Magnis Energy Technologies [ASX:MNS] announced today that commercial production has started at the Imperium3 New York (iM3NY) lithium-ion battery manufacturing plant.

Magnis, with its joint venture partner Charge CCCV [C4V], are the major shareholders in iM3NY.

iM3NY expects first sales in late September with the preceding weeks used for quality assurance.

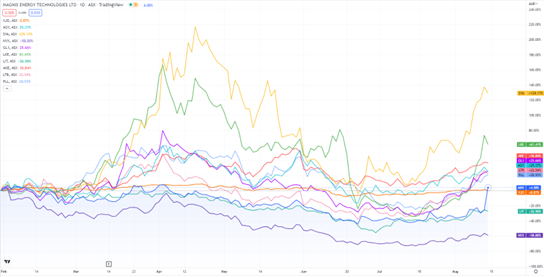

MNS shares rose as high as 35% in early trade before cooling somewhat by the afternoon.

While the stock is up 50% in the past month, MNS is still down 20% year-to-date.

Source: www.tradingview.com

Production begins at iM3NY

This morning, Magnis said commercial EV battery production is now underway at iM3NY’s US-based lithium-ion battery plant in Endicott, New York.

MNS expects initial production of several thousand cells next month at iM3NY, which will ramp up to ‘15,000 cells/day as production scales up to an annual production rate of 1.8GWh’.

MNS said there is no cobalt or nickel in the iM3NY cells, which use technology patented by MNS’s partner, Charge CCCV.

The iM3NY team plans to increase annual capacity to 38GWh by 2030.

iM3NY expects first sales in late September, with the preceding weeks used for quality assurance.

iM3NY’s CEO Chaitanya Sharma commented:

‘The iM3NY team has put in a huge effort to achieve this major milestone of commercial production with iM3NY being North America’s only pure home-grown battery plant.

‘Despite a challenging global environment and supply chain issues, we have successfully started production close to schedule which is a major achievement. We now look forward to increasing production rates toward and over the gigawatt hour mark.’

Magnis addresses increasing EV demand

Magnis’ Chairman, Frank Poullas, commented on the launching of iM3NY’s production and upcoming targets for the plant, with specific focus on high EV demand in the US:

‘After many years of hard work by everyone involved, today represents a momentous occasion for Magnis, it’s partner C4V and the wider iM3NY team.

‘With previously announced binding sales agreements, I look forward to updating the market as we move towards generating revenues and increasing the capacity of the plant to meet some of the huge demand currently experienced for Lithium-ion Batteries especially in the United States.’

iM3NY’s Chairman and C4V President, Dr Shailesh Upreti, also added:

‘About 6 years ago, C4V and Magnis had the vision to produce American made Lithium-ion batteries at a large scale using the BMLMP technology which possess many advantages in the current marketplace.

‘Today, that vision has become reality and we are working hard to scale up towards double digit gigawatt scale production to continue to lead our position in the US market.’

Ways to play the EV revolution: lithium is just one

The EV market is rapidly expanding, boosted further by government initiatives and funding programs supporting production across the globe.

But our energy expert, Selva Freigedo, thinks the global transition to EVs means the industry faces a supply crunch, which can send prices for battery materials soaring even higher in 2022 and beyond.

If you’d like to know more, I suggest checking out Selva’s battery tech metals report.

Find out more about ‘Three Ways to Play the Great EV Battery Race’ here.

Regards,

Kiryll Prakapenka