The Lithium Power International’s [ASX:LPI] updated Measured and Indicated resource for the Maricunga lithium project in Chile grew 90% on 2019 DFS.

Investors were happily surprised, sending the LPI share price up 9% at time of writing.

Despite not notching triple-digit gains over the year unlike some of its high-fling peers, LPI is still up 60% in the last 12 months.

I will be interested to see how the market rates today’s big jump in LPI’s resources over the following weeks and months.

LPI’s resources increase 90%

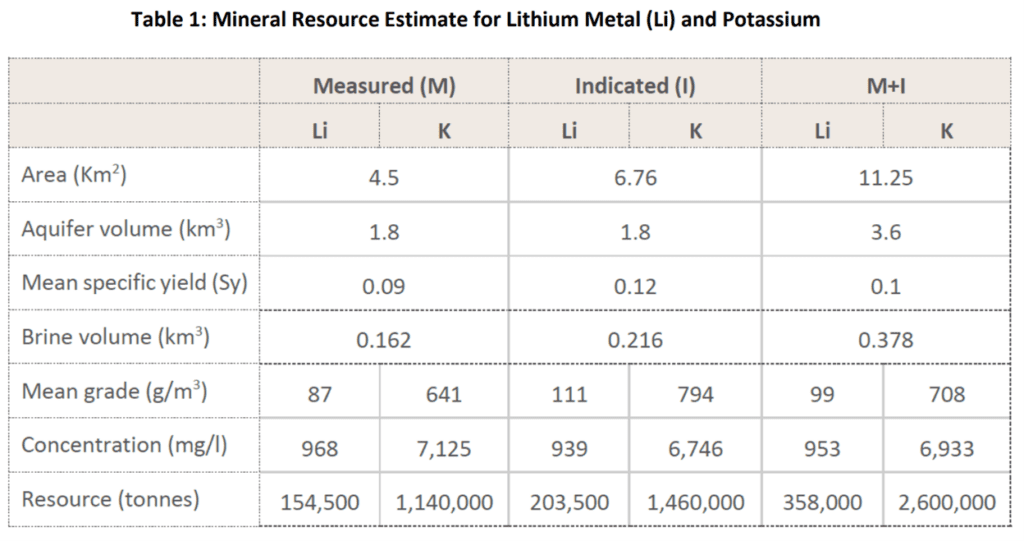

Lithium Power reported that the updated Measured and Indicated (M&I) resource for the Maricunga Stage One Lithium Brine Project in Chile notched a gain of 90% compared with LPI’s 2019 definitive feasibility study.

The updated M&I resource now stands at an estimated 1,905,000 tonnes of lithium carbonate equivalent (LCE) for the Stage One (Old Code) mining properties at an average grade of 953 mg/l lithium.

This represents close to double the initial resource of 1,020,000 tonnes of LCE in the equivalent area in the 2019 DFS.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

The Maricunga resource remains open at depth.

A new exploration target between 400–550m was defined for further resource expansion below the Old Code concessions and between 200–550m below the New Code concessions.

LPI said these prospective targets hold promise of containing between 1.2–2.1Mt of lithium carbonate equivalent.

Next steps for Lithium Power Share Price

Today’s update comes a month after LPI successfully completed a $12.4 million placement to further develop the Maricunga Lithium Brine Project.

LPI Chief Executive Officer Cristobal Garcia-Huidobro said today the updated resource results ‘confirm Maricunga as one of the world’s richest lithium brine deposits.’

The result also expedited technical activities aimed at completing an updated DFS in Q4 2021.

What’s the focus for LPI now?

For CEO Garcia-Huidobro, it’s securing financing for Stage One, which is now a priority.

Garcia-Huidobro said LPI has already received ‘preliminary indications of interest from international financial institutions and private funds for debt and equity financing of the project.’

Despite the potential challenges, lithium stocks have enjoyed positive momentum lately as investors seek to position themselves advantageously for an electric vehicle future.

If you want to learn more about investing in lithium stocks, then you should read our free 2021 lithium report.

It outlines three stocks that could surge on the back of renewed demand for lithium in 2021.

Click here to read the report.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here