In March 2009, a group of reporters and car enthusiasts gathered up in Hawthorne, California, for the presentation of a new car.

The company doing the unveiling was relatively small. It only had one car model on the roads, a US$109,000 sports car, of which it had only sold 250 units.

Although still a luxury car, the model the company was unveiling that day was a cheaper sedan that could go from 0 to 60 in less than six seconds.

The company had huge ambitions for their new car.

As the CEO mentioned that day, the sedan was set to make history by playing a similar role in reshaping the auto industry, just as the Ford Model T did in its day.

As he said:

‘This is one of the most historic cars. We are trying to accelerate the EV revolution and get us off oil.’

If you haven’t guessed it yet, the company is Tesla, and the car is the Tesla Model S.

Musk wanted to have the Model S hit the roads by the third quarter of 2011 and to build 20,000 of them a year.

But the truth was that the company was struggling to get financing.

This was just after 2008, and money was scarce.

‘We can’t move forward with that without a major amount of capital,’ he had said during an interview just a few months before.

But talk about being in the right place at the right time…

Only a month before the unveiling of the Tesla S, US President Obama had signed the American Recovery and Reinvestment Act, a stimulus package that would drive US$800 billion into the economy…and that included US$90 billion to promote green energy.

Dubbed the ‘biggest energy bill in history’, the stimulus helped push companies like Tesla, which got a US$465 million loan from the Department of Energy to design and build electric cars.

Today, Tesla is a US$900 billion company, manufacturing close to a million electric cars per year.

Yet Obama’s stimulus also boosted more than 100,000 renewable energy projects across the country. It established large-scale solar and wind farms and lowered power costs. In fact, the stimulus doubled solar and wind capacity in the US in just four years.

Now, last night, Biden signed the Inflation Reduction Act into law…

Dubbed as the ‘boldest climate package in history’, the landmark bill allocates US$369 billion to clean energy. This is four times the amount brought in by Obama and the largest clean energy investment in US history to date.

Its effects have already been flowing into all sectors of the US clean energy economy: wind, solar, hydrogen, cleantech, batteries, to name a few…

Yet the climate bill has also been pushing ASX lithium stocks.

Three factors boosting lithium stocks

Pilbara Minerals [ASX:PLS] is up 30% in the last month, Lake Resources [ASX:LKE] surged 112%, Core Lithium [ASX:CXO] is up 57%, and Liontown Resources [ASX:LTR] close to 70%.

Of course, it helps that lithium prices have stayed steady even as many other commodities such as oil and iron ore are facing downward pressures due to lower economic growth.

And that EV sales have continued to grow. In the first half of this year, EV sales hit 4.2 million, a 63% rise from the same time last year.

What’s more, we could see another lift in lithium prices in the short term from disruptions in production.

With temperatures rising in the Sichuan province in China, the government has asked companies to stop production over the next six days to save on power. Sichuan is one of China’s main lithium provinces holding companies such as Tianqi Lithium and CATL.

While lithium stocks cooled earlier this year after reports that the battery metals bull market was over, I’m still very bullish on lithium.

Fact is, there are still reports that there isn’t enough lithium supply coming online to cover demand.

The latest was from Kent Masters, Chief Executive at lithium producer Albemarle. He stated recently that lithium supply isn’t keeping up with demand:

‘It’s systemic for a pretty long period of time. For seven to eight years it stays pretty tight.’

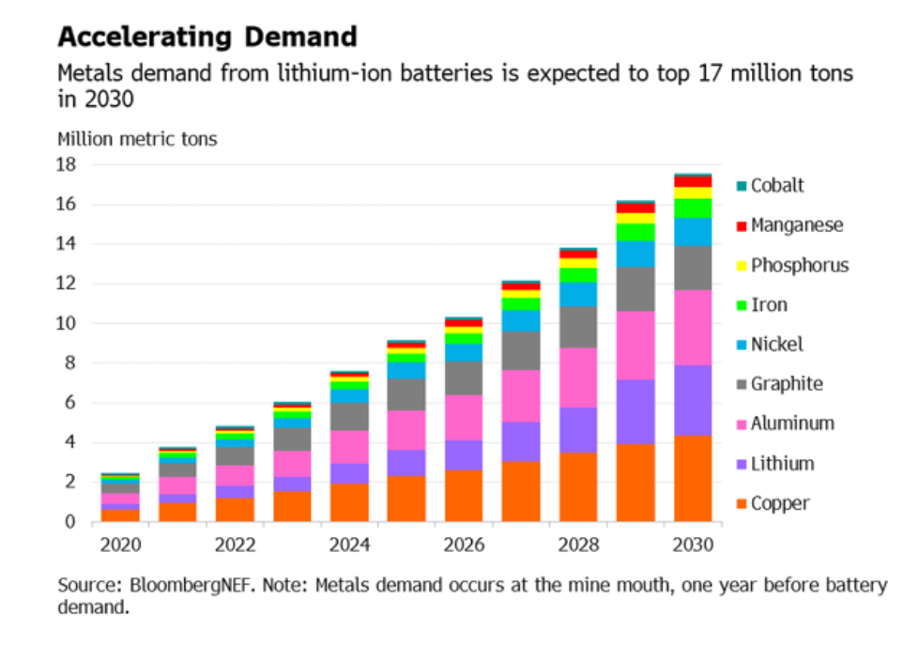

And with demand for EVs continuing to increase, we should see demand for battery metals such as lithium, copper, aluminium, and graphite continue to rise, as you can see below:

|

|

| Source: BloombergNEF |

A pivotal moment

But of course, while lithium — and battery metals — are getting most of the press, the fact that one of the top economies in the world is investing big in renewable energy shouldn’t go unnoticed.

The money will flow into all parts of the clean energy economy, boosting the sector for years to come.

Over the following decades, we will see plenty more money flow into the transition. So it’s not too late to get involved.

Until next week,

|

Selva Freigedo,

For Money Morning

Selva is also the Editor of New Energy Investor, a newsletter that looks for opportunities in the energy transition. For information on how to subscribe, click here.