What a difference a year can make. Take 2020, for example…

This time last year no one would have predicted the world would be grappling with a pandemic. We were still two months away from confirming the initial outbreak in Wuhan.

Now, because of that we find ourselves in a very new world. One filled with lockdowns, border closures, and economic collapse.

It’s been a wild ride, that’s for sure.

More importantly it has also brought about dramatic change. Some of which is for the better, and some of which is for the worse.

Indeed, for some sectors or industries it has seen a total reversal in outlook. Today, I want to talk about one such industry.

And what better way to do so than with two contrasting headlines!

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Record turnaround

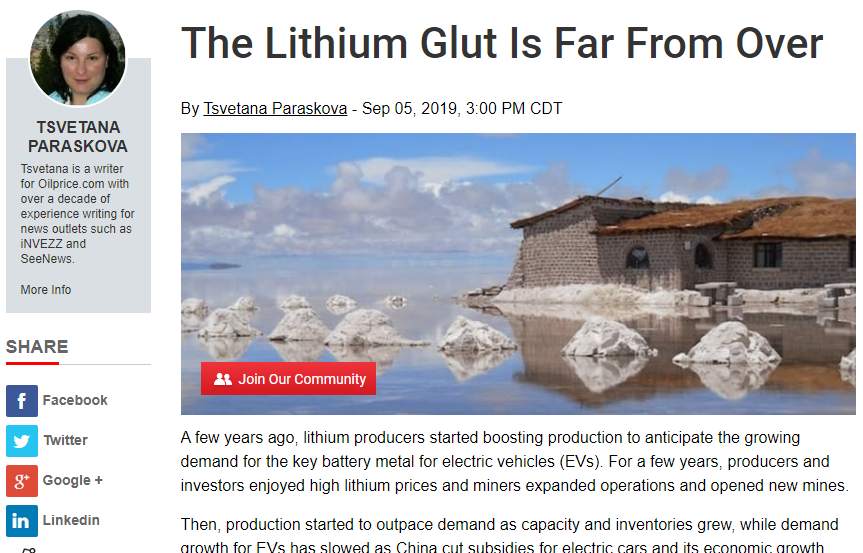

Below is an article taken from Oilprice.com, which was published on 5 September 2019:

|

|

|

Source: Oilprice.com |

As you can see, it’s about lithium. Specifically, the lithium glut. An oversupply that has plagued the sector and the broader industries that surround it.

Long story short, all the signs pointed to a grim outlook for this unique metal.

At least, that was what most people were expecting…

Now, one year on, I want you to take a look at this article. One that was just published on Wednesday (30 September):

|

|

|

Source: Oilprice.com |

Same website, same author, but a very different outlook.

In just over a year, lithium has managed to become a hot commodity once more. Shirking off a glut and now facing supply shortages.

That’s pretty unreal — for any kind of commodity.

So, what is behind this turnaround in Lithium demand?

Well, as you may be able to tell from the cropped text — it is hard to ignore the influence of Tesla.

Yes, electric cars (as per usual) are the number one reason behind this lithium boom. Just as they were a few years ago. The difference this time though is that the sales are starting to back up the hype.

Going green for good

Now if you take a look at Tesla’s share price one would assume they were selling upwards of 500 cars per day. That might at least justify their frankly insane market cap.

Suffice to say, the market has high expectations of Tesla and the wider EV industry. Which, as we’ve seen before, has burnt many investors in the past.

Having said that though, the EV market has been formidable in 2020. Especially in recent months.

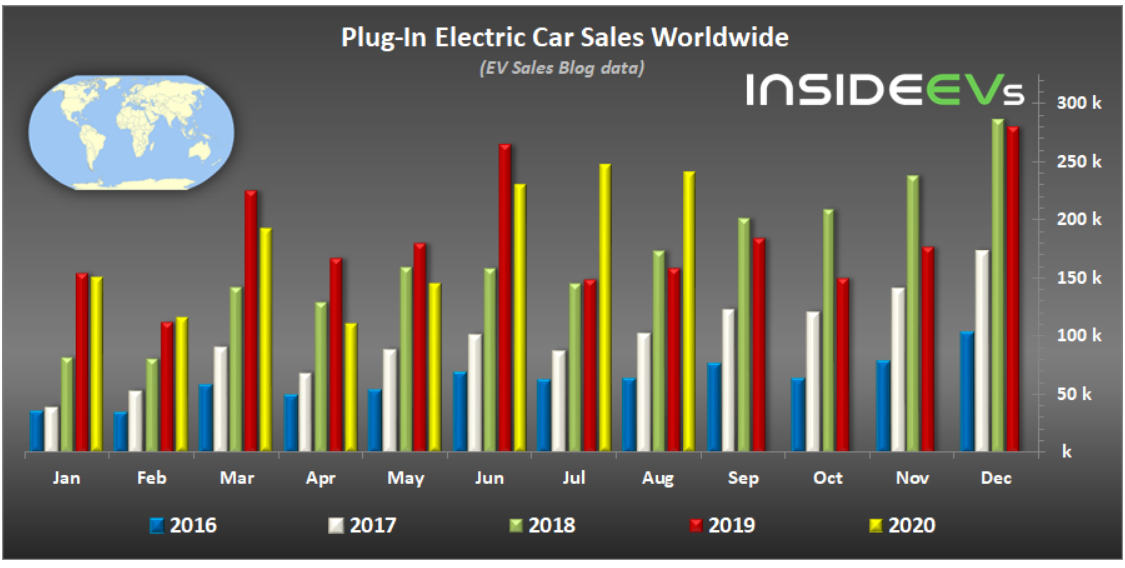

Take a look at this sales data, for example:

|

|

|

Source: Inside EVs |

The red line shows global sales for 2019, while the yellow line shows 2020 figures.

As you can see, for much of this year, sales have trailed last year. That is until July and August.

In these past two months sales have exploded compared to previous years. An indicator that is no doubt the major catalyst for this new lithium crunch.

Plus, more impressively, this EV demand boom is defying the wider downturn in the car market. Which, according to Moody’s, has seen a 27% drop in overall sales. A slump that the industry isn’t expected to recover from until 2025!

In other words, expect EVs to become a much bigger portion of total car sales. Or, as Bloomberg New Energy Finance put it:

‘The electric vehicle market will probably grow year-on-year in 2020. That’s quite a different expectation than we had four months ago, when BNEF published its Long-Term Electric Vehicle Outlook projecting an 18 percent year-on-year decline in EV sales.

‘With the global auto market post-peak and EV sales still growing, it stands to reason that EVs will become that much more important to the auto industry’s future growth as their market share increases.’

So, by all accounts it seems there is a lot of substance behind this lithium boom. Meaning that for investors, it may be time to start looking at miners once more.

As I mentioned yesterday, Piedmont Lithium Ltd [ASX:PLL] is just one such example. A tiny lithium miner whose share price has exploded this week after a new deal with Tesla.

But they’re not the only ones. Even the bigger names, such as Pilbara Minerals Ltd [ASX:PLS] and Galaxy Resources Ltd [ASX:GXY], have been climbing recently.

As I said at the start, what a difference a year can make…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Is Lithium Ready for a New Bull Run in 2020? Free report reveals three stocks that could make serious gains. Download your report now.