At time of writing, the share price of Lynas Rare Earths Ltd [ASX:LYC] is up over 4%, trading at $4.89.

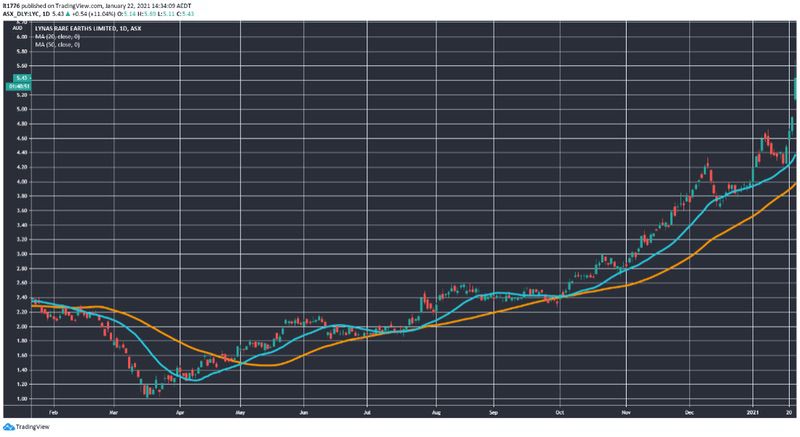

It’s been a case of steady, and now accelerating, upward momentum for the LYC share price since the market low last year:

Source: TradingView

Let’s take a quick look at the most recent announcement, detailing a contract for LYC’s US facility, and the outlook for rare earths and the LYC share price.

US facility spurs Lynas shares

It’s been a long-awaited bit of news for LYC investors, and here’s the key passage:

‘Lynas Rare Earths Limited (ASX:LYC, OTC:LYSDY) (“Lynas”) has today entered into an agreement with the United States Government to build a commercial Light Rare Earths separation plant in the United States, through our wholly owned subsidiary, Lynas USA LLC.

‘This collaboration with the Department of Defense is sponsored by the Title III, Defense Production Act program, which sits within the Pentagon’s office of Industrial Policy, and will ultimately be directed by the Office of the Undersecretary for Acquisition and Sustainment.

‘This project is scheduled to be completed in accordance with the Department of Defense timetable and as part of our Lynas 2025 plan. Detailed costings are still being finalized; we expect Department of Defense funding to be capped at approximately US$30 million. Lynas will also be expected to contribute approximately US$30 million under the agreement.’

So you’ve got a small capital expenditure outlay for a potentially crucial shift in the rare earth’s supply chain.

It took LYC a fair amount of time to get to this stage, but there are a number of things to consider going forward.

Outlook for the LYC share price

Here’s what I think is at play with regard to the outlook for Lynas shares.

Firstly, LYC has always been a company that is deeply enmeshed in, and influenced by, geopolitical factors.

I’ve charted the movements on key events, such as Trump tweets and trade war moves, on a number of occasions.

But there’s an even bigger picture, which is worth paying attention to.

Namely, a super ‘hot’ inflationary scenario that leads to a massive commodities boom.

This has been a key theme in our Exponential Stock Investor service since August, and I’d encourage you to check that service out if you want to learn more.

The potential commodities boom combines strongly with murmurs out of the Biden administration that the overall US stance towards China will remain largely the same, even if the tone and strategy changes.

In my eyes, all of this points to a more positive outlook for the Lynas share price, even if the long-term chart for LYC points to caution. Please note, this is not a formal recommendation but merely my outlook on LYC.

Again, this is just my view and there is a heap of risk out there at the moment, not least of which is growing strain in the global financial system due to a near endless flow of cheap money, poor economic conditions and the advent of more aggressive QE, leading into the age of Modern Monetary Theory.

A few things to keep in mind, then, when looking at the current run-up in the LYC share price.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments