Shares in global jewellery retailer Lovisa Holdings [ASX:LOV] are falling sharply for the second day after the company announced a major leadership shakeup.

Lovisa revealed that its current CEO, Victor Herrero, will be departing the company in May 2025 after agreeing to a 12-month amended contract.

The company has already lined up his successor, announcing that John Cheston will take over as CEO and Managing Director starting June 4, 2025.

Shares in Lovisa are down by -6.3% today, trading at $28.49 per share, which puts their return at 38% for the past 12 months.

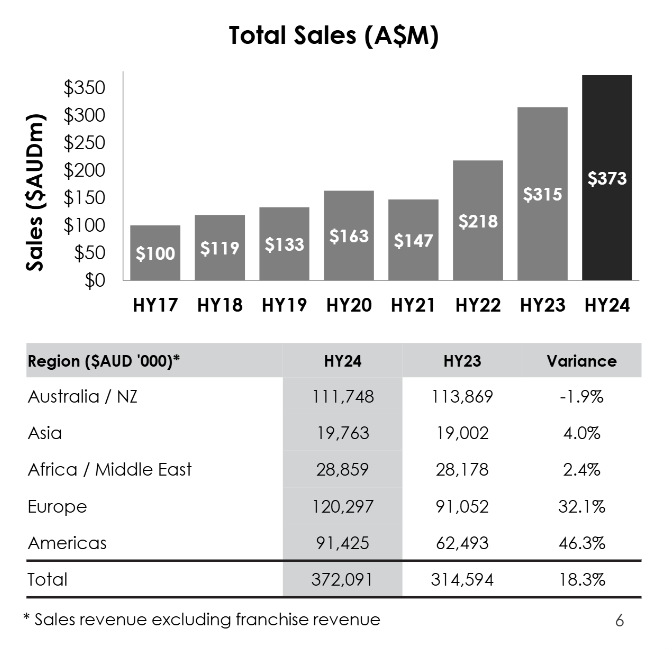

This isn’t bad, considering Lovisa’s struggles the past few years. Despite this, the stock saw an incredible price jump in February after topping market expectations and posting 18.2% sales growth.

Prior to that, it had been the target of numerous short sellers and negative sentiment.

Now, with the latest leadership change and share price drop, is Lovisa a good investment?

Source: TradingView

Shakeup at Lovisa

It appears that behind the scenes, two retail billionaires are battling it out for retail leadership.

John Cheston, the long-time Smiggle boss, is jumping ship from Soloman Lew’s Premier Investments [ASX:PMV] to Brett Blundy’s Lovisa [ASX:LOV].

The appointment of Mr Cheston, who has led Smiggle’s for over a decade, can be seen as a major coup for Lovisa.

Smiggle’s growth has been one of the standouts in the struggling Premier Investments retail empire.

In fact, Solomon Lew had unveiled plans to separate retailer Peter Alexander and Smiggle into separate ASX-traded entities in early 2025.

Smiggle and Peter Alexander were the key drivers of profit growth in the first half of FY24, and Mr Cheston was seen as the thought leader in much of its success.

‘John is a highly successful global retailer and will join Lovisa at a very exciting time as we continue our global growth,’ commented Mr Blundy, the billionaire businessman and chairman of Lovisa.

Meanwhile, exiting Lovisa CEO, Mr Herrero will take a sizable pay cut for his remaining term.

Despite Lovisa’s change in fortunes at the start of the year, there had been ongoing grumbling about Victor Herrero’s remuneration.

In fact, it may surprise many to learn that he held the position of the second-highest-paid CEO on the ASX at around $30 million in 2023.

That had never sat well with shareholders, who had voted to reduce his pay package thrice during his tenure.

Under the new agreement, Herrero will receive a fixed annual remuneration of US$1.3 million with no short-term or long-term incentives for FY24.

Incoming CEO Cheston’s pay package includes AU$2.35 million (US$1.56 million) in fixed remuneration.

Plus the potential to earn an additional AU$2.35 million per year in short-term incentives if Lovisa achieves EBIT growth of 30% or greater.

He can also benefit from a further $2 million if further growth is met in the future.

But the next question is, can the leadership change spur further growth, and is it a good investment now?

Outlook for Lovisa

While the CEO transition news has made Lovisa shares significantly cheaper compared to yesterday, the company still trades at a premium valuation relative to many other retailers on the ASX.

The sharp pullback may pique the interest of some investors who like the company’s long-term global growth story.

Lovisa has certainly been rapidly expanding its store network across markets like Australia, the US, South Africa, and the UK.

However, as you can see below, that growth remains concentrated in Europe and the Americas for now.

Source: Lovisa

It’s also worth considering that much of that anticipated growth looks to already be reflected in Lovisa’s share price even after today’s drop.

Those bullish on Lovisa are betting that incoming CEO John Cheston, who has a strong track record in global retail, will be able to continue executing the company’s ambitious expansion plans without missing a beat.

His performance-heavy compensation structure, with large incentives tied to delivering 30%+ EBIT growth, shows the board’s expectations remain high.

However, value-oriented investors may prefer to wait for an even more attractive entry point or consider cheaper growth opportunities.

Especially as the retail sector remains beaten down as the cost-of-living crisis continues in many countries.

Ultimately, while Lovisa may be a more intriguing opportunity after today’s selloff, investors will need to weigh the risks of the CEO transition and rich valuation against the potential upside of the company’s global growth trajectory.

For those uncertain, it may be smart to wait for further clarity before making a move.

A different opportunity

Our resident commodity expert, James Cooper, has been looking for the next big opportunity.

And he thinks he’s found it.

It’s one that’s part of a broader shift in global markets.

A stock that could benefit as we shift from an ‘Age of Abundance’ to an ‘Age of Scarcity’.

With this new scarcity, we could be on the cusp of the last major oil boom and shortages in critical minerals.

Investors could benefit by positioning themselves in the right resource and exploration companies today before demand goes vertical in the future.

If you want to learn more about his top pick in oil or opportunities around the corner.

Then click here to learn more CODENAME: LAST BARREL

Regards,

Charlie Ormond

For Fat Tail Daily

Comments