New investing paradigms don’t come around very often.

Usually, it’s 35-40 years between these big moments.

Just long enough for the current crop of investors to have no memory of the possibility of extreme change.

But when they hit, they hit hard.

Consider Japan in 1989…

They’d been growing every decade since the 1950s, and investors in Japan had made a mint.

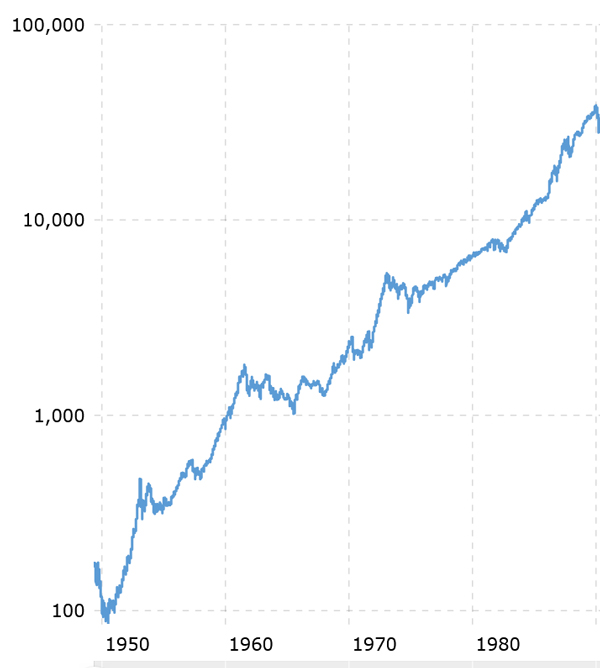

Check out the chart of the Nikkei 225 Index from 1950 through to 1990:

| |

| Source: Macro Trends |

It seemed inevitable that Japan would dominate the next few decades as it had the previous ones.

The consensus was that Japanese companies were unstoppable.

Big-name brands like Toyota and Fujitsu were rewriting the book on how to run a modern manufacturing company.

I personally remember reading case studies about their famous just-in-time supply chain systems back at Uni in the 1990s.

Even if you just watched classic 80s sci-fi movies like Blade Runner, you would’ve been similarly convinced Japan would dominate the future.

I mean, this is how director Ridley Scott envisioned LA by 2018:

| |

| Source: Blade Runner |

Of course, the consensus was wrong.

As it turned out, 1989 was the end of the road for the four-decade-old Japan trade.

Millions of investors who didn’t see it coming got wiped out.

I think a similar moment is underway right now. And at least one billionaire investor agrees with me.

But it’s not Japan where the trouble lies. It’s somewhere far more fundamentally important.

Let me explain…

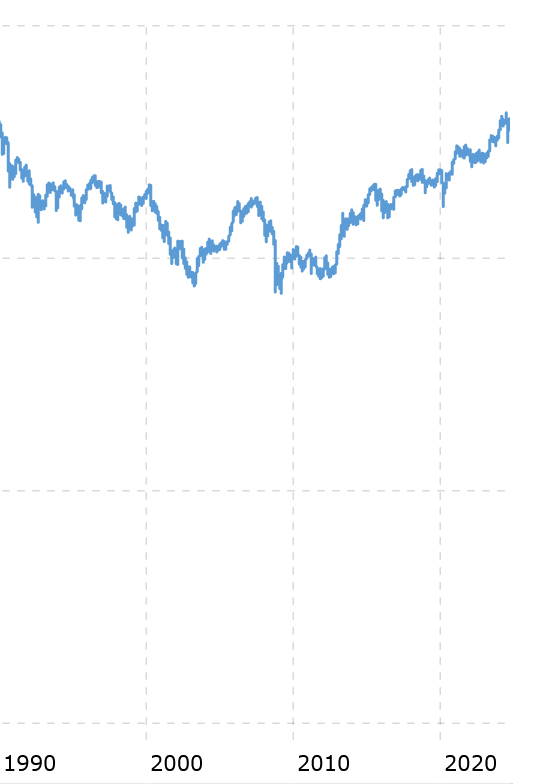

Check out the returns on the Japanese Nickei index from 1989 to today:

| |

| Source: Macro Trends |

It’s crazy to think about.

But Japan still hasn’t recovered from the lost decade through the 1990s.

Like me after a big night out (these days anyway!), it seems this is a hangover without end!

As Planet Money reported:

‘…in the early 1990s, it all came to a sudden halt. Japan went from being one of the fastest-growing countries in the world to one of the slowest. And this economic stagnation went on and on and on. For THREE decades.’

Little did investors know back then, but a new investing paradigm was taking shape.

Japan was no longer the place to be.

As it turned out, Japan wasn’t the future…it was the new digital world of the internet.

