Lotus Resources [ASX:LOT] released its DFS, ‘confirming Kayelekera as a low-cost, quick restart uranium operation.‘

The share price for the uranium stock was largely flat on Thursday.

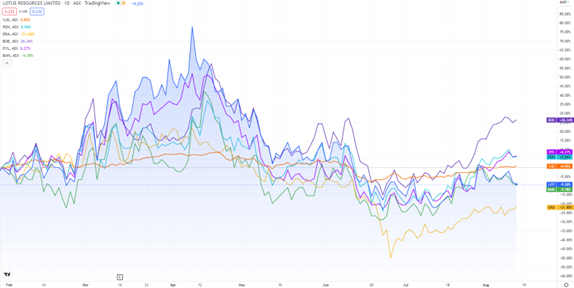

While LOT shares are up 50% over the past 12 months, they are down 25% year to date.

www.tradingview.com

DFS validates Kayelekera uranium

On Thursday morning, Lotus Resources brought out the latest results for its DFS (Definitive Feasibility Study) on the restart of the Kayelekera Uranium Project in Malawi.

Lotus revealed that the DFS findings paint Kayelekera Uranium as ‘one of the lowest capital cost uranium projects globally’ — one that will only take 15 months to rebuild.

Pending a FID (Final Investment Decision), the company will be boosting engagements with nuclear energy utilities, exploring funding avenues, and moving forward with offtake options.

Kayelekera Uranium breakdown

- The mine has an ore reserve estimate of 15.9Mt (metric tonnes) at 660 ppm U3O8 for 23Mlbs (metric pounds) U3O8

- Uranium produced based off 96% ore reserves and 4% inferred mineral resources

- 15-month rebuilding time, low costs averaging on 2.4Mlbs U3O8 each year for the first seven years

- Cash costs of US$29.1/lb and AISC of US$36.2/lb during the first seven years of production

- Low initial capital cost of US$88 million, initial capital intensity of US$37/lb (including S$35.8 million for new plant and infrastructure)

- Mine life of 10 years

- Restarting at a time when uranium market conditions suggest significant demand

Lotus said that its operating costs have been calculated higher than past operations and Scoping Study estimates due to elevated feed grades in ore sorting, lower grid-power costs, and improvements in nanofiltration uses — all despite high inflation.

Source: LOT

LOT management commentary

Keith Bowes, Lotus’s Managing Director, shared his thoughts:

‘Having an asset with low technical risk and low restart capital, which can quickly commence production, are key characteristics that investors look for in a mining project. The results of the Restart DFS clearly put Kayelekera in this category and this provides an opportunity for the Company to leverage off the strongest fundamentals for the nuclear/uranium industry in many years.

‘The standout features of the Restart DFS are the low capital costs and attractive operating costs, which consider the current high inflation environment, whilst also ensuring a positive legacy as we have significantly reduced our carbon footprint, in line with the Company’s ESG strategy.

‘The initial upfront capital costs remain one of the lowest in the industry, both from a headline (US$88m) and an initial capital intensity perspective (US$37/lb annual production). This is an excellent achievement given current inflationary pressures.’

Lotus and the future of uranium

Lotus mentioned the future demand for uranium as the world moves to renewable energy.

Mr Bowes said:

‘With the Restart DFS now complete the Company looks forward to continuing its work with the Malawian government to secure a Mine Development Agreement that will support the Project financing and shareholder returns appropriate for the scale of investment.

‘We believe we are still in the early stages of the uranium market upcycle and are confident that the uranium price still has some way to go before it peaks. The Company will look to lock in prices that ensure long term profitability and good returns for our investors.’

Nuclear is once more being considered as an option to bolster countries’ energy security.

As a comprehensive report by Energy Options Network (EON) notes:

‘An inherent advantage over technologies that only produce electricity (like wind and PV) is nuclear’s capacity to produce both electricity and heat, affording it the ability to take advantage of all hydrogen production technology options.’

And with Europe steadfastly holding to its resolution to abandon Russian oil, nuclear may see a resurgence soon.

And there is one small Aussie uranium stock that could help with Europe’s energy transition.

Ryan Clarkson-Ledward, our small caps expert, has profiled this potential saviour in a recent research report.

To hear more about it, click here.

Regards,

Kiryll Prakapenka,

For Money Morning