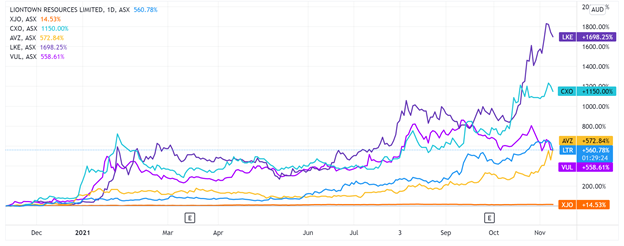

The Liontown Resources Ltd [ASX:LTR] share price is currently down 9%, trading at $1.69.

Liontown Resources released a definitive feasibility study (DFS) for its 100%-owned Kathleen Valley lithium project.

DFS confirms ‘tier-1 global lithium project’

LTR said today that the DFS confirms the Kathleen Valley project as a tier-one global lithium project with ‘outstanding economics and sector-leading sustainability credentials.’

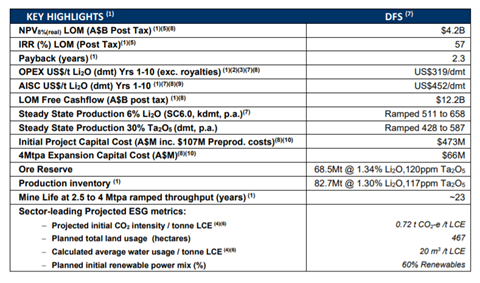

Building on the lithium stock’s October 2020 pre-feasibility study (PFS), the DFS sees LTR’s base production rise from 2Mtpa to 2.5Mtpa, producing around 500ktpa of spodumene concentrate.

A 4Mtpa expansion is now planned in the project’s sixth year, to deliver around 700ktpa spodumene concentrate.

With these production revisions comes a bump in the project’s economics.

The DFS delivered a ‘substantial increase’ in the post-tax net present value (NPV). The NPV, discounted at 8%, now stands at $4.2 billion.

The improvement sees the project’s payback time shrink to 2.3 years.

Life of Mine (LOM) free cash flow — post tax — now totals $12.2 billion.

Liontown’s Chief Executive Officer and Managing Director, Tony Ottaviano, said:

‘At the initial planned production rate of ~500ktpa of spodumene concentrate, Liontown will represent 5.7% of the world spodumene market and 4% of the lithium market on a Lithium Carbonate Equivalent (LCE) basis, with a project that has been conservatively designed to incorporate realistic capital and operating cost assumptions that take current market conditions into account.’

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

So why the LTR share price is down?

The numbers in the DFS seem very positive. So why is LTR stock falling?

It looks like investors are not as optimistic about some of the key assumptions made in the DFS.

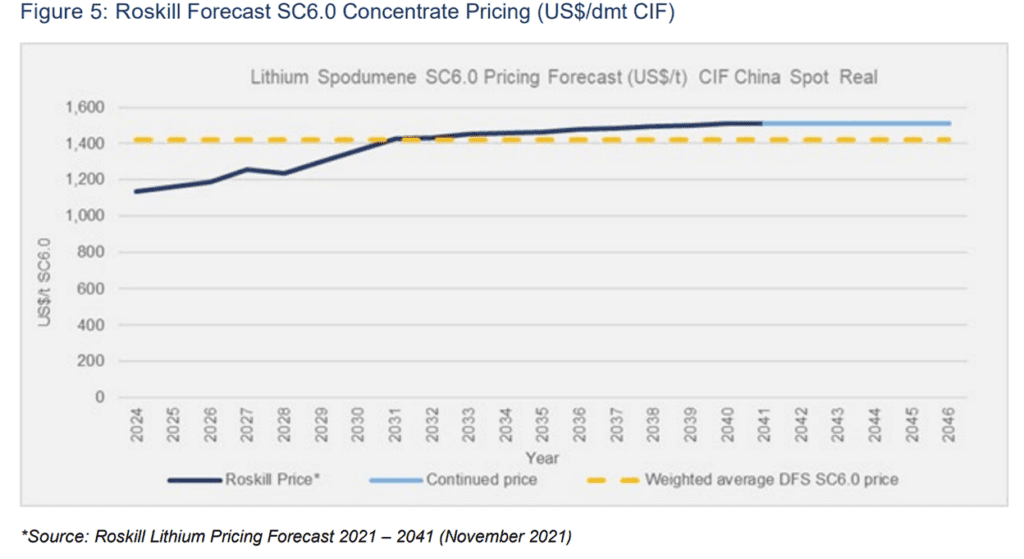

Namely, the DFS assumes a weighted average spodumene price of US$1,392/t Free on Board (FOB) LOM, based on Roskill’s long-term forecast prices.

Liontown’s Chief Executive Officer and Managing Director, Tony Ottaviano, said:

‘The DFS also applies independently sourced long-term pricing assumptions which we believe establishes the project on very firm footing while retaining exposure to the huge upside of spot lithium pricing — which is currently significantly higher than the assumed weighted price of US$1,392/dmt FOB of SC6.0.’

While the spot lithium price may be higher right now, will it remain so throughout the project’s commercial production?

If the realized price slips below the DFS estimate, it could impact the rosy project economics.

Compare this to another lithium developer — Core Lithium Ltd [ASX:CXO]. CXO’s DFS assumed a concentrate price of US$743/t.

Source: CXO presentation

If you want to learn more about the lithium industry, I suggest checking out this report.

And if you want an in-depth tour of investing in lithium, I suggest going over this guide we published last month.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here