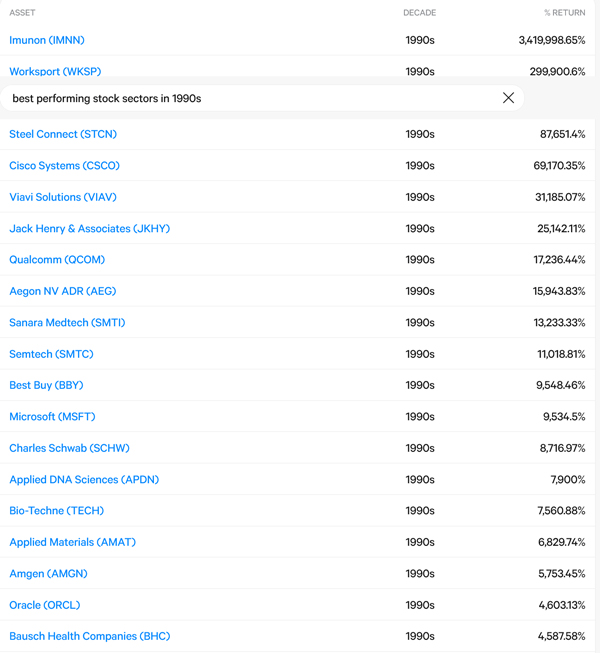

Here’s a table of some of the best-performing stocks of that decade:

| |

| Source: Stat Muse |

Most of these stocks were US-based stocks that rode the dot com wave. Check out the gargantuan returns on offer!!!

Anyway, my point is…

What worked in the past doesn’t always work in the future.

The landscape changes and a tipping point is reached.

Investors need to change their thinking quickly when such moments hit—sometimes drastically.

The question for you today is: Are we reaching a similar tipping point?

And if so, where should you put your money next…

A tectonic shift

The big problem of our time isn’t a three-decade bull run in Japanese stocks – or any stock markets, really.

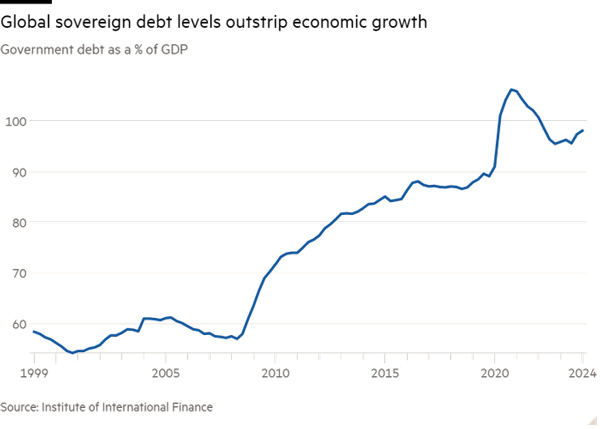

This time it’s a massive multi-decade increase in global sovereign debt.

Check it out:

| |

| Source: Institute of International Finance |

What makes this problem even worse is that the USA – home of the reserve currency – is one of the countries with the fastest-growing debt load.

That changes the game for markets.

And some investors are starting to worry about it.

One investor who has been around long enough to see investing paradigm shifts occur is billionaire Paul Tudor Jones.

He was on TV last week saying this:

‘All roads lead to inflation. The playbook to get out is to inflate your way out (a small tax on the consumer) and run interest rates below inflation, with nominal growth above inflation. That’s historically the way every civilisation has gotten out.’

What exactly is he saying here?

He’s basically saying that the US debt burden is now so high that the US government will try to inflate its way out of it.

By devaluing their currency (which is what inflation does), they’re trying to lessen the real cost of their debt burden.

At the same time, they’ll be happy enough to see inflation run a little hotter than normal, as that will increase nominal growth.

Over time, if nominal growth is more than interest rates, it will reduce their debt-to-GDP ratio and help ‘solve’ their debt crisis over the longer term.

Of course, such a policy creates one huge group of losers.

And it’s a tectonic shift in thinking for markets.

Why?

Well, for years, all sorts of investors have used the US dollar as a store of value—a way to preserve purchasing power over time.

It’s a fundamental part of every diversified portfolio.

And foreign investors also loved it as a safe, secure asset to preserve their wealth in. Even if that meant funding the US government machine.

In a low-inflation environment, investors were happy to fund the US because the real returns on US debt after inflation were positive.

But we’ve reached a tipping point in US debt where the debt is now too high.

We’re seeing a growing BRICS movement of non-Western countries looking to create new options away from the US dollar.

This group controls 42% of the world’s FX reserves and 45% of the world’s population, making it a powerful block of nations.

The BRICS are looking to move away from the US dollar and, more specifically, the US fixed-income space—a massive US$50 trillion market.

This process has been underway for a while as economist Lyn Alden noted:

‘Many people point out that U.S. debt held by foreigners is at an all-time high, nominally. But with constant debasement, nominal new highs represents a low bar. The better metric, imo, is the percent U.S. debt held by foreigners. That’s been down over the past decade.’

There’s a political element to the BRICS, of course. The confiscation of Russian US assets in 2022 has no doubt added impetus to this transition.

But here’s the thing…

Investors like Paul Tudor Jones now agree with the BRICS on the unappealing nature of US debt, too.

No one wants to hold the hot potato that is US government debt.

