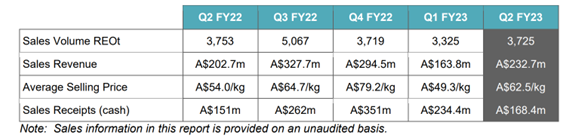

For Q2 FY23, Lynas Rare Earths [ASX:LYC] reported sales revenue of $232.7 million, which was a significant increase on Q2 FY22’s total of $202.7 million.

Sales brought in $168.4 million, which the company put down to well-timed deliveries from the latter part of the quarter.

LYC was worth $9.35 a share at time of writing, having moved upwards 3% in share price by midmorning.

The rare earths miner has surged 7.5% in shares value over the last week, and bolstered 20% in the past month, and yet, despite these bullish movements, it’s still down in its sector and the wider market average, 8% and 2% respectively over the last 12 months.

Source: TradingView

Lynas’ quarterly highlights

This morning, Lynas Rare Earths, one of the largest rare earths mining companies worldwide, shared improvements all-round in its December quarterly activities report.

The group shared that its sales revenue for Q2 totalled $232.7 million, an improvement on the same time last year when the group reported $202.7 million in quarterly sales revenue.

LYC’s sale receipts of $168.4 million also saw a vast improvement on Q2 FY22’s $151 million.

The company attributed the upshoot in sales to the timing of deliveries occurring later in the quarter.

Lynas reported a closing cash and short-term deposit balance of $934.2 million, $260 million higher than Q2 FY22 but $92.4 million lower than the first quarter of the 2023 financial year.

Production and sales outcomes in the December quarter recovered in the aftermath of water supply disruptions experienced in the prior quarter.

Rare earth oxide output was 4,457 tonnes in the second quarter, an increase of 248 tonnes at the same time last year and 957 more than the first quarter.

Mt Weld delivered a record quarter for rare earth volume, assisted by efficient ore processing.

Neodymium and praseodymium (NdPr) production was 1,508 tonnes for Q2 FY23, up from 1,359 tonnes in Q2 FY22, and 463 tonnes more than Q1.

Source: LYC

LYC and the journey ahead

Lynas said market prices were increasing from December, brought on by the Lunar New Year holidays and an expected surge in consumption in China.

The rare earths explorer warned that any future pricing movements will ultimately depend on China’s economic recovery.

Incidentally, the company spent more on exploration and development in the latest quarter, where $38.3 million was spent this time last year; the company forked out $141.9 million by the end of December.

Lynas said its CapEx cash outflow increased alongside progress in all three major growth projects; construction at the PDF (Permanent Disposal Facility) in Malaysia, and major construction activities accelerating at the Kalgoorlie Rare Earths Processing Facility.

Mt Weld was said to be progressing as planned, significantly in engineering design as well as procurement of supplies, items, and package awards.

The company’s senior lender, JARE, has agreed to defer LYC’s payment of US$11.5 million in historical interest to June 2023, with no penalties or further interest to be incurred.

Incoming! A commodity boom approaches

Speaking of sales and production increases in rare earths, our resources expert and on-the-ground experienced geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom.

A boom where Australia (and ASX stocks) stands to benefit…

James is convinced ‘the gears are in motion for another multi-year boom in commodities’.

The next big mining boom is predicted to happen in the next few years, brought on by the ‘Age of Scarcity’.

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, check out the recent interview with James and Greg with Ausbiz at the end of last year.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia