The share price of battery metals explorer and developer Liontown Resources Ltd [ASX:LTR] has dropped for the second day in a row following its investor presentation.

Today’s loss of 12.5% or 1.5 cents per share comes on the back of LTR’s official addition to the ASX All Ordinaries, effective 22 June.

The LTR share price dug its way out of its low in late March but it could be beginning to feel the sting of the COVID-19 pandemic with producers reporting declining revenues or outright losses.

Source: Tradingview

New wave lithium explorers struggling with the lithium price decline

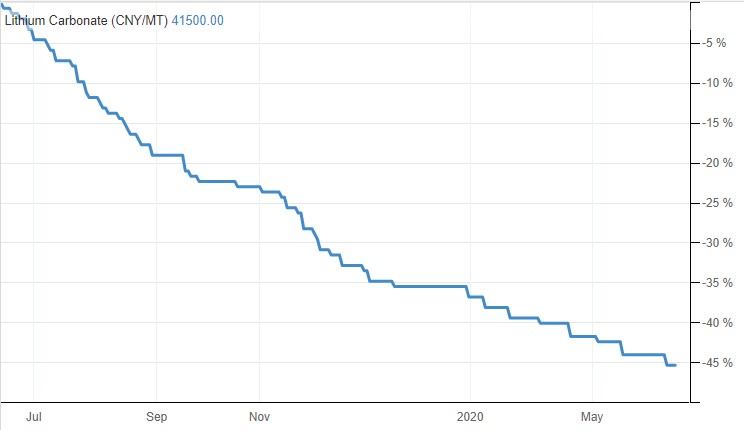

Lithium prices fell another 1.6% in May due to weak short-term demand.

The lithium price is still charging down, despite the promise of an EV revolution.

Lithium Carbonate prices over past year, source: Trading Economics

However, the longer-term forecast for lithium is more positive.

Demand for lithium is expected to pick-up in the second half of 2020 as the widespread adoption of electric vehicles drives the demand for battery minerals.

During April, Chinese new energy vehicle production increased to 80,000 units.

Larger producers like Pilbara Minerals Ltd [ASX:PLS] and Galaxy Resources Ltd [ASX:GXY] have had to moderate production and reduce costs in the hope of a market turnaround.

LTR is one of a handful of lithium explorers not as exposed to prevailing low prices who are readying for the next bull market.

The company has completed a review of mining options and recent tests have defined the potential to improve future economic returns from its flagship Kathleen Valley project in WA.

Kathleen Valley is marketed as a world class resource boasting 156Mt at 1.4% lithium with 80% measured and indicated resource.

The mine also has a potential life of +25 years.

The review is part of an updated pre-feasibility study and supports the company’s strategy of targeting higher-grade material.

LTR expects to release the updated study in the fourth quarter of 2020.

What’s the deal with the LTR share price then?

The S&P/ASX has slipped the past couple of days and could be to blame for the drop off in share price.

Depressed lithium prices aren’t likely to have helped either — but remember, LTR has managed to push through this low-price environment reasonably well.

The company purchased its Moora tenements in 2018/2019, which shares the same geological terrain as the Julimar discovery — a new Ni-PGE discovery by Chalice Gold Mines Ltd [ASX:CHN].

The area is an emerging precious and base metal province as PGE deposits and LTR has allocated near $2 million for further exploration.

Kind regards,

Lachlan Tierney,

For Money Morning

PS: Looking for the stocks well-placed for a lithium price rebound? Get an in-depth look at the potential winners from this move here.

Comments