Jones told Bloomberg emphatically last week:

‘I want to own ZERO fixed-income investments.’

Remember, traditionally, fixed income represents 40% of most standard 60/40 investment portfolios.

If even a small part of this huge market agrees with Jones and the BRICS, then trillions will leave fixed income.

So, the trillion-dollar question…

Where will it go….?

The new paradigm portfolio

You want to own scarce assets with a defendable moat in this new investing paradigm.

Scarce assets that either have store-of-value or productive qualities that allow them to beat inflation over time.

For BRICS nations, they should also be harder to confiscate and not part of the US financial order.

That leads us to four assets…

Gold, Bitcoin, commodities, and perhaps certain tech stocks (though I’d argue against big tech in favour of smaller-cap AI disruptors).

(Editor’s Note: Talking of small cap disrupters, by the way, my friend and colleague Callum Newman has a new report due out this Wednesday. He’s been calling for a huge rebound in small, speculative stocks since November last year. As it turns out, that was the bottom! His open portfolio is flying right now…and he believes there is more to come. Look out for this new report this week).)

We’re already seeing this story start to play out.

Gold has been on a tear this year, with the price now at new all-time highs.

While you might think you’ve missed the boat here, my colleague Brian Chu says one part of the gold market is set to ‘slingshot higher’ as it plays catch-up over 2025.

If this happens at the same time as the gold price is trending higher, it could offer you some extremely good trades.

Check out what Brian has to say on that here.

What about commodities?

Pauk Tudor Jones (who owns both gold and Bitcoin too) calls commodities ‘ridiculously cheap.’

This is certainly a view our own in-house geologist, James Cooper, shares.

He’s been banging on about the commodity cycle for a while and how we’re set for a supply crunch in some key commodities very soon.

Check out James’ latest thesis here.

I also like tech stocks, but they’re a double-edged sword.

I’m not sure ‘Big Tech’ is the place to be, as they’re currently spending trillions on energy and data centre costs to support their AI ambitions.

At current prices, they’ll need to execute to perfection to justify already high share premiums.

As the AI revolution starts, I think the opportunity will shift from your Google’s and Amazon’s of the world to the smaller disruptors.

For example, a small fintech company in the US called Dave Inc. is up almost 700% this year on the back of integrating AI into its app.

Their use of AI in both the credit assessment and customer service parts of their business has seen revenue grow by 70%, while expenses FELL by 25%.

As I noted in my Alpha Tech Trader note:

‘The AI revolution is about two things: driving efficiencies for existing businesses and opening up industries for disruption.

Like the internet did before, AI gives small companies the power to do more with less.’

Of course, Bitcoin is my favourite way to play this situation – it has been for a while!

It’s the only asset that lives outside the existing financial order on its own network.

We’ve already seen record inflows into the new Bitcoin ETFs propel Bitcoin to within a whisker of new all-time highs in 2024.

But last week, an intriguing new potential catalyst came to light…

This ‘hidden’ line item will be discussed in every boardroom

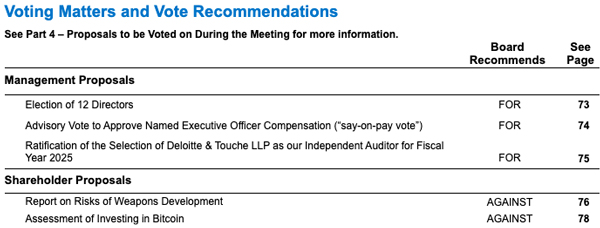

Hidden amongst a recent regulatory filing for Microsoft – the third-largest listed company in the world – was this proposal.

Check the bottom line:

| |

| Source: SEC |

Yep, your eyes aren’t deceiving you.

Microsoft shareholders are set to vote on putting Bitcoin on their balance sheet at the December 10th AGM.

I should say that the board has advised shareholders to vote AGAINST this proposal.

But the fact it’s even made it onto the agenda is a very big development.

Some big shareholders—perhaps Fidelity and Blackrock, which collectively own 10% of Microsoft and also have their own Bitcoin ETFs—could be pushing for this.

While I give this vote a 10% chance of passing, if it does, expect fireworks for the Bitcoin price…and a mad scramble to get some Bitcoin for every other big tech company.

If you want to get in ahead of this moment – or even just protect some of your wealth from the Great Debasement – I highly recommend you check out my new Bitcoin Investor’s Launchpad four-week course presentation.

It will show you how to get started and invest in this asset correctly.

But I also want to show you that it’s not too late to invest in Bitcoin!

This is a young asset class, brimming with first-mover opportunity.

Still highly volatile, but a great chance to diversify your portfolio before this idea becomes heavily adopted by the mainstream.

My broader point is this…

———-

A new investing paradigm is upon us as governments scramble to get out of ever-mounting debt.

This process is messy and will involve political and economic compromises.

As usual, that’ll create winners and losers in investment markets.

This is not the time to fall back on old habits.

New paradigms reward new investing strategies, and, in my opinion, some mix of these four assets gives you the best chance of successfully navigating this moment.

Speak soon…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments