As I pointed out last week, one big early winner of Trump’s election win is Bitcoin [BTC].

This chart says it all:

| |

| Source: Coinigy |

This current surge has been record-breaking.

Now, you might not be a fan of Donald Trump. Or Bitcoin, for that matter!

But remember what I said last week.

If you want the opportunity to make money in the markets, you must be open-minded and let the evidence — not your own prejudices or biases — tell you what to do.

I wrote:

‘No idea is too crazy if that’s where the evidence leads. Some of my best investments – like Bitcoin – have come from hated or derided sectors.’

So today, let’s look at the evidence on the ground.

What is behind this price action?

Once I show you what’s happening, you’ll see why I think you should consider adding some Bitcoin to your portfolio as soon as you can.

Let’s start with this massive milestone…

Bitcoin takes silver…gold will be next!

Get this…

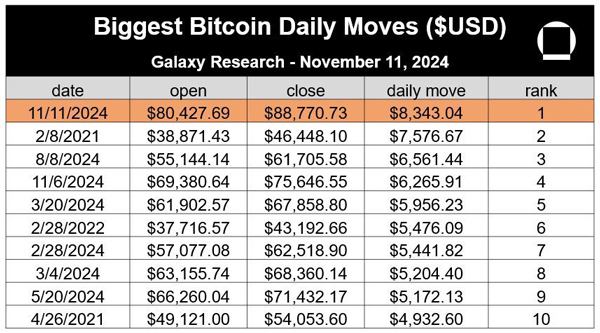

Last Wednesday, the price of Bitcoin shot up US$8,343 in just one day!

That was the biggest one-day gain on record.

Check it out:

| |

| Source: Galaxy Digital |

That surge led to Bitcoin overtaking silver as the second biggest monetary commodity.

As I said to subscribers of my Crypto Capital service on Thursday:

‘Next stop, gold!!!

‘Incidentally, if that were to happen, you’d be looking at a 10x increase from here. Or one Bitcoin equalling US$944,444.’

Of course, we don’t know if or when this could happen, bitcoin is still a volatile asset.

But speaking of gold, it’s interesting to see how it has performed in comparison to Bitcoin since Trump’s win.

Check out this chart:

| |

| Source: Trading View |

See that huge divergence?

As one commentator noted:

‘Pretty wild that the blow-off top on gold just happened on the same day a pro-bitcoin president was elected.

‘Historians might one day consider November 5th, 2024, as the pivot point in history when Bitcoin started to demonetize gold.’

Bitcoin to flip gold?

Many people probably still think this is impossible.

But it isn’t just wishful thinking from the pro-Bitcoin crowd.

Indeed, a sitting senator on the Republican side is actively pursuing this exact agenda:

| |

| Source: Bloomberg |

Yep, the game has changed with Trump’s win.

And when you dig deeper, you can see an increasing number of big-name buyers think this too…

So, who is buying?

Micro Strategy, who we’ve talked about previously, bought another US$2 billion worth of Bitcoin last week.

They’ve been buying Bitcoin in size for about four years now and have had better gains over that time frame than AI-darling Nvidia!

But they weren’t responsible for last weekend’s surge.

There appear to be some new ‘whales’ in town, though who exactly they are is hard to pin down at this stage.

There are persistent rumours that a big Petro-nation like Saudia Arabi or Qatar is buying in big.

Though nothing has been confirmed on that front yet.

But late last week, the latest regulatory filings dropped — called 13F disclosures — in which listed US entities revealed their Bitcoin purchases.

Check out some of the big-name buyers from the last quarter:

| |

| Source: X.com |

Make no mistake: corporate America is getting a taste for Bitcoin.

And the big funds are coming next.

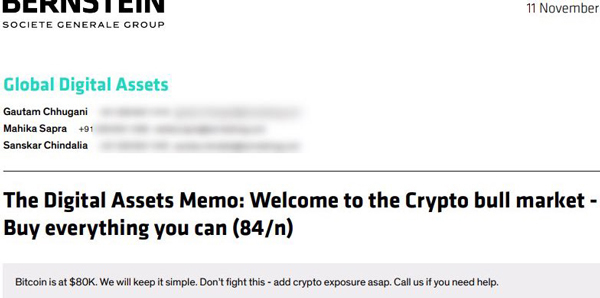

If this note from traditional finance firm Bernstein is anything to go by, we could be set for some interesting updates ahead:

| |

| Source: Bernstein |

As I said before, Trump’s win changed the politics of investing in crypto and the race to get a bite of this action is on.

It’s not just Trump driving the political tailwinds either…

With the recent appointment of Robert F. Kennedy Jr to Health, we now have 12 Bitcoin allies, 8 confirmed crypto holders, and 7 confirmed Bitcoin holders in his new team.

Plus, we’re seeing actual state governments in the US start to debate Bills like this:

| |

| Source: Fox Business |

In my opinion, you’ve still got time to jump on board before we see the next surge, but maybe not for much longer…

You may have three months, if I’m right

One interesting thing to note is that we’re not at the frenzy stage yet.

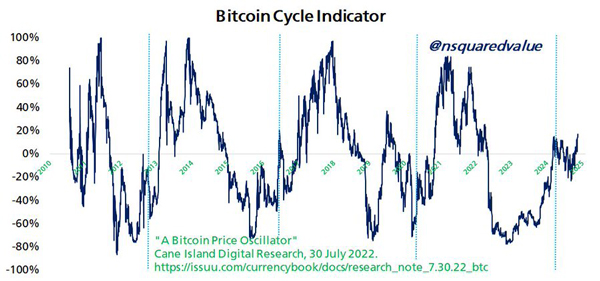

This chart explains why:

| |

| Source: Timothy Peterson/Cane Digital Research |

Analyst Tim Peterson created this chart and it’s a measure of buying strength.

The peaks and troughs (blue) align well with Bitcoin’s bull and bear markets.

As Peterson noted:

‘The peak of 2017 was 97%; 2021 was 84%. The current level is 16% above “middle” of the cycle. Still much upside. In fact, the magnitude of the recent rally, compared to historical volatility, is rather small.’

If Peterson’s indicator is right again, this party is just starting.

But by January 20th 2025, the window of opportunity could be shut.

Read my just-released special report here to understand why this is such an urgent date.

It’ll explain exactly what’s happening behind the scenes in Washington and how you can get ahead of what I think is coming next.

Speak soon…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments