The weekend news was dominated by the pow-wow held by Trump and Putin in Alaska. It was important because it was an opportunity for Putin to explain the Russian position which may help bring the war to a close. But from a financial perspective, the important news happened earlier last week…a real WTF moment.

We laughed earlier this year when Trump created a ‘Sovereign Wealth Fund.’ What would he fund it with, we wondered? The US has $37 trillion in debt. Where’s the wealth?

Mr. Trump has repeatedly said that he would ‘make the foreigners pay.’ The Mexicans were supposed to pay for ‘the wall,’ for example. Then, nations with trade surpluses were supposed to pay tariffs which would ‘pay off the national debt.’

| |

That was never going to happen. Because it’s not the exporter (the foreigners) who pay tariffs; it’s the importer…who then passes along the cost to either his shareholders or his customers.

The tariffs were, in effect, a national sales tax.

But then, last week, it suddenly looked like there might actually be a method to the madness, making it madder than ever. On Tuesday, Secretary of the Treasury, Scott Bessent, laid it out to Larry Kudlow… a plan to ‘make the foreigners pay.’

‘We have these agreements in place where the Japanese, the Koreans, and to some extent the Europeans, will invest in companies and industries as we direct them, largely at the president’s discretion. The way to think about it is that these huge [trade] surpluses, accumulated offshore… let’s say Japan, where we’re going to have $550 billion…and they will be reinvesting that back into the US economy, and we will be able to direct them.’

A White House ‘fact sheet’ further clarified that the US would take 90% of the gains from these investments.

Whew!

So bold. Such audacity. Foreigners will own more and more of US critical assets. But we’ll get the lion’s share of the profits. It is like Japan’s ‘Greater East Asia Co-Prosperity Sphere’ in which China and Southeast Asia were invited to join Japan’s economic scheme — or else.

The ‘else’ in Japan’s case, in the 1930s, was that Japan would invade and take whatever resources it wanted anyway. In today’s case, Japan and other US trading partners face high tariffs that could cripple their economies.

It is the importers who pay. But the more they pay, the harder it is for the exporter to sell. Trade slows. Both countries are harmed. But the US, with the world’s biggest single consumer market, figures that the foreigners can’t afford to say ‘no.’

The Business Standard adds detail:

US President Donald Trump’s trade policy has tied the financing of new American factories to the easing of some tariffs for foreign allies, a strategy that could channel more than $10 trillion into US manufacturing and critical industries…The targeted sectors include semiconductors, magnets, pharmaceuticals, steel, cars, and defense technology.

Let’s see…

We buy a toilet plunger from Costco. A South Korean company makes a profit of five cents. It deposits the money and gets local currency in exchange. The pennies end up in the central bank.

And now, presumably for the privilege of offering us the best plunger at the best price, the South Korean government is going to ‘invest’ the five cents in the US.

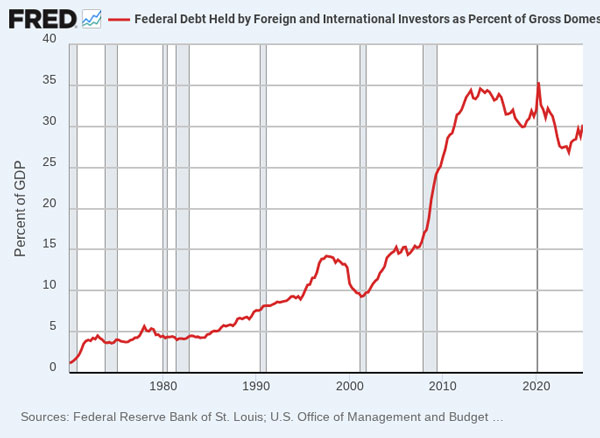

Up until now, it has generally chosen to use the five cents to buy US treasury bonds as a ‘reserve asset.’ Thanks to inflation, the fall of the dollar, and the sell-off in Treasuries, foreigners have lost about 20% of their money on US bonds since 2020.

But now, they will use their surpluses to buy other US assets, guided by the Big Man himself, who will somehow know where the capital will do the most good. And then, in the unlikely event that these politically-driven investments actually bear fruit — the US government will get 90% of it.

A 90% tax on the foreigners’ profits? Agreements in place? Probably not.

Another doomed experiment! With the tariffs, the Trump team is retesting the notion that central planning can do a better job of making trade decisions than individual buyers and sellers with skin in the game. Now, the Trump crowd will discourage foreigners from having anything to do with us…while testing the concept of a central industrial policy. POTUS will make capital allocation decisions, not private investors.

Let 1,000 AMTRAK’s bloom!

Will the money go to Nvidia? Maybe Palantir…directed thither by the wizards on the Trump Team, who perhaps appreciate the campaign contributions?

More data centers? More AI research? More chips…more drugs? The Mag 7 alone are worth $14 trillion. If there were a promising investment in these ‘critical’ industries, it wouldn’t need the feds to push capital its way.

And if they were not good investments, what possible public utility is served by sending them more money?

Regards,

Bill Bonner,

For Fat Tail Daily

Comments