This week is set to be dominated by the US election on Tuesday (Wednesday our time).

I’ve not much to add to this.

Suffice it to say, neither candidate is going to reign in the massive debt load the US continues to build.

To get an idea of how bad things are, their annual interest bill is now as much as their defence budget!

And as I pointed out last week, scarce assets like Bitcoin, gold, and commodities will likely do very well over the next four years, no matter who takes the Presidency.

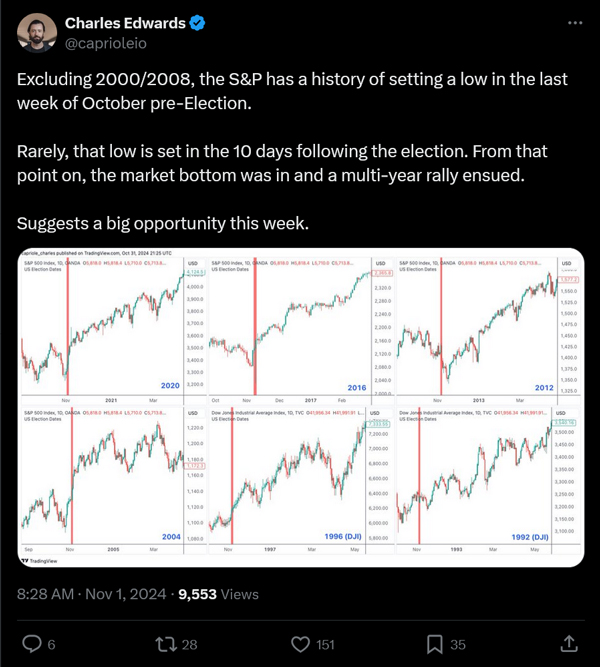

But I did come across one interesting election statistic I thought worth sharing.

Check out this tweet:

| |

| Source: X.com |

Basically, election week pessimism is usually a good time to buy.

Unless a dot com (2,000) or GFC (2008) type crash is coming soon!

Anyway, for the rest of today’s piece, I want to concentrate on a more fundamental idea far from the political spotlight.

If I’m right on this, some could make out like a 19th-century oil baron over the next decade.

Let me explain…

A New Source of Dynastic Wealth

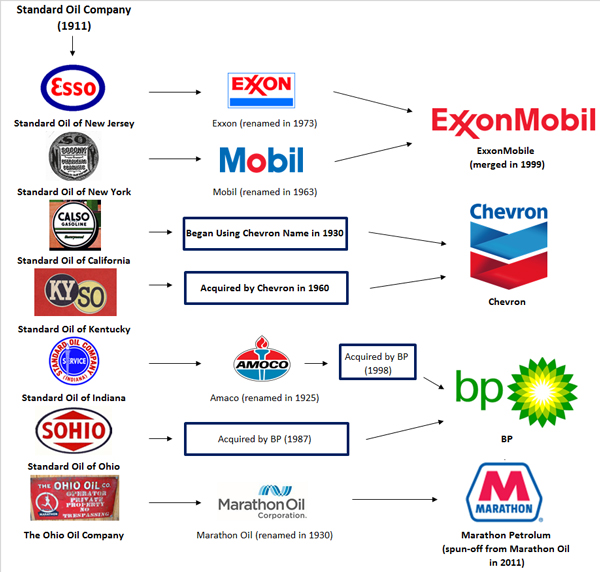

John D. Rockefeller, J. Paul Getty, H.L Hunt…famous names that live on to this day.

These were the oil barons of the 19th century who created dynastic wealth by riding the coattails of the Industrial Revolution.

Their pioneering companies went on to spawn the giant companies of the 20th century.

Check out the successors to Rockefeller’s Standard Oil company, for example:

| |

| Source: Dividend.com |

Why did they do so well?

Well, these famous people built their fortunes on the fundamental commodity all other technologies relied on – energy.

But think about this for a second…

Oil is a very valuable commodity.

But it isn’t the oil that has value, only what you can do with it.

No one actually uses crude oil in its raw form. You don’t put crude oil in your car or your jet, to run your tractor or machinery.

It needs to be refined and turned into something useful first.

So, an oil company’s value is based on two things: The amount of oil held in reserves PLUS the value added in refining operations.

Or, more simply, the commodity plus the use cases.

Based on this fundamental equation, oil companies today are a global market worth US$10 trillion.

With that in mind, let’s turn to last week’s big piece of news…

The Era of Crude Capital

The Michael Saylor-led Micro Strategy just announced plans to buy up to US$42 billion worth of Bitcoin over the next three years.

That’s enough firepower to buy more than the entire stack of new Bitcoin released (mined) to the market over that same time period.

Now, Saylor has been buying up as much Bitcoin as he could over the past four years already.

And by doing so, his company has added more value for shareholders than any other since 2020.

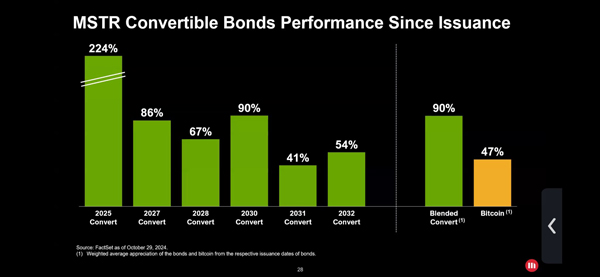

As this tweet states:

| |

| Source: X.com |

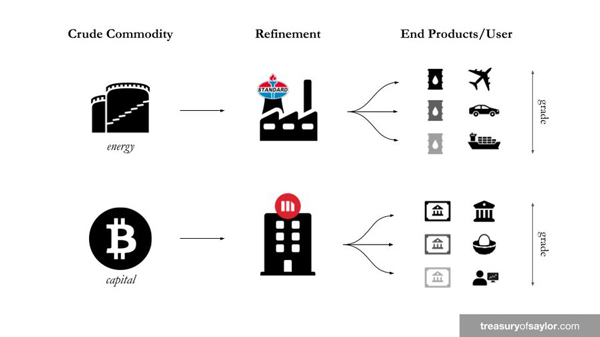

So, what’s this got to do with oil you ask?

