The Lithium Australia NL [ASX:LIT] share price is up today after its subsidiary’s patent was accepted for grant.

In today’s ASX announcement, Lithium Australia reported that the Australian patent applied for by its wholly-owned subsidiary — VSPC — for a proprietary cathode manufacturing process was accepted for grant.

VSPC’s process was deemed to be ‘novel and inventive’.

As I covered last week, LIT’s previous ASX announcement regarding a pilot test received a somewhat frosty investor reception.

This was not the case today.

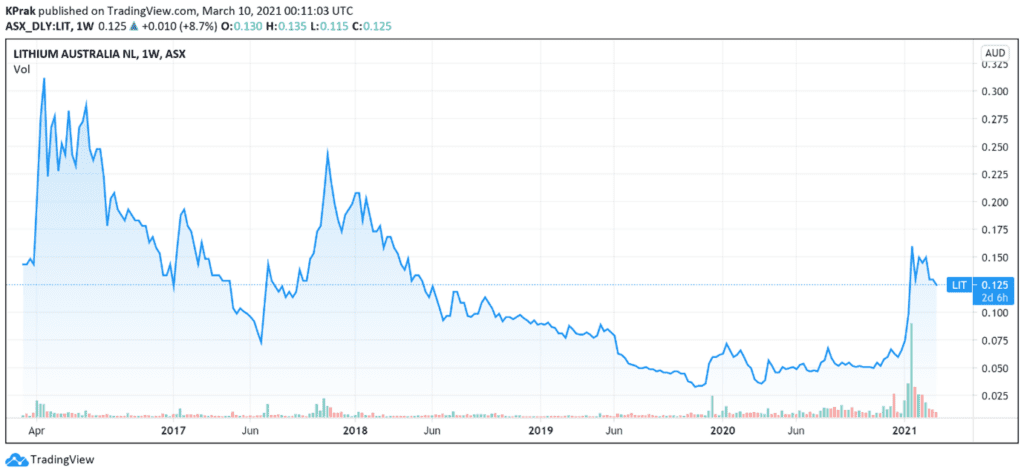

The announced patent grant saw the LIT share price rises by 8.6% to trade at 12.5 cents at time of writing.

What did Lithium Australia’s ASX announcement contain?

Here’s a quick snapshot:

- VSPC’s proprietary cathode material manufacturing process patent approved for grant

- VSPC’s method of synthesising lithium metal phosphates confirmed to be novel and inventive

- The intellectual property for VSPC’s proprietary process will last 20 years

- VSPC’s process reduces chemical costs by 15%

So, what’s the importance of this cathode material manufacturing process?

According to Lithium Australia, its subsidiary VSPC ‘has simplified its process for the production of lithium metal phosphate cathode powders, enabling the use of a broader range or raw materials as feed.’

The expansion of acceptable raw materials as feed has, according to LIT:

‘Significantly reduced the cost of manufacturing lithium ferro phosphate and other lithium metal phosphate materials.’

The patent grant helps Lithium Australia’s goal to develop ‘efficient and sustainable process technologies to manufacture materials for lithium-ion batteries.’

What did LIT’s management say?

Lithium Australia Managing Director Adrian Griffin offered this comment:

‘Lithium Australia/VSPC can now provide practical solutions for electric vehicle manufactures seeking cobalt-free batteries.

‘Further, the Company’s recent development of LMFP demonstrates the potential for phosphate-based, nickel and cobalt free batteries to achieve ehigh energy densities, an ideal combination in terms of e-mobility applications.’

Regarding the intellectual protection afforded by the grant, Griffin stated that ‘patent protection will provide us with a significant cost advantage in the production cycle of what is currently the most rapidly expanding sector of the battery industry.’

Lithium Australia continues news blitz

Today’s ASX announcement follows last Friday’s reveal that LIT will conduct a pilot test for one of its key product offerings — its LieNA spodume conversion process.

It also follows news that the US Patent and Trademark Office approved Lithium Australia’s SiLeach patent application for its SiLeach process, which is capable of producing a variety of lithium chemicals.

On top of that, LIT’s Australian patent received a Notice of Acceptance from IP Australia with a full grant expected at the end of April 2021.

LIT share price outlook

Why have investors received today’s news more positively than last week’s pilot test announcement?

As I said last Friday, an announcement of a pilot test may not be immediate and a concrete enough development for investors.

That announcement also came on a down day for the market.

However, the All Ords is not faring much better today, down slightly at time of writing, all the while LIT’s share price is rising.

As I said then, ‘investors may have been looking for more concrete positive news in the shorter term and may now take a wait-and-see approach to the development of LieNa’s commercial viability.’

Maybe it’s the case that an accepted grant for a process deemed ‘novel and inventive’ was just the shorter-term concrete news investors were after with Lithium Australia.

Lithium Australia is still at a relatively early stage where it is applying for grants to secure intellectual property rights for its proprietary processes.

However, investors will be looking closely at how well LIT can commercialise these patents and proprietary methods.

As the company itself stated in its latest quarterly release, it is:

‘Currently exploring the commercialisation of LieNA with a number of lithium concentrate producers. The construction and operation of a LieNA pilot plant is the next step towards achieving this outcome.’

In the same release, Lithium Australia revealed cash and cash equivalents at quarter end of $8,250,000.

According to the company’s financial statements, this position is enough to have an estimated five quarters of funding available.

How fast Lithium Australia can commercialise its patents and how long it can sustain its positive news streak will go a long way in determining investor sentiment towards this lithium stock.

If lithium stocks like LIT interest you or you want to find out more about the lithium industry and the related investment opportunities, it’s definitely worth checking out our free lithium 2021 report.

It includes a small ASX-listed company you might not have heard of before, with operations based in Europe. You can download that report for free, right here.

Regards,

Lachlann Tierney,

For Money Morning

Comments