Lithium Energy [ASX:LEL] announced a doubling of its total graphite inventory across its Burke Projects in Queensland.

LEL shares are up by 1.1%, trading at 93 cents as at Friday morning on the back of the company’s maiden RC drilling results.

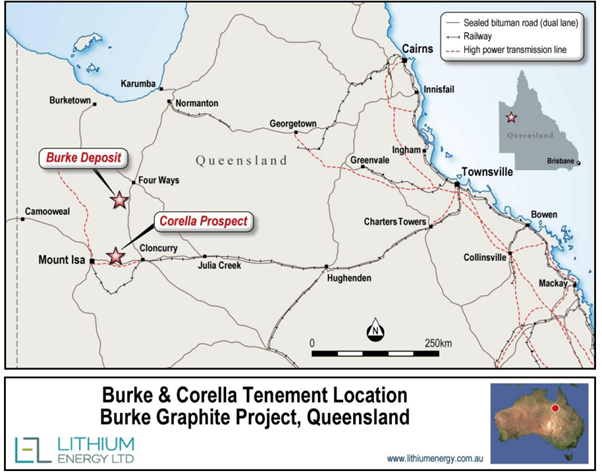

The total graphite inventory of the company across the QLD Burke and Corella deposits has now doubled to 2.6Mt of contained graphite.

With the news, Lithium Energy maintains its quarter’s momentum, with shares up 20.78% in 2023 year-to-date.

What’s next for the company?

Source: TradingView

All that glitters isn’t gold

Today’s announcement markedly increases the QLD Burke Graphite Projects inventory — doubling it to a potential 2.6 million tonnes of graphite for the company.

This comes after the recently completed RC drilling at the Corella Tenement delivered a maiden Inferred Mineral Resource Estimate (MRE) of 13.5Mt at 9.5% for 1.3Mt of contained graphite.

The site also includes a higher-grade inferred portion of 4.5Mt at 12.7% total graphitic carbon of 570,000 tonnes.

These higher grades make the site especially attractive for use in lithium-ion batteries, which require low impurities and smaller graphite flake size.

Typically this forces battery producers into energy-intensive synthetic graphite production or reliance on China, which holds a near monopoly on the market.

‘The major increase in our graphite inventory contributed from the Corella Project adds significant value to the overall Burke Graphite Project,’ Lithium Energy executive chair William Johnson said.

‘In particular, the additional resource provides the company with the potential for expanded development options for our proposed vertically integrated battery anode material manufacturing facility based in Queensland.’

‘These potential options will be considered as part of the engineering studies currently being undertaken at Burke.’

Lithium Energy is now undertaking metallurgical test work with help from CSIRO — assessing the potential for integration with a proposed purified spherical graphite (PSG) manufacturing operation based in the region.

Source: Lithium Energy

Early signs look good as initial tests point to the suitable use of LEL’s high-grade graphite in battery anodes.

The company has acquired several submissions from engineering firms to assist with the progression of studies that relate to graphite manufacturing.

The development of a downstream graphite processing facility in the region has the potential to establish it as a significant producer of battery-related minerals outside of China.

Australia to profit from incoming drilling boom

The prospect of Australia chipping away at China’s control over critical battery inputs could also be an opportunity.

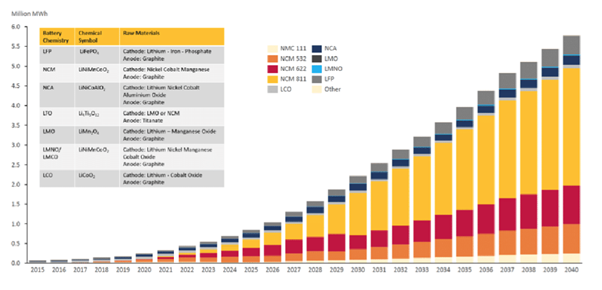

Source: Benchmark Mineral Intelligence

Demand for these critical battery minerals is only growing as we move towards net zero.

The wider energy industry is making massive bull market-like gains in the face of recession, interest rates, and wider market sentiment.

It’s almost like an alternate universe, the universe of booming drillers.

More of these booms are marked to happen for every single metal that can be found on the period table.

It’s been described as a ‘new golden age’ for junior explorers — and for investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Yes, it’s very possible. Many are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Fat Tail Commodities

Comments