Over the weekend, I listened to an excellent discussion with Jeff Currie on Macro Voices.

If you haven’t come across that name before, Currie was the former Head of Commodities Research at Goldman Sachs.

He was also credited with calling the 2000s China-fuelled commodity boom, years before the event occurred.

One of the key discussion points was Currie’s belief that the EU is about to embark on a massive military build-out. And unlike the US, it actually has the capacity to do so.

You see, Currie doesn’t view Europe as the economic basket case, like many believe.

For one thing, it has a far lower government debt-to-GDP ratio versus the US.

In 2024, the average debt-to-GDP ratio in the Euro area was 87%.

For the US, it was 124%!

That gives Europe plenty more firepower for fiscal spending.

But it also wins out on soft measures, like far better income equality and less poverty.

I visit the US every couple of years, and I have to admit parts of the country look third-worldish, with crumbling infrastructure and a vast amount of homelessness.

Meanwhile, you’ll find suburbs with a proliferation of mini-mansions stretching on for miles. The US economy is capitalism on steroids.

By the way, if you are interested in finding European stock opportunities, not something you’ll come across often, my colleague Nick Hubble does some excellent work here.

Europe could emerge as a surprising spring of investment opportunity as investors shift away from their narrow focus on US markets.

But in terms of the European arms build-up… Well, that could have significant implications for certain resource stocks in Australia, too…

Metals linked to national rearmament

Think copper, nickel, antimony, silver, tungsten and titanium.

These traditional ‘war chest metals’ have traditionally been associated with conflict and national rearmament. They’re widely used in munitions and other military hardware.

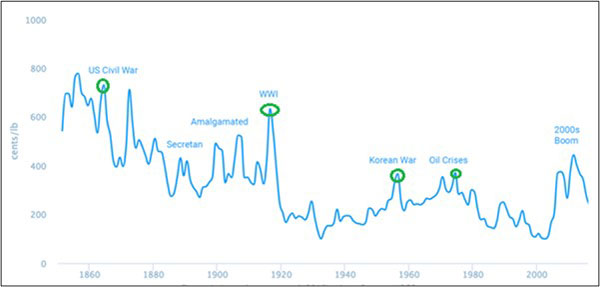

And as you can see below, some of the highest ever prices (copper) have occurred on the back of conflict:

| |

Cold wars, hot wars… It doesn’t matter.

Even the very thought of major escalation leads to national rearmament and surging prices for those metals needed to build military hardware.

As you can see, copper’s most significant spikes are synonymous with war.

It’s a forgotten link, perhaps because the last great copper boom was driven by Chinese industrial growth.

Back then, copper surged to over $4.60 per pound, peaking in 2011.

Yet, adjusted for inflation, the early 2000s commodity boom was a whimper compared to what happened during previous ‘war years.’

In real terms, copper skyrocketed to over $7 per pound during WWI, almost DOUBLE the levels achieved in the China-fuelled commodity boom of the early 2000s.

It also surged during the US Civil War, the Korean War, and the Vietnam War in the 1970s.

So, what does history tell us?

Metals perform extremely well amid political chaos and geopolitical chest-beating.

Look around, that’s the environment we’re in today!

As in every commodity cycle, we must be aware of the potential catalyst that will drive resource stocks higher.

Last time, that was China.

But this cycle is looking far different.

Given what we’ve seen over the weekend in the Middle East and Eastern Europe in recent years, the trend over the coming years looks unnerving.

Most of us want peace, unfortunately, though that’s becoming less certain.

But throw in the US’s latest attempts to water down its commitment to NATO, and there’s every reason Europe will be panicking more than most!

That’s why the EU could be on the verge of a historic arms build-up, as Jeff Currie points out.

Again, that’s something to be intensely aware of as the commodity cycle turns more bullish.

Let’s hope (and pray) that EU leaders don’t find a reason to use all that military hardware once they build it!

But for now, the trend is clear: citizens are anxious. And governments will play into that anxiety by getting bigger defence budgets passed through parliaments.

That means more demand for metals.

Until next time.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments