Pure-play lithium resources company Lithium Power International [ASX:LPI] saw its share price rise more than 4% on Friday after announcing its drilling program in Greenbushes, Western Australia, has officially begun.

With this milestone under its belt, the company now prepares to demerge from its 100%-owned subsidiary Western Lithium and streamline its focus to Chile prospects.

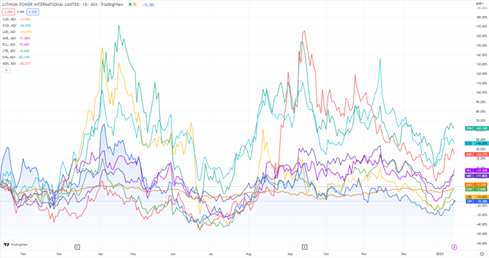

LPI shares were trading at 49 cents by Friday afternoon. Throughout 2022, the stock faced a devaluation of 31%.

For the sake of comparisons, fellow lithium producers Sayona Mining [ASX:SYA], Core Lithium [ASX:CXO], and Anson Resources [ASX:ASN] went up 57%, 44%, and 26% in the past year, respectively.

Source: Tr adingView

adingView

Drilling at Greenbushes begins

This week, Lithium Power commenced a new drilling program at its East Kirup lithium prospect, within Greenbushes, in the southwest of Western Australia.

LPI is employing two drilling contractors with forest experience to complete the work, working towards a Conservation Management Plan (CMP), which aligns with Western Lithium’s sustainable exploration and development practices.

Works are only to take place in dry weather conditions, according to the CMP, which is to minimise the negative impact on native trees.

‘The planned program includes 960m of reverse circulation drilling and 400m of HQ core-sized diamond drilling’, stated LPI.

‘The area has not previously been drilled, hence the objectives of the program are broad, with the aim of defining the water table, water quality and flow rates, and stratigraphy and geochemical anomalies along the Donnybrook Shear Zone previously defined by laterite and soil sampling.’

The East Kirup prospect is 20km northwest along the Donnybrook Shear Zone from Greenbushes, Australia’s largest lithium mine.

LPI Executive Director Andrew Phillips commented:

‘The results of this drilling program will be used − along with previously completed environmental surveys − to prepare a CMP to allow drilling on new tracks, the commencement of phase three.

‘While the core focus for LPI in H2 2022 was the MSB consolidation in Chile, throughout this time the Western Lithium team was expanding and diligently working to add value to the projects. Final approvals were also granted to commence this inaugural drilling program in the Greenbushes area.

‘The project area is large, requiring careful analysis to identify the selected drilling targets. The intention is to hit the ground running in 2023, and we are pleased that the commencement of the program is so early in the year.’

Western Lithium demerger

A year ago, LPI announced the intention to demerge Western Lithium.

While LPI accesses three tenements through Western Lithium (Greenbushes, the Pilbara Craton, and the Eastern Goldfields), demerging will enable LPI to focus on developing its Maricunga Lithium Brine Project in Chile.

CEO Cristobal Garcia-Huidobro said:

‘LPI believes that there is a compelling strategic rationale for the demerger of LPI’s WA hard rock lithium exploration assets. The Demerger will offer existing LPI shareholders the opportunity to create long term value via a new ASX-listed company.’

In Q1, there’ll be a general meeting in which half-year audited financials shall be released, and the official move to approve and execute the demerger will take place.

An incoming boom for commodities

Our resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

Similar patterns that occurred 20 years ago are happening again.

James is convinced ‘the gears are in motion for another multiyear boom in commodities’.

A boom where Australia (and ASX stocks) stands to benefit…

The next big mining boom is predicted to happen in the next few years.

The same investors that got rich last time are preparing to make their move — don’t let them take the monopoly again.

You can learn from James’ experiences AND access an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, we can also share a recent interview with James and Greg for Ausbiz at the end of last year.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia