In today’s Money Morning…EV global sales are picking up…China is the world’s leading EV market…a frenzy in lithium…and more…

Dear Reader,

Well, COP26 — the most important global climate conference since Paris in 2015 — is almost done.

And so far, it’s been pretty exciting with the summit hogging many of the world’s headlines.

Some of the major climate pledges have included ending deforestation by 2030, reducing methane emissions by 30% by 2030 compared with 2020 levels, and more than 40 countries have vowed to move away from coal by either 2030 or 2040.

And, of course, there’s also a lot of money at stake…the Glasgow Financial Alliance for Net Zero (GFANZ) — a group of banks, asset managers, and insurers — has committed US$130 trillion to achieving net zero.

But today is all about electric vehicles (EVs), so we’ll keep our eyes and ears on it…

EV global sales are picking up

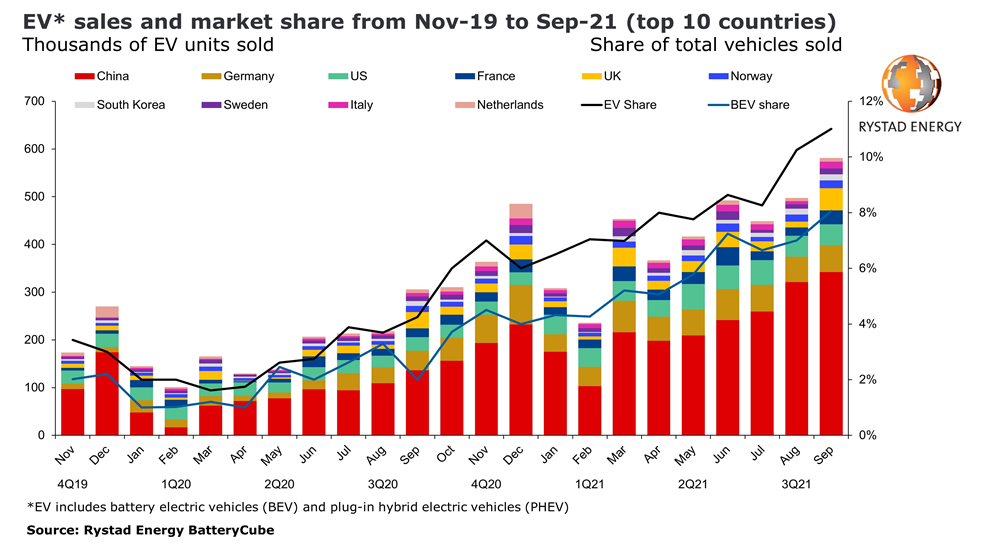

While EVs make up only a small percentage of the total fleet, EV sales have been picking up.

In 2020, even though the world was going through a pandemic, EV and plug-in hybrid sales almost doubled. Global EV sales went from 2.5% in 2019 to 4.2% in 2020, a 1.7% increase.

And sales are soaring in 2021.

In the first half of the year, EV sales were 2.65 million. It’s pretty great when you consider that EV sales totalled 3.2 million in 2020…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Rystad Energy expects that EV sales in 2021 could even be twice those in 2020, passing the seven million mark globally. That’s even with the pandemic still going.

That means that both plug-in hybrid (PHEV) and battery electric vehicles could reach a global market share of 10.3%, up from 5.3% in 2020, and hit double digits for the first time.

One of the reasons that EVs have been picking up has been because of China. China is the world’s leading EV market. Just in the first half of this year, they sold 1.1 million EVs.

|

|

|

Source: Rydstad Energy |

China is looking to hit peak carbon emissions by 2030 and net zero by 2060.

But for China there’s also clear advantages for getting onto EVs. EVs cut pollution and dependency on foreign oil, but also, it means it can create a whole new export market.

China dominates most of the lithium-ion battery supply chain and is in first place when it comes to BloombergNEF’s Global Lithium-Ion Battery Supply Chain Ranking. But they are starting to face some competition. As they noted:

‘China hosts 80% of all battery cell manufacturing capacity today, with capacity expected to more than double to over two terawatt-hours, enough capacity for more than 20 million electric vehicles (EVs), in the next five years. Yet, as governments around the world recognize the strategic importance of the battery industry, local supply chains are emerging to challenge China’s dominance.’

The US is starting to pick up its EV game. On Friday, US Congress passed Joe Biden’s new infrastructure bill which includes US$7.5 billion to create EV charging infrastructure and US$65 billion for clean energy and renewables. Biden also wants half of all new US vehicle sales to be electric by 2030.

And Europe has also been looking at bringing supply chains closer to home, with the goal of supplying all its own battery needs by 2025.

Of course, all this EV uptake will need more lithium…

A frenzy in lithium

Lately there’s been a frenzy in lithium with more Chinese companies going on a lithium buying spree.

Take Millennial Lithium Corp, for example.

The company who has lithium assets in Argentina has been at the centre of a bidding war.

In September, Contemporary Amperex Technology Co (CATL) — the world’s largest battery maker —and Ganfeng Lithium Co went head to head to acquire the company.

This comes after both companies have also made other lithium investments in companies like Pilbara Minerals and SQM.

Anyway, Ganfeng withdrew and CATL agreed to buy Millennial for CA$377 million (around AU$408 million).

But, a month after, when it looked like it was all settled, Lithium Americas Corp made another bid to buy the company offering about US$400 million (around AU$540 million).

Now CATL has the option to up the offer…or move aside.

Chris Berry from consultancy House Mountain Partners said that the bidding war is ‘just a taste of what’s to come’. He continued:

‘It’s not just hedge funds riding momentum. These are larger strategic players from both inside and outside the EV supply chain positioning amidst the decarbonization thesis.’

BloombergNEF expects global lithium demand will increase by five times by 2030 with lithium demand outstripping supply through to 2025, according to Jefferies.

With shortages looming, it’s not a bad idea to get some exposure to lithium.

Best,

|

Selva Freigedo,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here