Ledward,

For Money Morning