The Magnis Energy Technologies Ltd [ASX:MNS] share price rise 4% after the iM3NY battery plant upgrades annual capacity to 1.8GWh.

The graphite and battery developer saw its shares rise as much as 10.6% in early trade before settling at 39 cents per share at time of writing.

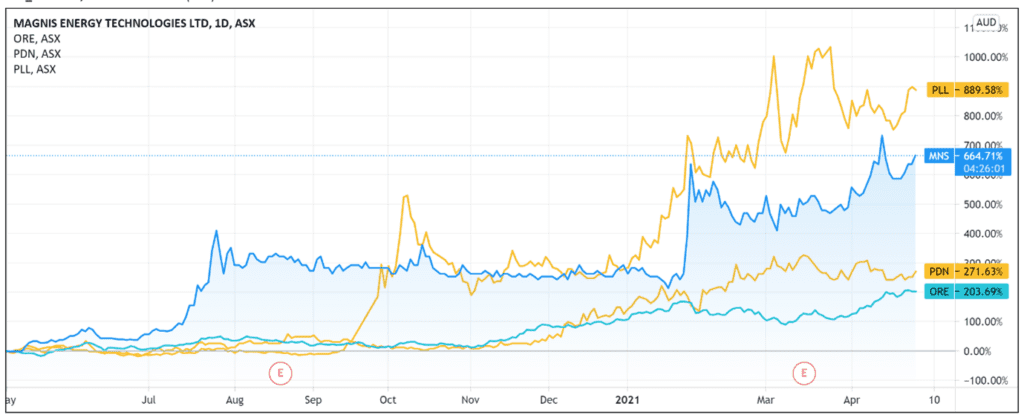

As we’ve covered here, lithium stocks are the talk of the ASX in recent months.

Surging lithium prices and more electric vehicles planned to hit the bitumen across the globe corresponded lately with rising share prices of lithium stocks.

Year to date MNS shares are up 95%, and up 650% in the last 12 months.

Magnis ups annual production rate

MNS announced that the battery plant in Endicott, New York — Imperium3 New York (iM3NY) — acquired new equipment that will increase annual production by up to 0.6GWh.

This brings the total potential annual capacity to 1.8GWh.

For reference, annual production of 24GWh corresponds to battery supply for up to 500,000 EVs, according to S&P Global.

iM3NY bought 60% of one of the production lines previously used by lithium-ion cell manufacturer A123 Systems of Romulus.

Once integrated into iM3NY’s existing production line, Magnis believes the equipment will provide iM3NY with the ‘flexibility to produce the same cell design as the current line or will allow iM3NY to manufacture different cell designs to further expand their customer base.’

The purchase was made using some of the US$85 million in funding received by iM3NY announced back on 19 April 2021.

The US$85 million received by the battery plant included a US$50 million senior-secured term loan from Riverstone Credit Partners and US$35 million of equity funding.

Over US$23.6 million of that equity injection came from Magnis.

The Riverstone loan has a four-year term with a 12.5% interest rate.

Magnis has a direct and indirect holding of 63% in iM3NY.

Three Ways to Invest in the Renewable Energy Boom

How much does MNS have in the bank?

In February this year, Magnis raised $34 million via a placement of 121,428,572 ordinary shares at 28 cents per share to institutional, professional, and sophisticated investors.

The raise contributed to MNS ending the March 2021 quarter with cash and cash equivalents of $29.7 million.

Magnis ended the previous quarter with cash and cash equivalents of $5 million.

Total relevant outgoings for the March quarter totalled $2.8 million, with a net cash loss from operating activities of $2.6 million.

The capital raise extended Magnis’s financial runway, with the firm having 10.7 estimated quarters of funding available.

What’s the outlook for MNS Share Price?

The battery developer has so far secured estimated minimum offtake sales of US$655 million via binding agreements.

MNS stated the binding orders are ‘mostly used in the energy stationary storage products along with transportation applications.’

CEO of iM3NY, Chaitanya Sharma, stated that the company is working ‘around the clock to fast-track production at the iM3NY battery plant following the recent injection of substantial funding.’

Summarising what many investors are likely thinking, MNS CEO Frank Poullas said with financing completed, the team in NY is ‘focused on meeting production milestones.’

Additionally, Magnis CEO Poullas also stated last month that:

‘With aggressive future expansion plans all the way to 32GWh of annual production, iM3NY is currently investigating a potential US listing.’

The 32GWh figure would surpass the output of Tesla Gigafactory 1, which had an annualised rate of about 20GWh and would be an upgrade of 1,650% on iM3NY’s current potential production rate of 1.8GWh.

These are ambitious numbers, but with high expectations comes closer scrutiny.

With funding secured, attention will shift from the potential of the New York plant to its actual production numbers.

iM3NY’s team won’t be the only one focused on iM3NY meeting its production milestones.

The market will be just as focused.

Investors could also wonder about the likelihood of iM3NY listing in the US and the impact this would have on Magnis.

With plenty of upcoming near-term developments, I think Magnis will be closely watched by investors assessing its ability to ramp up its GHw production.

If you are interested in finding out more about lithium stock investment opportunities, then do make sure to check out this free report.

The report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. It is free to download right now.

Regards,

Lachlann Tierney,

For Money Morning

Comments