This is where it gets interesting…

Saylor likens Bitcoin to stored monetary energy—a new type of digital commodity.

Under this mental framework, ‘crude’ Bitcoin is the same as crude oil.

It’s a commodity that can be refined into something else that others value.

Either now or in the future.

Currently, Micro Strategy is using Bitcoin to create convertible bonds that certain investors absolutely love.

Amazingly, Micro Strategy is issuing these bonds at interest rates south of 1%. That’s basically people giving them almost free money.

They then use these funds to buy more Bitcoin.

Rinse and repeat…

But why are lenders so keen to give MicroStrategy money at such low interest rates?

And to invest in the ‘highly risky’ Bitcoin too?

Are they crazy?!?!

Well, here’s the thing…

A convertible bond comes with a very interesting and profitable feature for these bond investors.

You see, instead of getting their money back, the debt can also be converted into shares of the company (usually at a premium to the current share price).

This feature – called an option – has additional value to bondholders.

And because Bitcoin is very volatile – and therefore so is Micro Strategy’s share price – this volatility adds immense value to these bonds.

To be clear, Micro Strategy is offering bond investors a lower-risk way to profit from Bitcoin’s famous volatility while still adhering to their investment mandates.

The worst case for bond investors is that they get their money back (Micro Strategy has a cashflow-generating software business to help service any debt) plus a tiny bit of interest.

So far, this investment strategy is paying off big time for both Micro Strategy and their bond investors.

Check out the returns on various tranches of Micro strategy’s convertible bonds:

| |

| Source: FactSet |

Returns of 41%, 54% and 67% are unheard of in the corporate bond market, never mind 90% or even 224%!!!

If you don’t completely get this strategy, that’s fine. It’s a lot to take in.

But I come back to my analogy at the start…

Micro Strategy is using Bitcoin to create a unique financial product that the investment market finds very valuable.

In much the same way as an oil refinery converts crude oil – a commodity – into something more useful, so is Saylor with Bitcoin.

| |

| Source:Treasury of Saylor |

The main point is this…

Bitcoin is Stored Energy

Bitcoin is a kind of stored monetary energy.

It allows you to save the product of your labour in a monetary unit that can’t be debased over time.

Thought about another way…

For those who save in Bitcoin as opposed to their fiat currency, life continues to get cheaper every year.

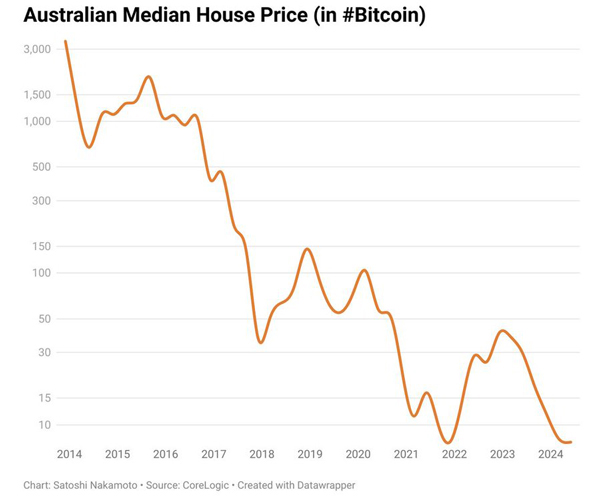

For example, check out the price of Aussie homes as priced in Bitcoin over the years:

| |

| Source: Core Logic |

It used to cost 3,000 Bitcoin to buy the average Aussie house in 2014.

Now, it costs under 10 BTC.

I reckon we’ll get to the stage where it costs 1 BTC.

This is Bitcoin’s fundamental value proposition. An escape from a world of ongoing fiat debasement.

But Bitcoin – as the world’s first digital commodity – can also be refined for other uses.

In Micro Strategy’s case, they’re using it to create new financial products with features bond investors can’t get anywhere else.

Some tech entrepreneurs are using the Bitcoin blockchain to create a world of decentralised finance (DeFi) without banks.

Bhutan has amassed almost US$1 billion worth of Bitcoin using excess renewable energy (hydro) to mine Bitcoin.

The state of Texas in the US is using Bitcoin to stabilise their electricity grid.

A pioneering company called Gridless is using Bitcoin to subsidise the construction of renewable power stations in rural Africa.

A small fishing village in Norway on the edge of the Arctic Circle uses Bitcoin mining to heat its town.

Guatemala is using the Bitcoin blockchain to validate its election results and prove they were fair.

There are many more Bitcoin ‘refineries’ using the unique characteristics of Bitcoin to create new sources of value.

Too many to go into today.

But the outstanding success of Micro Strategy has shown what is possible in this new era of crude capital.

In my opinion, it’s like being an investor in oil in the late 19th century.

Owning Bitcoin is a way to stake a claim in this century’s most important digital commodity.

That’s why I’ve just launched a new series called the Bitcoin Investor’s Launchpad.

It’s a four-week course designed to show you how – and why – you should start considering investing in Bitcoin.

I’ll take you through a step-by-step process so you can go from crypto novice to Bitcoin expert (well, almost!) by the time you’ve finished.

You can find out more about that here.

Speak soon…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments