While lithium stocks have deflated in the last couple of months, this week, we got another indication that things are still hot in this space.

On Monday, Tianqi Lithium Energy Australia (TLEA), a joint venture between Chinese Tianqi and IGO [ASX:IGO], made a bid for junior explorer Essential Metals [ASX:ESS].

ESS owns Pioneer Dome Lithium, an early-stage project located around 130km from Kalgoorlie.

TLEA has offered $136 million to buy Essential Metals. If approved, the deal would pay 50 cents a share, 36.3% over the average price the share traded in the last month.

ESS’s shares skyrocketed almost 40% after the announcement, to 48 cents.

TLEA owns 51% of the Greenbushes mine, which is one of the largest lithium mines in the world.

Tianqi and IGO also own a lithium processing plant in Kwinana in Western Australia, where they turn lithium concentrate into lithium hydroxide to use in lithium-ion batteries.

The short story is that TLEA is looking to ramp up production for its refinery, and it needs more lithium for it. ESS gives it another source to explore and grow.

As IGO’s acting chief executive officer, Matt Dusci, put it:

‘The ESS transaction provides an opportunity to accelerate lithium exploration to bring new resources to production.

‘We look forward to supporting TLEA with future work programs over the ESS assets, as the joint venture seeks to bring new resources to production to address the market deficit of raw materials critical for clean energy transition.’

I mean, I don’t see that the story for lithium has really changed. Finding lithium supply remains an issue, in particular for carmakers.

BYD, for example, who recently overtook Tesla as the largest EV maker in the world, is mulling over investing billions of dollars in Chile to build up a battery materials supply chain.

And Piedmont Lithium [ASX:PLL] has recently amended their lithium supply deal with Tesla, which will likely result in Tesla paying more…

Instead of having fixed lithium prices, the new agreement states that Tesla will buy spodumene at prices ‘determined by market prices at time of shipment’.

In short, while lithium stocks have taken a hit recently, things are still looking pretty tight in the lithium space.

Why have lithium stocks dropped?

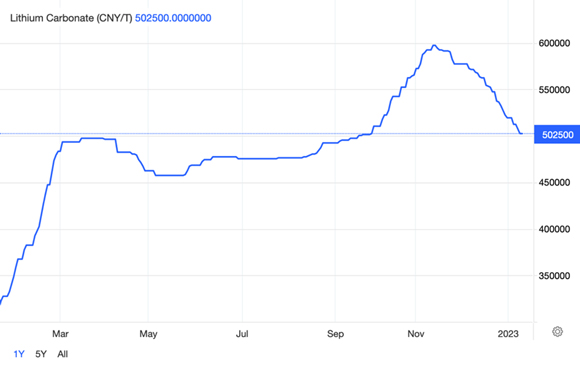

Lithium stock prices took a dive in December. One of the reasons for that fall was a drop in lithium carbonate prices.

As you can see below, lithium carbonate prices in China hit a peak in November and have been falling since:

|

|

|

Source: Tradingeconomics |

There was a lot of uncertainty in China about EVs with lockdowns from the pandemic and the end of EV subsidies in China.

And, of course, lithium stocks also got hit by general market fears of inflation and recession. When there is a crisis, cars sell less.

Albeit that wasn’t exactly true for EVs during the pandemic. While internal combustion vehicle sales fell during that period, EV sales actually grew…

And then, it also didn’t do lithium stocks any favours that Goldman Sachs and Credit Suisse turned quite bearish on lithium in November.

Still, let’s take a look at that lithium carbonate chart price again, this time we’ll extend it to include the last five years:

|

|

|

Source: Tradingeconomics |

Even with the fall in November, lithium prices are still pretty high when compared to 2021.

This time could be different

Lithium prices could remain high in 2023. There’s plenty that could keep a floor on lithium prices.

For one, China’s economy is reopening and relaxing COVID rules. Don’t forget that China is the largest EV market on Earth.

What’s more, the market is driven by the energy transition and government pledges around the world to phase out fossil fuel cars.

As Eric Norris from Albemarle, the largest lithium producer in the world, said a couple of weeks ago in an interview with the Financial Times:

‘One of the reasons that we see things being so tight is just the market is fundamentally different. In 2019, the market didn’t grow very much and it was 300,000 tonnes. Prior growth rates may have been 30,000-50,000 tonnes a year.

‘Today, the market grows 200,000 tonnes a year, almost the full size of what the market was back then.’

Indeed, there’s a lot of money already flowing into producing lithium-ion batteries.

According to Benchmark Minerals, in the last four years, there’s been close to US$300 billion committed to lithium-ion battery gigafactories — large factories that produce lithium-ion batteries — with US$131 billion coming in just the last year.

Most of this investment is coming from China, but investment is also starting to accelerate from the US after the recent Inflation Reduction Act.

And all these gigafactories are going to need raw materials…

So it’s likely lithium prices will stay high this year.

If you are looking to invest in lithium stocks, though, stock picking will be key. While lithium stocks have been knocked off their highs recently, there’s still a lot of hype about them.

On that note, my colleague Callum Newman may have found a ‘hidden gem’ in this sector. It’s an obscure lithium play in disguise.

You can learn more about this stock, along with Cal’s four additional best stock ideas, here.

Regards,

|

Selva Freigedo,

Editor, Money Morning